What Is High Frequency Trading

Post on: 14 Июль, 2015 No Comment

Examples of HFT Traders

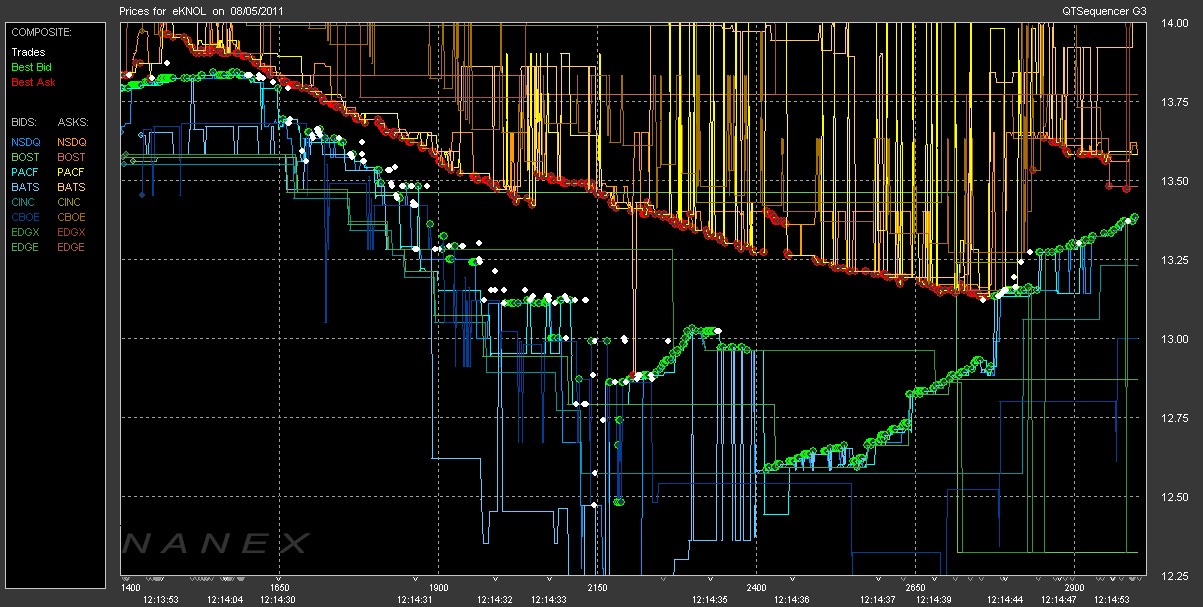

High frequency traders use a number of different strategies designed to take advantage of market inefficiencies. Since these trades take place algorithmically, market researchers can spot them relatively easily (Figure 1). Patterns produced by HFT have been the focus of extensive research by organizations like Nanex that focus on documenting the activity for regulators and other interested parties.

Figure 1 – KORS Quote Stuffing – Source: Nanex Reserach

Perhaps most famously, many HFT traders rely on so-called low-latency strategies to generate profits. HFT traders with extremely fast connections, using things like microwave networks over long distances, take advantage of the difference in price that the same security may have on multiple exchanges. These differences may be individually very small, but may add up to significant numbers very quickly.

HFT traders focused on market making operations aim to capitalize on the spread between bid and ask prices. For example, HFT trading firms might place a limit order to buy or sell in other to earn the bid-ask spread. Some exchanges also offer rebate income to market participants willing to make markets in relatively illiquid securities, providing yet another venue to generate automated profits.

HFT traders can take advantage of arbitrage opportunities, such as event or statistical arbitrage, using automated software, too. For example, there may be market inefficiencies in the pricing between domestic and dollar-denominated bonds or spot and forward contract currencies. HFT traders can generate profits by buying one asset and selling another until the difference between them closes.

All of these strategies are focused on generating small profits from inefficiencies that add up to big numbers over time. With thousands or millions of trades placed every day, making even pennies per trade can translate to millions of dollars.

HFT Risks & Rewards

High frequency trading can generate significant profits at a relatively low risk, since the strategies involve very little risk and a high Sharpe ratio. For example, HFT traders capitalizing on an arbitrage scenario face exceptionally low risk, since they aren’t using any leverage and the simultaneous buying and selling removes any risks associated with the individual security being traded.

The problem arises when the computer algorithms being used to generate HFT trades become error-prone. For instance, Knight Capital Group famously lost $440 million in just 45 minutes when trying to modify its algorithms to effectively compete against a new NYSE program launched on the same day. The technology went on a trading frenzy (Figure 2) and nearly caused a financial crisis on its own.

Figure 2 – One Second of Trades in EXC with 39 Trades – Source: Nanex Research

HFT firms are also facing increased competition, which makes the markets more efficient and limits profit potential. Some experts estimate that the profits from these strategies have fallen from an estimated peak of $5 billion in 2009 to about $1.25 billion in 2012, since there is less inefficiency to exploit and a greater number of HFT trading firms going after a smaller piece of the pie.

HFT Controversy & Regulation

The Flash Crash on May 6, 2010 set the stage for increased regulatory scrutiny of high frequency trading operations. On that day, the Dow Jones Industrial Average plummeted roughly 1,000 points or 9% and recovered the losses within minutes in the biggest one-day point decline on an intraday basis in the index’s history. The SEC and CFTC concluded that HFT was largely responsible for the crash.

The government’s report indicated that a large mutual fund firm began selling usually large numbers of E-Mini S&P 500 contracts that exhausted available buyers and triggered HFT trading firms to begin aggressively selling. Arbitrage-based HFTs then began buying the e-minis and selling the equivalent amounts of stock in the equity markets and then eventually began buying and selling with each other.

Regulators have also grown concerned with frontrunning. New York’s Attorney General Eric Schneiderman called HFT “insider trading 2.0” though SEC head Mary Jo White insisted that using computer algorithms to trade ahead of other investors is “not unlawful insider trading.” FINRA has since suggested that the SEC at least consider registration requirements for HFT firms to avoid systemic risks.

The Bottom Line

High frequency trading involves rapidly buying and selling securities in order to capitalize on market inefficiencies. Often times, these inefficiencies come in the form of arbitrage opportunities, event-driven opportunities, or simply low-latency strategies that take advantage of faster access to information. HFT firms have fallen in popularity since 2009 but remain a big part of the U.S. equity markets.

Some regulators are concerned with HFT firms’ significant footprint that introduces some level of systemic risk, while others are concerned with the ways that the firms generate profit by front-running investors. Over time, these concerns could result in additional regulations for HFT firms that could further limit their participation in the U.S. equity markets, for better or worse.