What Mutual Fund is Right For You Online Day Trading

Post on: 24 Июнь, 2015 No Comment

Hong Kong is your home, and you have no intention of leaving anytime soon. With the high quality of life and strong economy, why would you? Hong Kong has the highest life expectancy of any location worldwide. Now that you have found your home, it is time to start looking into the importance of retirement planning. Make sure to look at Mutual Funds NAV when figuring out how you are going to fund your retirement.

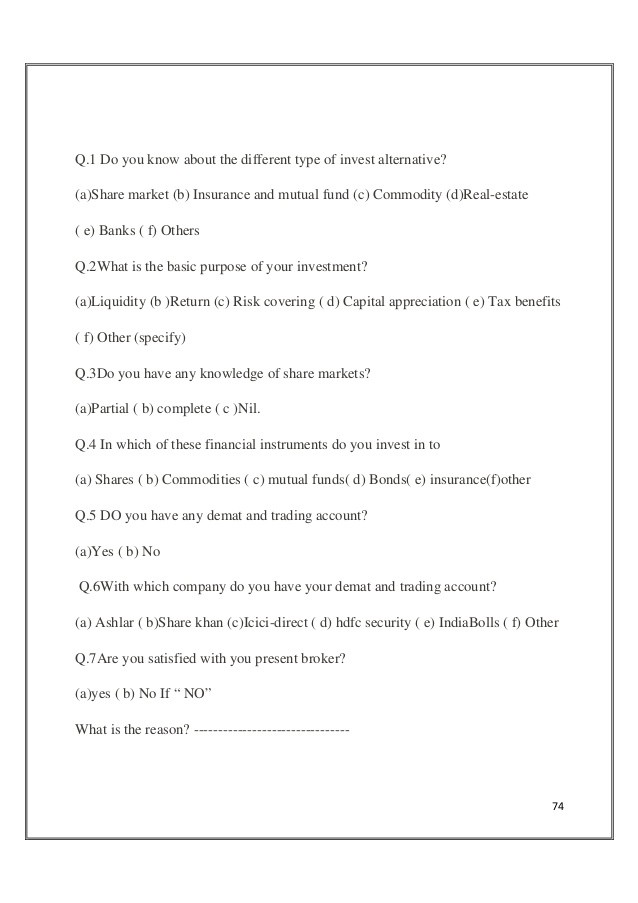

A Mutual Funds NAV represents a funds per share market value. This is the price at which the investors buy fund shares from a fund company and sell them to a fund company. It is derived by dividing the total number of cash and securities in a funds portfolio less any liabilities, by the number of shares outstanding. A Mutual Funds NAV computation is taken once at the end of each trading day based on the closing market prices of the portfolios securities. Make sure to contact a financial planners if you have any questions, because they help individuals become financially comfortable enough to retire without worry that they will run out of funds.

Investing in a mutual fund allows you to minimize the risks associated with your investment, while maximizing the returns. A mutual fund is an investment vehicle that pools money from investors who share a similar investment objective and invests the money in stocks, bonds or other securities. The four types of mutual funds are Equity Funds, Fixed Income Funds. Balanced Funds and Money Market Funds. Hong Kong is home to the most restrictive rules on mutual funds in the world. The Securities and Futures Commission and the Mandatory Provident Funds Authority govern rules on mutual funds.

AN ETF is a cost efficient investment opportunity with low expense ratios. An ETF holds assets such as stocks, commodities or bonds close to their net asset value over the course of the trading day. There are several different types of ETFs including Index ETFs, Stock ETFs and Bond ETFs. ETFs have their advantages including their structure, which is set up for tax efficiency. A professional money manager can help a client actively manage their investments in order to lower risks associated with their investments.

When figuring out how to invest for your retirement look at Mutual Funds NAV. This will help you get a better handle on your investments and you can see how your money is growing. If you are ready to start saving for your retirement meet with a financial adviser and look into growing your portfolio.