What Is Monetary Policy Objectives Types and Tools

Post on: 3 Май, 2015 No Comment

Definition: Monetary policy is how central bank manage the money supply to guide healthy economic growth. The money supply is credit, cash, checks, and money market mutual funds. The most important of these is credit, which includes loans, bonds, mortgages, and other agreements to repay.

Objectives of Monetary Policy

In December 2013, the Fed set specific targets. It wanted unemployment below 6.5% and the core inflation rate no more than 2.5%. This was the first time the nation’s targeted the unemployment rate.

Types of Monetary Policy

Central banks reduce inflation by raising the Fed funds rate, selling securities through its open market operations or other measures to reduce liquidity. The Fed doesn’t worry about inflation until it reaches its target of 2% (for the core inflation rate). For more, see Contractionary Monetary Policy .

The Fed takes the opposite actions to lower unemployment and avoid recession. In this case, the Fed lowers the Fed funds rate, buys bank securities and otherwise increase the liquidity. For more, see Expansionary Monetary Policy .

Monetary Policy vs Fiscal Policy

Ideally, monetary policy should work hand in glove with the Federal government’s fiscal policy. However, it rarely works this way. That’s because elected officials get re-elected for spending tax dollars, or reducing taxes, on Federal programs that reward voters and campaign contributors (to put it quite bluntly). As a result, fiscal policy is usually expansionary. To avoid inflation, monetary policy must be a little contractionary.

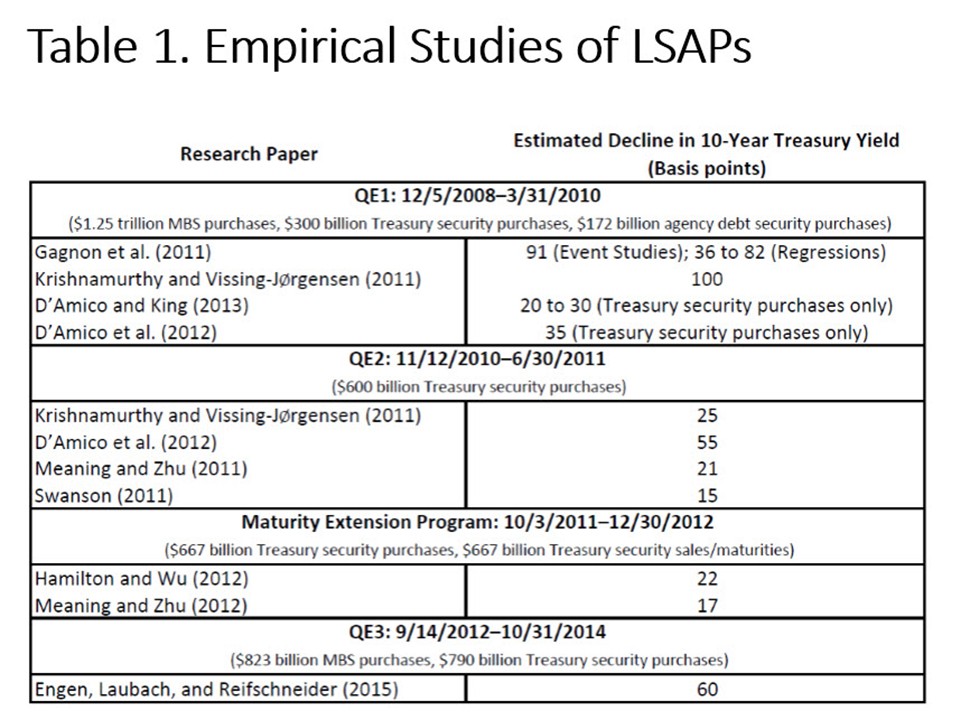

Ironically, during the Great Recession. politicians became concerned about the U.S. debt. which had exceeded the benchmark debt-to-GDP ratio. As a result, fiscal policy became contractionary just when it needed to be expansionary. To compensate, the Fed injected massive amounts of money into the economy with Quantitative Easing.

Tools of Monetary Policy

All central banks use at least three tools of monetary policy. but most have many more. They all work by directly impacting the amount of liquidity in an economy. This is done by managing banks’ reserves.

The Fed’s has five such major tools. First, it sets a reserve requirement ,which tells banks how much of their money they must have on reserve each night. If it weren’t for the reserve requirement, banks would lend 100% of the money you’ve deposited. Not everyone needs all their money each day, so it is safe for the banks to lend most of it out.

However, the Fed requires that banks (on average) keep 10% of the money deposited on reserve. That way, they have enough cash on hand to meet most demands for redemption. When the Fed wants to restrict liquidity, it raises the reserve requirement. Since it’s difficult to ask banks to change this, the Fed only does this as last resort.

Second, the Fed can easily manage banks’ reserves with the Fed funds rate. This is the interest rate that banks charge each other to store their excess cash overnight. The target for this rate is set at the eight Federal Open Market Committee (FOMC) meetings. The Fed funds rate impacts all other interest rates. including bank loan rates and mortgage rates.

Third, the FOMC usually sets the central bank’s discount rate. which is what it charges banks to borrow funds from the Fed’s fourth tool, the discount window. The discount rate is usually a percentage of a point higher than the Fed funds rate.

Fourth, the Fed uses open market operations to buy and sell Treasuries and other securities from its member banks. This changes the amount of reserves banks actually have on hand to lend, without changing the reserve requirement.

Fifth, many central banks including the Fed use inflation targeting to clearly set expectations that they want some inflation. That’s because people are more likely to buy now if they know prices are rising.

In addition, the Fed created many new tools to deal with the Great Recession. To find out more, see Federal Reserve Tools. Article update November 29, 2014