What is the reason behind rupee value depreciation

Post on: 16 Март, 2015 No Comment

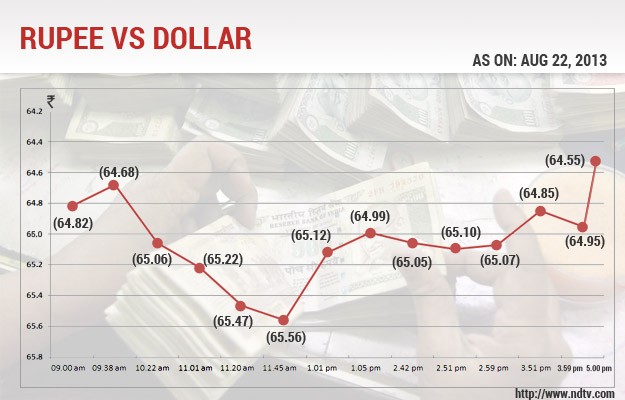

The past two weeks have been disastrous for the rupee value against dollar currency. The same time last month (22-Aug-2011), rupee value against dollar was 44.5 45.0 range, at this time of writing this article it is hovered to the range of 49.0 50.0. It is expected to raise further which would result in weakening the rupee value against the dollar currency. Rupee value depreciation is the hot topic nowadays due to the huge fall in value. This kind of increase would have the drastic impact on the macro economy of the country like heavy raise in the import cost where countries like India largely depends on the importing on Oil and other crucial raw materials needed for the industries.

This article explores the reason behind the rupee value depreciation, how RBI trying to defend the rupee value and how it is going to affect the industries. I come up with this article after the readers request to understand the currency war on recent days. If you have any thoughts, please post it in the comments section. Subscribe to our future articles here. Also like us on facebook page .

also read:

How currency value is determined?

We are not going deep dive into economic terms to understand the currency value fluctuation. There are many factors to decide the currencies values but that could be very difficult for the common man to understand the theory. Here I will put it in the simple words why the currency value is often fluctuated. A currency will tend to become more valuable when its demand is higher than supply. A currency will tend to become less valuable when its demand is less than supply. It is the basic theory. We need to understand in the global economy terms, when the currency will have more demand and when it will have less demand.

Remember that exchange rates are expressed as a comparison of two currencies. It is always relative and can be measured between two countries. Interest rates, Inflation and exchange rates are highly related. Reserve bank change the interest rates to control the Inflation and exchange rates.

We can take our real time example of stock market investment to understand the above principle. As we know that, our stock market is dominated by the overseas investors (outside India), because of the our growing economy and industrial development. When our economy is doing well and market is performing better than other countries, overseas investors would invest heavily on our market. How they would put it in our market. They will sell or convert to our currency and invest in India. It is clear that when more investors coming to India, the demand for the currency will be very high. Our rupee value will be increased against dollar. In the same way, when they are pulling out of market, demand for the rupee will be decreased and value is depreciated.

Here I am talking only about the dollar. because it is the global currency and most of the countries trading using the dollar as trade reserve currency. The above example is given to explain it in simple words, the demand for a currency would come in the different way. When we are importing from other countries, we should have the currency of that country to pay for the trade. The value for the currency is fluctuated on real time.

If a currency is free-floating, its exchange rate is allowed to vary against that of other currencies and is determined by the market forces of supply and demand. Exchange rates for such currencies are likely to change almost constantly on financial markets, mainly by banks, around the world. A movable or adjustable peg system is a system of fixed exchange rates, but with a provision for the devaluation of a currency. For example, between 1994 and 2005, the Chinese yuan renminbi (CNY, ¥) was pegged to the United States dollar at ¥8.2768 to $1.

Why RBI intervene on Rupee Value Depreciation?

In the last week we have seen RBI has acted to stop the erosion of rupee value against the dollar currency. What it did was sold the dollar currency in the market to increase the value of rupee. But, it is very difficult for the Reserve Bank of a country to adjust the value of the currency, the long term solution would be fix the problem in economy and bring the inflation into control. You would wonder why RBI has to intervene on rupee value depreciation. Note that, RBI would not allow currency to be higher after certain level because of the exports would get affected like IT companies would suffer if the rupee get appreciated against the dollar. However, if the countrys economy is not in good shape, no one can not stop the falling rupee value.

India is heavily depend on the import of raw materials and Oil for its industrial development. In the decreasing rupee scenario, the outgo of money will be much higher. This would affect the expenses for the companies who imports raw materials for their factory and all the Oil Marketing Companies (OMC) will incur heavy payment to import the Oil. Now you would have understood why the Petrol prices have been increase in the last fortnight. If you look into the news papers, the reason said by our finance minister was the depreciation of rupee value against dollar.

Updated (05-Sep-2013):

Dr. Subbarao has retired from the RBI governor job and Raghuram Rajan took over as RBI governor from 5th September, 2013. He will assume the office for the next five years. He has the toughest challenge of fighting with the lowering economy and raising inflation.

Raguram Rajan Takes Over as RBI Governor