When cracks appeared in the China interbank market

Post on: 7 Август, 2015 No Comment

HuoKan

BEIJING (Caixin Online ) — Along with the sudden emergence of a cash crunch, the somewhat obscure interbank market has never garnered more attention, ranging from that of government leaders to individual investors.

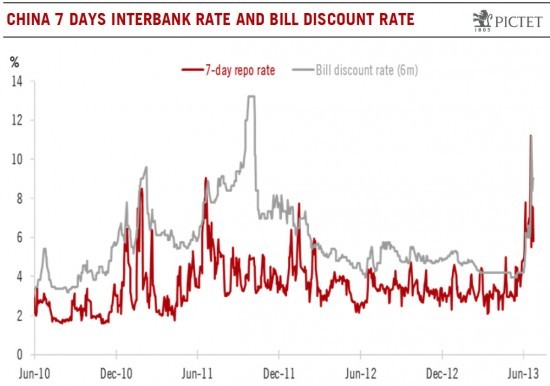

Since late June, there have been dramatic fluctuations in the interbank market, with interest rates skyrocketing and rumors of financial institutions defaulting. Stocks and bonds prices fell for days. On June 24, the Shanghai Composite Index SHCOMP, +0.70% fell 5.13%, then hit 1,849 points a day later, the lowest since August 2009.

The storm hasn’t been limited to financial institutions that make transactions on the interbank market. Since the Shanghai Interbank Offered Rate hit a new high of 30%, a so-called cash crunch has become almost a household topic.

Interbank market rates were high, but capital supply froze. Also on June 24, the China Development Bank made a rare, sudden cancellation of a scheduled issuance of floating-rate bonds. The policy bank was not alone. Since mid-June, at least 22 bond issuers have postponed issuance or changed terms.

About Caixin

Caixin is a Beijing-based media group dedicated to providing high-quality and authoritative financial and business news and information through periodicals, online and TV/video programs.

The situation continued to escalate and banks scrambled for capital. Around June 25, a number of banks decided to suspend offering loans until July 15, including even the highest quality type of loans — personal mortgages.

Companies began receiving requests from banks to repay loans on a tight schedule, and were told that their loans wouldn’t be renewed for the time being. Through loan-borrowing companies, tight liquidity spread from the financial market to the real economy, hampering China’s already sluggish economic growth.

Many fingers were pointed at the People’s Bank of China (PBOC). At first, the central bank was silent. Then, after the close of the market on June 24, it took to a high-profile position, assuring the market that it would inject liquidity when necessary.

The behemoth, state-owned commercial banks followed its lead. The chairman of Industrial and Commercial Bank of China (ICBC) 601398, +0.00% IDCBY, -0.28% Jiang Jianqing, told the media his bank would act as a stabilizer.

Smaller joint-stock banks, such as Industrial Bank 601166, +3.26% and Minsheng Bank 600016, -0.53% CMAKY, +0.91% were in the teeth of the storm and thought to be in more dire situations. They held emergency teleconferences to appease the market.

Caixin Online

The next day, a number of members of the State Council, the country’s cabinet, met with people in the financial sector and discussed responses.

On the same day, the central bank injected liquidity into the interbank market and committed itself to safeguarding the stability of the money market. Although the size of the liquidity was unconfirmed, market insiders speculated that the central bank had carried out a targeted reverse repurchase at a small number of institutions to inject liquidity.

Moreover, that week saw 25 billion yuan ($4.08 billion) USDCNY, -0.08% in central bank notes reach maturity, representing a small-scale injection of liquidity. Short-term interbank market interest rates fell significantly in the wake of these moves.

Thus, the market panic gradually ended. But its shadow remains. Via bonds, the tight liquidity caused by short-term factors will last until July 15. Meanwhile, market short-term interest rates have stabilized. But the 14-day and 21-day interbank market repurchase rate is still high, at 8% to 9%.

After years of glorious results, the fragile side of the Chinese banking sector was finally exposed in the unexpected cash crunch. When institutions begin to worry about liquidity and are suspicious of each other’s ability to pay, panic shoots through the market.

The chief strategist of the domestic investment firm China International Capital Corp. (CICC), Huang Haizhou, said that problems in the country’s financial industry are just beginning to appear; a financial crisis within three years is inevitable; and all that China can strive for is a “controlled, minor crisis.”

