What s the difference between government bonds and bank notes

Post on: 20 Апрель, 2015 No Comment

Heres something I wrote in 2009. In light of a recent post by Randy Wray. Id love to have some readers here answer my question.

Heres what I wrote:

The Treasury doesn’t have to issue [government] bonds at all. In fact, since the Treasury does control the electronic printing press, it could legitimately buy stuff with money it prints out of thin air.

Sounds a bit like counterfeiting, doesn’t it? But, let’s step back for a second: what is the functional difference for the federal government between Treasury securities and bank notes? Both are liabilities of the federal government. But liabilities of what? The only obligation they enforce on the government is the promise to repay with more paper (or electronic bank credits, if you will). For all intents and purposes, bank notes, reserve deposits, and Treasury securities are fungible: they are obligations to be repaid in the same fiat currency.

I’m looking at a five dollar bill right now. It says Federal Reserve Note across the top. It has an oversized picture of Abraham Lincoln in the middle. It also says this note is legal tender for all debt, public and private in the lower left, signed Anna Escobedo Cabral, Treasurer of the United States. On the back, I see The United States of America up top and In God We Trust underneath with a picture of the Lincoln Memorial in the middle, labelled Lincoln Memorial for those who don’t know what it is. But, I’m trying to figure out why Geithner and the gang couldn’t just reel off a bunch of these and some Jacksons and Benjamins and pay people?

Now I’m looking at a Canadian Twenty. It sure is colourful. It has a bunch of French on it and a picture of the Queen. But, other than that, it’s really no different than the American fiver. Ce billet a cours legal/ This note is legal tender.

I have some Euros and Mexican pesos too. But these central banks don’t say anything about their obligations. Very dubious! At least they’re colourful like the Canadian money.

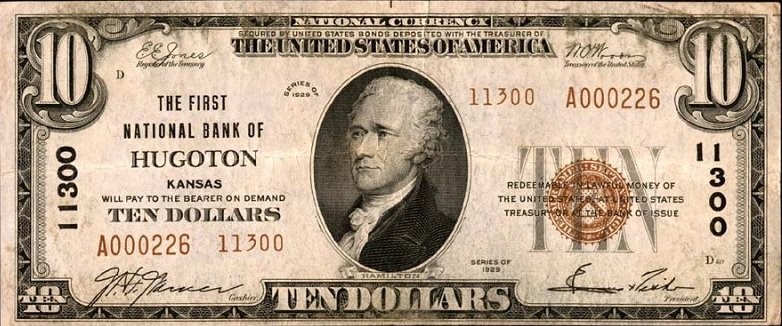

How ‘bout a British tenner? Dickens on the front, and the Queen on the back (she’s everywhere). A-ha. Here’s what I’m looking for. It says Bank of England. I promise to pay the bearer on demand the sum of ten pounds.

I think that gets me to my point, actually. From the government’s perspective, there is no functional difference between any of its obligations like bank notes, electronic credits, or treasury bills and bonds. As the Ten pound note says, “I promise to pay the bearer on demand the sum of [fill in the blank sum][fill in the blank fiat currency].”

So, the U.S. government could legitimately stop issuing bonds altogether if it wanted to. When people complain about the admittedly enormous government debt, they don’t think of the mechanics of the issue. As I see it, in a fiat money environment, the first function of the Treasury bonds is to serve as a vehicle to add or subtract reserves in the system to help the Federal Reserve hit a target Fed Funds rate. The second is to give holders of government obligations a return on their investment. After all, bank notes or bank reserves don’t pay much if anything.

Am I missing something?

P.S. This is Edward Harrison, not Yves.

P.P.S. the constraint on the Treasurys just printing money is a self-imposed legal one; the Treasury cant have overdrafts at the Fed.