What Is the Mutual Fund Expense Ratio

Post on: 28 Июнь, 2015 No Comment

A Definition and Explanation of Mutual Fund Expense Ratios

The mutual fund expense ratio tells and investor how much money, as a percentage of a mutual fund’s net worth, is used to pay fund expenses each year. Generally speaking, the lower the expense ratio, the better. Getty Images

Understanding the Mutual Fund Expense Ratio

Now that you know the answer to the question, What is a mutual fund? it’s time to go further and talk about the mutual fund expense ratio in-depth.

Last year, I was studying several index funds and the effect that mutual fund expense ratios had on the long-term returns for investors. I was so taken aback by the difference in quality and expense for otherwise identical S&P 500 index funds that I wrote an essay explaining how a 22 year old, investing throughout his or her career until 65, might end up with only $3,000,000 by investing in a mutual fund with a high expense ratio rather than the $6,000,000 that was otherwise possible from investing in a mutual fund with a low expense ratio! To quote John Bogle: Costs matter. They do. A lot.

In the world of mutual fund investments. costs are measured by the mutual fund expense ratio. All mutual funds must, by law and in a manner prescribed by the Securities and Exchange Commission, disclose the expense ratio to existing and potential investors. But what is a mutual fund expense ratio, exactly, and what makes up the costs it includes? Glad you asked!

A Breakdown of the Costs Included in the Mutual Fund Expense Ratio

The average mutual fund expense ratio is going to include several costs. These are:

- Management Fees: This is a fee paid to the portfolio management company for investing the money according to a mandate determined by the fund’s board of directors. The management fee is often the biggest component cost of a mutual fund expense ratio. A typical management fee might run from 0.50% to as high as 2.00%. Generally speaking, the lower the fee, the better for the investor because every penny you pay for management is a penny that is not compounding for your wealth. Mutual fund companies such as Vanguard are owned by the fundholders themselves so there is no management fee of which to speak in the traditional sense, often resulting in drastically lower expense ratios than funds sponsored by major financial institutions that hold the exact same portfolio of investments.

Additional Costs That Should Be, But Are Not, Included in the Mutual Fund Expense Ratio

There are a few other items that are very real costs to a mutual fund shareholder but that are not included in the mutual fund expense ratio. These include:

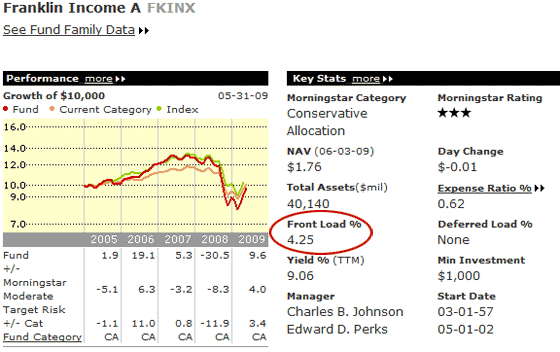

- Mutual Fund Sales Loads: A mutual fund sales load is nothing more than a commission that goes to the person or institution that convinced you to invest your money. If a mutual fund has a sales load of 5% and you invest $100,000, you immediately lose $5,000 of your investment and own only $95,000 worth of the fund. Mutual fund sales loads are almost always unnecessary and bad but there are a few cases where they may be acceptable. For example, some people may not save money or may panic and cash out of investments unless they have their hand held by a professional. If a sales load results in someone staying the course by developing a relationship with an adviser, it will be a relatively small annualized percentage of capital after 10, 20, or 30 years. Personally, I’d prefer a fee-based adviser that made money off of growing wealth for investors, not selling financial products. Mutual fund sales loads should be included in mutual fund expense ratios but they are not.

The lesson in all of this is to pay attention to the mutual fund expense ratio. It represents real money coming directly out of your own pocket. If you are like many investors, you may decide to invest in a low-cost index fund due to the low expense ratio .

More Information About Investing in Mutual Funds

To learn more about how to invest in mutual funds, read The Complete Beginner’s Guide to Investing in Mutual Funds. a special I put together that links to some of the best mutual fund content on the Investing for Beginners site.