Behind the crunch

The central bank was severely criticized throughout the episode. The mildest blame is that the PBOC failed to communicate with the market to guide expectations. The harshest criticism is that it was failing to act as a lender of last resort.

The PBOC is the only player who can see the cards every bank is holding, so unless banking institutions are reporting fraudulent numbers en masse, the central bank’s judgment is the most authoritative.

At the same time, many people support the central bank for not indulging the high-risk behavior of individual institutions. They say now is the time to sound the alarm regarding banks with weak liquidity positions and poor management of their assets and liabilities.

A source at ICBC said: “Some institutions were excessively risk-taking in the past. The central bank is now using open market mechanisms to punish reckless institutions and using the pricing mechanism to force institutions to be more cautious, to deleverage and to better their risk management.”

However, the central bank said that “so-called stress-tests and punishment of radical institutions” were only the market’s interpretations. There is no shortage in the total amount of liquidity and the recent liquidity crunch is a structural issue, it said.

The PBOC is the only player who can see the cards every bank is holding, so unless banking institutions are reporting fraudulent numbers en masse, the central bank’s judgment is the most authoritative.

While the PBOC stressed that overall the market was balanced, some people are asking whether the central bank also has an obligation to keep a close watch on the money market yield curve and stabilize price fluctuations. Should the central bank have recognized interest rates were soaring in the first weeks of June and intervened?

This isn’t one of the central bank’s responsibilities, said Lu Lei, dean of the Guangdong University of Finance. The prices of funds in the interbank market are formed completely by the market, and the central bank has no obligation to stabilize them, Lu said.

“At this stage, the volume of money supply is the main variable that the central bank needs to keep a close watch on, rather than lending rates in the interbank market.”

However, Zhang Ping, head of the Chinese Academy of Social Sciences’ Institute of Economic Research, said that “financial stability is the primary function of the central bank.”

Whatever the function of the central bank is, at the beginning of the cash crunch, the market misjudged its intentions.

A recent report from Goldman Sachs Gao Hua Securities said that the consensus was that with current low economic growth and low inflation, even if monetary policy weren’t relaxed further, it should remain at a relatively relaxed level.

IMF: Emerging markets greatest global risk

A slowdown in emerging-markets economies tops the International Monetary Funds list of global risks, highlighting the fallout in markets since Federal Reserve Chairman Ben Bernanke raised the possibility in May of a pullback in easy-money policies.

After rates soared in early June, the market believed that the central bank would carry out short-term liquidity operations (SLOs), which are commonly known as “directional reverse repurchases” because they are operations targeted at individual banks. SLOs would stabilize fluctuations in interest rates, but the central bank took no such action in the beginning, nor did it publicly respond to the market.

However, after panic began to build, the central bank changed its position.

On June 24 and 25, central bank officials spoke to Caixin and went on CCTV to clarify.

One said: “For institutions with liquidity management problems, we will take appropriate measures according to the circumstances in order to maintain the overall stability of the money market.”

A senior executive at a large bank told Caixin that the key is to stabilize expectations, to strengthen coordination, and to complete daily liquidity management and response plans.

He said that from the perspective of large banks and financial authorities, this round of liquidity tightening is indeed a “pseudo liquidity squeeze.” There is sufficient capital, but many small and medium-sized financial institutions in search of profits invest a large amount of short-term debt into higher-yielding financial assets.

These assets are generally longer-term, leading to a lack of funds that can be liquidated. Once the market shows signs of trouble, it will produce a period of tight capital.

The relaxation may be rather limited as investors remain uncertain about the trends of economic fundamentals and the handling of liquidity in the context of monetary policy tightening. There are also questions as to how the central government’s economic reform efforts will proceed.

When will it end?

A central bank source said that five factors have influenced interbank market liquidity recently.

First, because commercial banks face interim assessments and information disclosure deadlines in June, they often have a “rush time” mentality; loans usually grow rapidly, and notes have increased as a proportion of the loan structure, putting pressure on these banks’ liquidity.

Second, the end of May through early June is an important tax settlement period, and the increase in government fiscal income parked in banks has also led to reduced liquidity.

