What the Detroit Bankruptcy Means for Municipal Bonds Money Morning We Make Investing Profitable

Post on: 24 Июнь, 2015 No Comment

display>

You can’t blame investors in municipal bonds for being worried about how the Detroit bankruptcy will affect the muni market it’s by a factor of four the largest municipal bankruptcy in U.S. history.

Last Thursday Detroit filed for Chapter 9 bankruptcy to seek relief for $18 billion in debt obligations, a debt driven primarily by years of soaring public pension obligations and shrinking tax revenue.

In the city’s bankruptcy filing, Detroit emergency manager Kevyn Orr proposed cutting some of those retirement benefits and giving the city’s municipal bondholders a haircut that could leave them with pennies on the dollar.

That prospect not only spooked investors in Detroit’s municipal bonds, but triggered concern that other municipalities might soon decide to do the same thing.

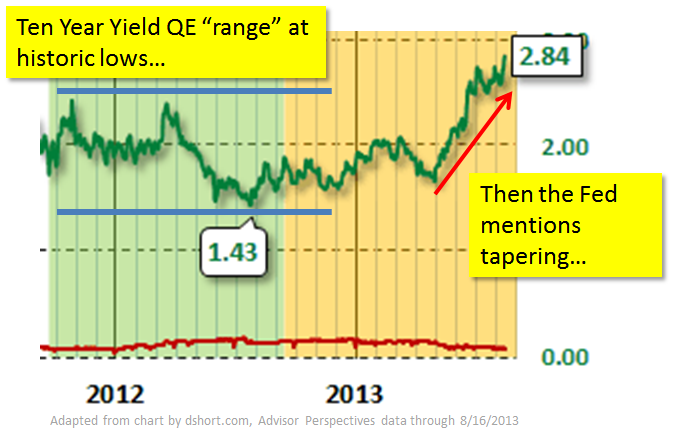

Municipal bonds as an investment have already come under pressure this year. June was the fourth month in a row of negative net outflows. Over that time, $20 billion has exited the muni bond market.

I think this will definitely help add to the stampede out of muni bonds, Theodore Feight, owner of Creative Financial Design, told Investment News .

What Should Investors Do About Municipal Bonds Now?

No doubt, the Detroit bankruptcy will scare some investors out of the municipal bond market completely. But as is usually the case with a herd mentality, that probably is not the best move.

For one thing, few municipalities are anywhere near as bad off as Detroit.

We view Detroit’s default and subsequent bankruptcy filing as idiosyncratic, and not as a symptom of a wider issue in the municipal market, Jane Hudson Ridley, a credit analyst with Standard & Poor’s. said in a July 19 statement. Although we have seen isolated pockets of distress across the country, we do not view bankruptcy filings or defaults as a trend.

If anything, the Detroit bankruptcy is a reminder that all investments carry risk, and that you can get burned even in relatively safe sectors like municipal bonds. Most general obligation municipal bonds are secured by a pledge to raise taxes ad infinitum to cover interest and repayments, making them appear very safe.

Investors have viewed munis as a close corollary to Treasury securities, Warren Pierson, a portfolio manager of the $1.1 Baird Intermediate Municipal Bond Fund, told Forbes . I think the market has been lulled into lending money to credits that are not as good as they appear.

Investors in municipal bonds also need to keep in mind that it takes most municipalities a long period of time to get into severe debt trouble. The trap is that as their financial picture deteriorates the interest rate they pay goes up making them increasingly attractive investments.

Other U.S. cities currently teetering on the brink of bankruptcy include Chicago, Cincinnati and Camden, NJ, among dozens of others.

How the Detroit Bankruptcy Has Created an Opportunity

But if the herd does take the bait and starts to bail out of the municipal bond market even faster than it has over the past four months, that presents savvy muni investors with a golden opportunity.