Which Vanguard Index Fund Is Better S&P 500 or Total Market

Post on: 13 Июнь, 2015 No Comment

What is the difference between the Vanguard Total Stock Market index fund and the Vanguard 500 Index fund? I am 25 years old and have $50,000 to invest in a fund. I intend to invest for at least 34 years. What do you recommend?

— Kristina M. Ricca

Kristina,

If the (VFINX ) Vanguard 500 Index is the Tom Cruise of the fund world, then the firm’s (VTSMX ) Total Stock Market fund is more like Kevin Spacey.

The 500 Index fund seems to get all the money and attention. The latter fund is not as well known but is just as accomplished, according to some financial professionals.

Vanguard’s $79 billion 500 Index tracks the Standard & Poor’s 500 index. Though widely viewed as a gauge of market performance, the S&P 500 is actually concentrated in large-cap stocks.

The $10 billion Total Stock Market fund, on the other hand, tracks the Wilshire 5000 index, which consists of about every publicly traded equity in the U.S. The Wilshire 5000 actually contains more than 7,000 stocks, including the ones in the S&P 500 and everything else. That means you will find large-company stocks in the index on down to small-caps.

At the end of January, the 500 Index fund had a median market cap of $65.1 billion while the Total Stock Market fund’s median market cap was $33.8 billion.

The Total Stock Market fund will not own all 7,000-plus stocks in the Wilshire index. (Currently, it owns 3,120 names.) Instead, it invests in a large sample of stocks that matches certain characteristics of the index (such as industry weightings, market capitalization and dividend yield), according to Vanguard’s Web site. There is really no need to own every stock in the index. The bottom 30% (by market cap) of the more than 7,200 stocks in the Wilshire index represent only 0.27% of the market’s value, according to data provided by Wilshire Associates.

Both the Vanguard 500 fund and the Total Stock Market fund will give you broad exposure to the stock market, but the Total Stock Market fund will give you greater diversification with its more extensive selection of equities. In some way, there is no way to be more diversified than to own everything, says Jim Troyer, a principal in Vanguard’s core management group.

The idea behind diversification is that you have good news to offset the bad. When small-cap stocks underperform, you have large-caps as a counter, and vice versa. When value investing is out of favor, your investment in growth stocks buoys your returns. Robert Levitt, a financial adviser with Levitt Novakoff & Co. in Boca Raton, Fla. explains it this way: The most aggressive thing you can do is buy one stock. The next thing to do is buy portfolio of stocks. If you can’t stomach that, you buy a portfolio of stocks and some bonds.

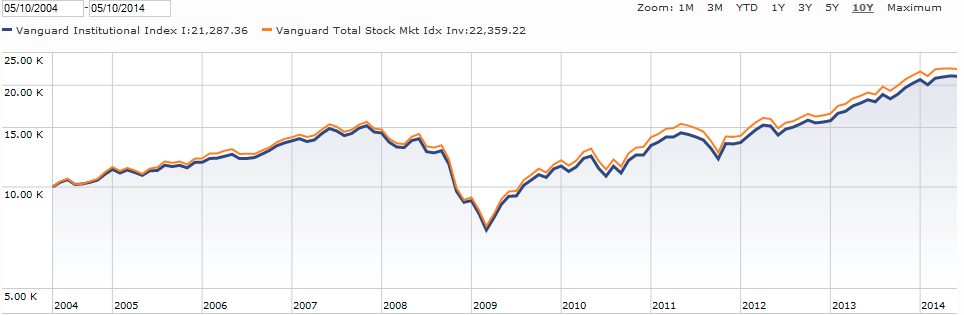

Over the past several years, large-cap stocks have been the market champions and small-caps have languished on the sidelines. In turn, the Total Stock Market fund, with its exposure to small-caps, has trailed the 500 Index fund. As of February 11, 1999, the Total Stock Market’s five-year average annual return is 21.6% compared to 24.3% for the 500 Index, according to Lipper. (Both handily beat the average general equity fund’s return of 17%.)

However, when small-caps begin to outperform the large-caps again, the Total Stock Market fund will be able to produce returns that beat the 500 Index fund. That said, in the great debate between large- and small-cap stocks, the expected returns are pretty darn close to each other, asserts Vanguard’s Troyer. Depending on the time, we don’t think there is an expected return differential between the two over very long time horizons, at least 20 years.

In fact, the average annual price performance (not including reinvested dividends) over the 20 years ended Jan. 31, 1999 for both indices is very close. The S&P 500’s average annual performance was 13.6% vs. the Wilshire 5000’s 13.3%, according to Lipper.

With both of these funds, you are getting the low-expense, low-turnover index funds advocated by many investors and financial professionals. (The larger debate between index funds and actively managed funds is for another time and place.) The Total Stock Market fund’s expense ratio is 0.2%, a hair higher than the 0.18% for the 500 Index.

But which one to choose? For a first-time fund buyer or for a core investment you will hold long time, the Total Stock Market fund may be the better choice. I think the Total Stock Market fund is probably not a bad fund for somebody who wants to get broad exposure to the overall U.S. equity market, says Tim Schlindwein of Schlindwein Associates. a financial advisor in Chicago. The Vanguard 500 clearly has a narrower focus on larger companies and by definition is less diversified. While that has been a winning strategy, if one wants a core holding that can be ridden through lots of up and down market cycles, the Total Stock Market fund may be your pick, he says.

A final note: There are other total-market index funds out there. Wilshire Associates, creator of the actual index, recently launched its own Wilshire 5000 Index fund, and Fidelity and T. Rowe Price both offer their own versions of a total market index fund.

Send your mutual fund questions to fundforum@thestreet.com. and please include your full name.