What You Need to Know About Target Date Funds

Post on: 15 Апрель, 2015 No Comment

It’s easy to see the appeal of target date funds. They’re billed as a simple, safe, convenient solution for saving for retirement. You pick a fund with a diversified mix of assets based on the year you hope to retire. It automatically rebalances, so you just sit back and enjoy the ride.

“On the surface, target date funds appear to be a safe investing alternative, but they are actually very dangerous and will ensure that many retirees run out of money,” says Matthew Tuttle, CEO of Tuttle Wealth Management.

That’s a dark prediction, particularly for a product that is one of three designated by the Pension Protection Act of 2006 (PPA) as a qualified default investment alternative (QDIA) for defined contribution plans. Target date funds have become the dominant default investment option. TDFs have taken off. By 2006 they had assets of $114 billion, nearly $250 billion in 2008, and before the market downturn there were predictions that assets would exceed $1 trillion by 2013, according to research from Prudential, Strengthening Target-Date Funds With Guarantees to Enhance Retirement Security.

Target date funds have already proven not to be a panacea. During the stock market turmoil of 2008, target date funds designed for those retiring as soon as 2010 lost as much as 41 percent of their value.

“Target date funds generally still seem to hold too much equities close to maturity. The percentage of stocks that target date funds hold at their target date rose to an average of 43 percent in 2010, from 40 percent in 2007, according to a Brightscope report. That seems too high, especially given the lessons that should have been learned in 2008 and 2011,” points out Kevin Cimring, chief operating officer of Jemstep, a personal online investment guidance and management service.

There are a number of “issues” with TDFs. “They are off the shelf funds that are not customizable. They are retirement date driven only, and do not consider individual risk tolerance or other personal circumstances. For instance, long-dated TDFs could be too aggressive for even young investors who are risk averse,” explains Mike Maglio, investment director for PNC Wealth Management.

Then too, you put asset allocation in someone else’s control and you don’t really have the ability to manage your overall portfolio according to what’s best for you. “One section of your portfolio is a bit of a locked black box,” says Cimring.

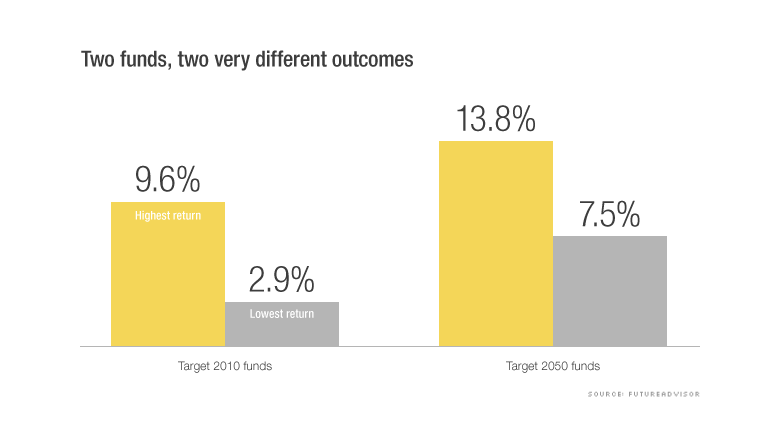

Set it and forget it doesn’t work. It doesn’t allow for changing life circumstance and tactical moves based on economic conditions. “Initial allocations and ‘glide path’ allocation changes over time, vary across TDFs for equal target dates. Investors should be aware of how initial allocations and glide path changes apply to their portfolios,” says Maglio.

What’s also troublesome to Cimring is the conflict of interests. “Holding actively-managed stock funds result in higher fees than bond funds (or index funds, which simply mimic the major indexes such as the S&P 500). That gives the target date managers an incentive to stuff the target date fund with more profitable (and riskier) funds. Target date funds also tend to have higher fees than the underlying funds they hold.”

While the automatic balancing is held up as benefit, some disagree. “Target date funds get more ‘conservative’ as you get closer to 65. This brings up two problems. What is more conservative? Typically that is bonds, but bonds are in a huge bubble right now and interest rates have no where to go but higher, which would make bonds go down, maybe a lot. The other problem is that people rarely retire at 65 cold turkey these days, and even if they do, they might live for another 40 years, they will still need to earn a decent return on their money,” says Tuttle.

As outlined in Prudential’s research, “Target date funds leave participants facing three major risks to enjoying a secure retirement – bear market risk: the risk of significant loss of future retirement income because of sharp declines in asset values in the years immediately preceding retirement; zero balance risk: the risk of running out of money after retiring because of a string of poor market returns or outliving one’s assets, and purchasing power risk: the risk of retirement income not growing rapidly enough to keep pace with inflation during retirement.”

Target date funds might be a viable option for those who don’t want a say in choosing their investments either because they simply don’t want to, or don’t feel like they know enough. They are also for those who don’t mind paying a bit more for that luxury. But for many people, TDFs might regrettably leave them with the first hand experience that one size does not fit all.