When diversification fails

Post on: 16 Март, 2015 No Comment

LONDON (Reuters) — The attractiveness of spreading investment eggs in many baskets is fading fast in the short term as strengthening correlations of different asset classes are aggravating losses on a diversified portfolio.

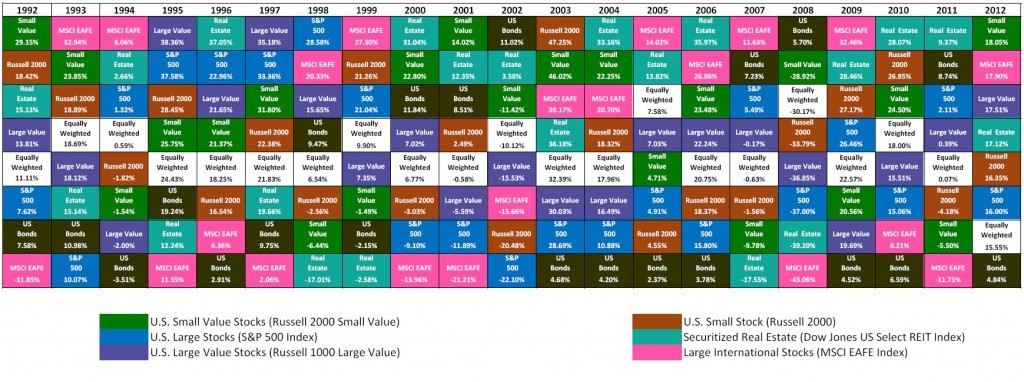

During the credit boom of 2002-early 2007, investors were encouraged to diversify their traditional equity-bond portfolio, spread risks and seek extra alpha returns by buying commodities, hedge funds, real estate which were seen as having almost zero correlation with traditional stocks and bonds.

However, since the credit crisis began in August 2007, these alternatives fell in lockstep with, or sometimes faster than, equities, driving volatility higher and amplifying losses of a risky portfolio.

A diversified approach worked like a charm until October last year. But diversification failed in 2008, said Terence Moll, head of multi-asset strategy at Investec Asset Management.

Some of alternative assets went through bubbles and precisely these bubbles got punished. Assets that are overpriced do not give diversification.

His analysis shows returns to eight-asset class portfolio — comprising of stocks, bonds, emerging market stocks and bonds, real estate, commodities, hedge funds and managed futures — lost 29.1 percent since October 2007.

This compares with a loss of 26.3 percent in a simple equity-bond portfolio.

And adding in fancier asset classes such as timber or infrastructure, the 12-asset class portfolio lost an even deeper 43 percent in the roughly same period.

FREE LUNCH GONE

Taking last week’s example, world stocks, measured by MSCI fell 5 percent in the week. NY light crude, plunged by a bigger 25 percent, while the Reuters-Jefferies CRB index fell 14 percent.

Until the last three months it used to be said that diversification is the only free lunch in the market but that free lunch seems to have gone away, said Andrew Dyson, head of EMEA institutional business at BlackRock.

Analysts say the very unique nature of the deleveraging this year has resulted in all risk assets falling at the same time.

We are under stress and the correlation is going up, said William De Vijlder, chief investment officer at Fortis Investments.

But undervaluation (of a diversified portfolio) is not related to the view that diversification is bad. Valuation on a diversified portfolio has gone down but that creates opportunities. Investec’s Moll thinks investors may not want to seek out new and seemingly uncorrelated asset classes to diversify their portfolio, but they should consider mixing traditional and alternative assets in the right proportions.

Alternative investment has entered the main stream. Alternative is never going to be alternative again, he said.

HEADING TO ZERO WORLD Last week, central banks from New Zealand, Australia, Sweden, Denmark, Britain and the euro zone slashed interest rates, with Sweden surprising investors with an aggressive cut of 1.75 percentage points.

This week’s data on UK manufacturing and retail sectors and U.S. retail sales and investor confidence among others is only likely to reinforce the argument that interest rates have further to fall in the next few months. Merrill Lynch estimates that central banks around the world have cut interest rates by a total of 88 basis points this year. It expects an additional 86 basis point of cuts by end-2009. Speculation is also swirling that interest rates in major economies heading to zero, especially in the United States where investors expect the Federal Reserve to cut the cost of borrowing to 0.25 percent this month.

The world of zero rates seems even closer in reality, looking at real interest rates — nominal interest rates minus inflation. Credit Suisse estimates official rates of 1 percent in both Britain and Europe would give a real rate of zero.

The Swiss bank has found that in Europe defensive stocks such as food and health care tended to outperform three months after the first cut, followed by cyclical stocks such as technology and autos three months after the second cut.

However, the bank cautions against piling on cyclical stocks as they do not yet fully discount recession and its model suggests a further 5 percent underperformance.

Fund managers also agree generally on the issue of getting back into stocks now.

A lot of people admit that there are a lot of opportunities. But they are on buyers’ strike, De Vijlder from Fortis said.

If get the timing wrong you can lose 7-8 percent. It’s not the environment where you do your asset allocation on January 2 and not do anything for the rest of the year.

(Additional reporting by Sebastian Tong ; Editing by Ron Askew)