What is Tactical Asset Allocation Definition Index Funds ETFs

Post on: 15 Июль, 2015 No Comment

Balancing Techniques for Mutual Fund Investors

Definition:

Tactical asset allocation is an investment style where the three primary asset classes (stocks, bonds and cash) are actively balanced and adjusted by the investor with the intention of maximizing portfolio returns and minimizing risk compared to a benchmark, such as an index.

This investing style differs from those of technical analysis and fundamental analysis in that it focuses primarily on asset allocation and secondarily on investment selection.

Why Asset Allocation Trumps Investment Selection

This big picture view is for a good reason, at least from the perspective of the investor choosing tactical asset allocation, and something called Modern Portfolio Theory. which essentially states that asset allocation has a greater impact on portfolio returns and market risk than individual investment selection.

One need not be a statistician to understand the basic premise here. Imagine a fundamental investor who has done a good job of research and analysis and they have a portfolio of 20 stocks that has consistently matched or out-performed S&P 500 index funds for three consecutive years. This would be good, right?

To answer the question, consider this recent scenario: During the three year period from the beginning of 1997 through the end of 1999, many investors found it easy to out-perform the S&P 500. However,during the 10-year period from January 2000 through December 2009, even a solid portfolio of stocks would have had roughly a 0.00% return and was out-performed by even the most conservative mix of stocks, bonds and cash.

The point is that asset allocation is the greatest influencing factor in total portfolio performance, especially over long periods of time. Therefore an investor can be poor at investment selection but good at tactical asset allocation and have greater performance, compared to the technical and fundamental investors who may be good at investment selection but have poor timing with asset allocation.

How to Be Tactical: Neutral-weighting, Over-weighting and Under-weighting

For example the investor employing tactical asset allocation may arrive at a prudent mix of assets suitable for their risk tolerance and investment objectives. If this investor chooses a moderate portfolio allocation, it may be targeted at 65% stocks, 30% bonds and 5% cash.

The part of this investing style that makes it tactical is that the allocation will change depending upon the prevailing (or expected) market and economic conditions. Depending upon these conditions, and the investor’s objectives, the allocation to a particular asset (or more than one asset) can be either neutral-weighted, over-weighted or under-weighted.

For example, consider the 65/30/5 allocation given above. This may be considered the investor’s target allocation; all of the assets are neutral-weighted. Now assume that market and economic conditions have changed: Valuations for stocks become relatively high and a bull market appears to be in the maturity stages. The investor now thinks stocks are over-priced and a negative environment is near. The investor may then decide to begin taking steps away from market risk and toward a more conservative asset mix, such as 50% stocks, 40% bonds and 10% cash.

In this scenario, the investor has under-weighted stocks and over-weighted bonds and cash. This reduction in risk may continue in steps as it appears a new bear market and recession are drawing closer. The investor may attempt to be almost completely in bonds and cash by the time bear market conditions are evident. At this time the tactical asset allocator will consider slowly adding to their stock positions to be ready for the next bull market.

It it important to note that tactical asset allocation differs from absolute market timing because the method is slow, deliberate and methodical, whereas timing often involves more frequent and speculative trading. Therefore tactical asset allocation is an active investing style that has some passive investing, buy and hold qualities because the investor is not necessarily abandoning asset types or investments but rather changing the weights or percentages.

Using Index Funds, Sector Funds and ETFs for Tactical Asset Allocation

Index funds and Exchange Traded Funds (ETFs) are good investment types for the tactical asset allocator because, once again, the focus is primarily on assets, not investments. This is a kind of big picture, forest-before-the-trees methodology, if you will. For example, the mutual fund investor can simply choose stock index funds, bond index funds and money market funds, as opposed to building a portfolio of individual securities. The specific fund types and categories for stocks can also be simple with categories, such as large-cap stock, foreign stock, small-cap stock, and/or sector funds and ETFs .

When sectors are selected, the tactical asset allocator may choose sectors he or she believes will perform well in the near future and intermediate term. For example, if the investor feels Real Estate, Health and Utilities may have superior returns compared to other sectors over the coming several months or few years, they may buy ETFs within those respective sectors.

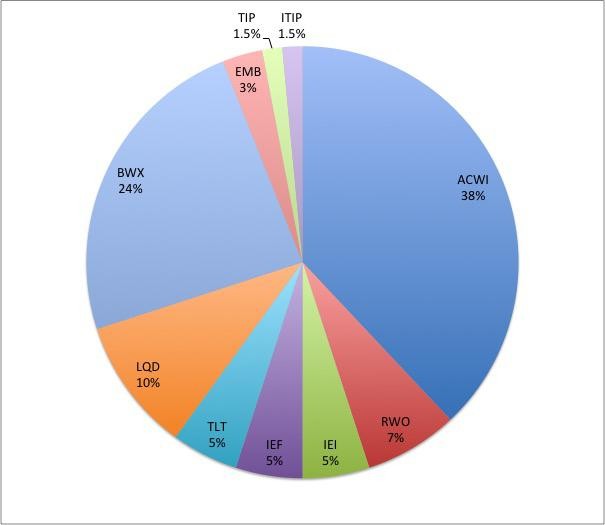

Example Index Fund and ETF Allocation

The tactical asset allocator will often use index funds and ETFs to build a portfolio because the investor wants to manage the asset class and control the underlying holdings and avoid the potential for style drift and stock overlap that can result from the use of actively-managed funds. In essence, the investor is creating their own alpha.

Here’s an example portfolio using index funds and ETFs

65% Stocks:

25% S&P 500 Index

15% Foreign Stock (MSCI) Index

10% Russell 2000 Index

5% Real Estate Sector ETF

5% Health Sector ETF

5% Utilities Sector ETF

30% Bonds:

10% Short-term bond Index

10% Treasury Inflation Protected (TIPS) bond Index