What s a Better Investment for Retirement; 401k IRA Stocks Bonds CD s or Mutual Funds

Post on: 22 Апрель, 2015 No Comment

by Chuck Rylant

August 8th, 2009

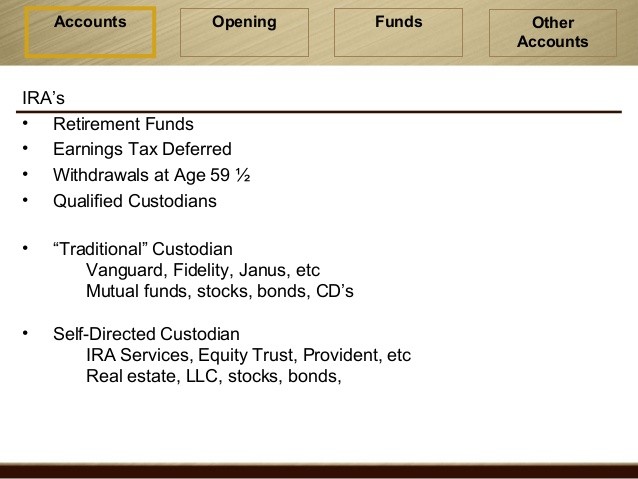

This is not a very good question from an academic perspective, and some experienced investors may frown on my article when they read the title. But since Im asked it so often, that makes it a great question. A 401K and an IRA are not investments. They are tax privileged accounts that you, or sometimes your employer, can put money in for retirement.

Retirement plan rules are incredibly complex and change frequently, but for most plans like the 401K and IRA, you wont pay income taxes on the money you contribute until you withdraw it. So, for example, if you earned $65,000 from your employer and contributed $5,000 to your 401K plan, you would only pay income tax that year on $60,000 of income. This is an oversimplified example, but it helps illustrate the idea.

Now let me explain the other investments in the question. The money you contribute to the retirement plan can be used to buy many different kinds of investments. These can range from investing in a small business to buying stocks, bonds, CDs or mutual funds. The retirement plan is just a basket that holds money that you use to buy investments, but it has great tax benefits.

Now on to the original question of which is better. No one is better than the other, its a matter of timing and making sure you have the right mixture of investments to fit your needs at the time. The IRS generally imposes stiff penalties for withdrawing money from retirement plans before age 59 ½, so if you may need (notice I did not say will need) the money sooner, you should probably eliminate those plans as an option.

Then you need to decide which investments to buy either within or outside the retirement plan. Here again its a matter of how soon youll need the money. Generally if youll need the money within five or fewer years, stocks are probably not the best way to go and a CD, money market or short term bond are more appropriate. When your time line is five or more years away, stocks become a better idea.

At the risk of completely complicating things, mutual funds are investments that buy all of the investments weve discussed so farstocks, bonds, real-estate, and CDs. So you really need to examine what the mutual fund is invested in to make an informed decision.

Ive tried to tackle a whole range of complicated topics and give you a basic idea of which investment is best. Obviously there are entire books on these topics, but hopefully you have a better idea of the difference between an investment (stock, bond, CD and mutual fund) and a retirement plan (401K and IRA) so you can get closer to your own retirement.