What Is the Fiscal Cliff

Post on: 3 Июнь, 2015 No Comment

Please refer to our privacy policy for contact information.

The Fiscal Cliff Explained

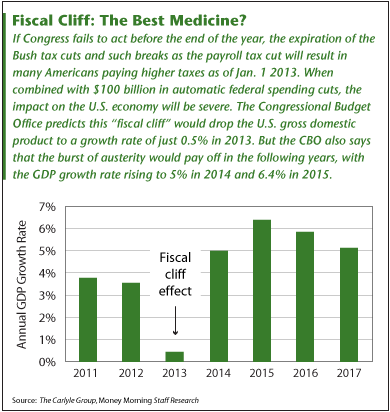

“Fiscal cliff” is the popular shorthand term used to describe the conundrum that the U.S. government faced at the end of 2012, when the terms of the Budget Control Act of 2011 were scheduled to go into effect.

Among the changes that were set to take place at midnight on December 31, 2012 were the end of last year’s temporary payroll tax cuts (resulting in a 2% tax increase for workers), the end of certain tax breaks for businesses, shifts in the alternative minimum tax that would take a larger bite, a rollback of the Bush tax cuts from 2001-2003, and the beginning of taxes related to President Obama’s health care law. At the same time, the spending cuts agreed upon as part of the debt ceiling deal of 2011 — a total of $1.2 trillion over ten years — were scheduled to go into effect. According to Barron’s. over 1,000 government programs — including the defense budget and Medicare are in line for deep, automatic cuts. Of the two, the tax increases were seen as the larger burden for the economy.

The Fiscal Cliff Deal

Three hours before the midnight deadline on January 1, the Senate agreed to a deal to avert the fiscal cliff. The Senate version passed two hours after the deadline, and the House of Representatives approved the deal 21 hours later. The government technically went over the cliff, since the final details weren’t hashed out until after the beginning of the New Year, but the changes incorporated in the deal were backdated to January 1.

The key elements of the deal are: an increase in the payroll tax by two percentage points to 6.2% for income up to $113,700, and a reversal of the Bush tax cuts for individuals making more than $400,000 and couples making over $450,000 (which entails the top rate reverting from 35% to 39.5%). Investment income is also affected, with an increase in the tax on investment income from 15% to 23.8% for filers in the top income bracket and a 3.8% surtax on investment income for individuals earning more than $200,000 and couples making more than $250,000. The deal also gives U.S. taxpayers greater certainty regarding the alternative minimum tax. and a number of popular tax breaks — such as the exemption for interest on municipal bonds — remain in place.

The Congressional Budget Office estimates that current plan includes $330.3 in new spending during the next ten years, and it will increase the deficit by $3.9 trillion in that time period despite raising taxes on 77.1% of U.S. households. Bloomberg reports, More than 80 percent of households with incomes between $50,000 and $200,000 would pay higher taxes. Among the households facing higher taxes, the average increase would be $1,635, the policy center said. A 2 percent payroll tax cut, enacted during the economic slowdown, is being allowed to expire as of (December 31). The two-percentage point increase in the payroll tax is expected to take about $120 billion out of the economy, which should have a negative impact of about seven-tenths of one percent on GDP growth .

Did the Deal Accomplish Anything?

The fiscal cliff agreement is good news to some extent, although it shouldn’t be ignored that lawmakers had 507 days (since the August, 2011 debt ceiling agreement) to address this problem, but still came down to the final hours before they were able to reach a solution — an unnecessary, self-inflicted burden on the economy and financial markets. What’s more, the agreement addressed only the revenue side (taxes) but postponed any discussion of spending cuts — the so-called sequester — until March 1.

Also, it’s important to keep in mind that higher taxes were the most important element of the cliff, and taxes are in fact going up as part of the deal. While the problem is therefore solved in the sense that the deadline has passed, a portion of the concerns related to the cliff indeed came to fruition. And on a longer-term basis, the cliff deal did little to address the country’s debt load — which currently stands at $16.4 trillion and counting.