Shutterstock

Peoples Bank of China

Third, there was an increase in the demand for cash before the Dragon Boat Festival in early June, affecting liquidity in the banking system.

Fourth, recent fluctuations in liquidity in the interbank market are related to changes in the foreign exchange market. After the State Administration of Foreign Exchange introduced a new decree to tighten up the management of foreign exchange flows, banks with higher levels of foreign exchange loans needed to purchase forex, tying up yuan liquidity.

Meanwhile, more forex purchases by banks increased demand. The relative balance of supply and demand in the forex market also reduced the need of the central bank to purchase foreign exchange, which usually injects liquidity to the market.

The fifth factor regarded the handing in of statutory deposit reserves. According to regulations, the fifth of each month is the deadline for financial institutions to turn over sufficient reserves funds according to deposits at the end of the previous month.

Because deposits at financial institutions soared at the end of May, with general deposits increasing by 1.4 trillion yuan from May 20 to May 31, a portion of liquidity was frozen as banks turned over deposit reserve funds.

The factor will continue to affect the market liquidity level, since there have been more credit increases at financial institutions since June, and it is expected that the squeeze will occur again at the end of June. This will further increase capital pressure from turning over reserves.

The market has also made various analyses. For example, a source from Harvest Fund, a mutual fund, said: “The situation this year is different from in the past. We expect banks to turn over a high amount of deposit reserves, 200 billion to 300 billion yuan.”

Dongguan Bank financial markets analyst Chen Long said that in the first half of July many factors would siphon capital from the market. Usually companies start to pay corporate tax in July. Judging from changes in governmental fiscal revenue deposits, the net increase for July since 2009 has been around 400 billion yuan for government coffers, said Chen.

In addition to the tax, listed companies are preparing to pay mid-year dividends. Chen expects funds set aside by public companies for dividends for the first half of July to reach more than 100 billion yuan.

A city commercial bank executive, who previously worked at the central bank said that information asymmetry, coupled with the market panic, to a certain extent made banks suspicious of each other’s capital position and to hedge. Even banks with ample liquidity weren’t willing to lend because they didn’t know their counterparts’ ability to repay.

“Even if it was a transaction with a bank as large as ICBC, they would worry whether they would repay upon maturity,” the source said. “If (ICBC) couldn’t repay right away, the side putting up the money would face new liquidity difficulties. So even banks with money were unwilling to spend it.”

The senior executive at a large bank said government efforts to adjust the structure of the country’s economy played a role.

“At this critical point, the central bank is inclined to maintain existing liquidity,” the executive said. “In the early stages of the cash crunch, it didn’t commit to injecting monetary liquidity into the market when necessary, which to a certain extent led to the suspicion and panic in the market.”

Also important is the outflow of hot money from emerging markets and its return to the United States due to the signs that the Federal Reserve will end its quantitative easing policy.

In order to maintain the stability of the yuan exchange rate, the central bank needs a moderate tightening of the money supply, and in the near-term the central bank will have a difficult time putting too much liquidity into the market. This is another cause of the short-term capital crunch, said a source from a large state bank.

Sources in the market expect that due to the effects of annual dividends to be paid at the five largest banks, a net cut on wealth management products in the middle of the year and turning in reserve prepayments in early July, tight capital condition will continue to July 15.

The possibility of soaring short-term interest rates in the interbank market is small in the near term, but rates will remain high for some time.

Industry estimates show that after the bank rush period at the end of June and other factors, the seven-day repurchase rate will fall to around 3.5%, but won’t return to the 3% level of mid-May. The overall rising cost of financing should lead to slowing liquidity growth.

How are banks coping?

Throughout the episode, the public has suddenly learned that the country’s banking industry isn’t as liquid as imagined. Why?

An executive at a joint-stock bank said the cash crunch exposed poor liquidity management at commercial banks and a lack of coordination. He said regulators failed to compute in various factors tightening liquidity over two months and didn’t coordinate and make arrangements in advance.

Meanwhile, banks scrambling to cover themselves could only compete to raise yields, bringing panic to the market.

Yields on banks’ wealth management products soared for days. Under the influence of multiple factors, including the end of monthly assessments and mid-year net redemptions on the products, a price war among large banks has been intense.