The 2012 Fiscal Cliff Debate

In dealing with the fiscal cliff, U.S. lawmakers had a choice among three options, none of which were particularly attractive:

- They could have let the policies scheduled for the beginning of 2013 – which featured a number of tax increases and spending cuts that were expected to weigh heavily on growth and possibly drive the economy back into a recession – go into effect. The plus side: the deficit would have fallen significantly under the new set of laws.

- They could have cancelled some or all of the scheduled tax increases and spending cuts, which would have added to the deficit and increased the odds that the United States would face a crisis similar to that which is occurring in Europe. The flip side of this, of course, is that the United States’ debt would have continued to grow.

- They could have taken a middle course, opting for an approach that would address the budget issues to a limited extent, but that would have a more modest impact on growth. This is ultimately the course lawmakers choice in the agreement reached on December 31, 2012.

The fiscal cliff was a concern for investors and business since the highly partisan nature of the political environment made a compromise difficult to reach. Lawmakers had well over a year to address this issue, but Congress – mired in political gridlock – put off the search for a solution until the last minute rather than seeking to solve the problem directly.

In general, Republicans wanted to cut spending and avoid raising taxes, while Democrats sought a combination of spending cuts and tax increases. The agreement currently on the table raises tax rates to 39.6% from 35% on individual with income of more than $400,000 and on couples with incomes of more htan $450,000. It also lets the 2% payroll tax cut expire and delays spending cuts for another two months. The likely outcome of these changes is that economic growth will be pressured modestly, but the country will not face the severe economic downturn it would have if all of the laws related to the fiscal cliff had gone into effect.

The Worst-Case Scenario

If the current laws slated for 2013 had become law, the impact on the economy would be dramatic. While the combination of higher taxes and spending cuts would reduce the deficit by an estimated $560 billion, the CBO also estimated that the policy would have reduced gross domestic product (GDP) by four percentage points in 2013, sending the economy into a recession (i.e. negative growth). At the same time, it predicted that unemployment would rise by almost a full percentage point, with a loss of about two million jobs.

A Wall St. Journal article from May 16, 2012 estimated the following impact in dollar terms: “In all, according to an analysis by J.P. Morgan economist Michael Feroli, $280 billion would be pulled out of the economy by the sunsetting of the Bush tax cuts; $125 billion from the expiration of the Obama payroll-tax holiday; $40 billion from the expiration of emergency unemployment benefits; and $98 billion from Budget Control Act spending cuts. In all, the tax increases and spending cuts make up about 3.5% of GDP, with the Bush tax cuts making up about half of that.” Amid an already-fragile recovery and elevated unemployment, the economy was not in a position to avoid this type of shock.

The Term Cliff Was Misleading

It’s important to keep in mind that while the term “cliff” indicated an immediate disaster at the beginning of 2013, this wasn’t a binary (two-outcome) event that would have ended in either a full solution or a total failure on December 31. There were two important reasons why this is the case:

1) If all of the laws went into effect as scheduled and stayed in effect, the result would undoubtedly be a return to recession. However, the chances that such a deal wouldn’t be reached were slim despite the length of time it took to come to an agreement.

2) Even if the deal did not occur before December 31, Congress had the options to change the scheduled laws retroactively to January 1 after the deadline.

With this as background, it’s important to keep in mind that the concept of going over the cliff was largely a media creation. since even a failure to reach a deal by December 31 never ensured that a recession and financial market crash would occur.

The Next Crisis

Unfortunately, the fiscal cliff isn’t the only problem facing the United States right now. At some point in the first quarter, the country will again hit the debt ceiling — the same issue that roiled the markets in the summer of 2011 and prompted the automatic spending cuts that make up a portion of the fiscal cliff. To learn more about this issue, see my article What is the Debt Ceiling? A Simple Explanation of the Debate and Crisis .