What Is An Investment Policy Statement and Why NonProfits Need One

Post on: 3 Июль, 2015 No Comment

We manage funds for a wide range of non-profit entities. While they differ in many respects, most face the central challenge of prudently managing funds entrusted to them by donors. Typically the finance or investment committees tasked with this charge face two problems. First, committee members may or may not have the expertise needed to shepherd the organization’s core resources. Second, however well-intentioned and capable committee members, their tenure is often short while the endowment fund’s time horizon is long. An Investment Policy Statement (IPS) serves as a guiding document to address these and other investment related issues.

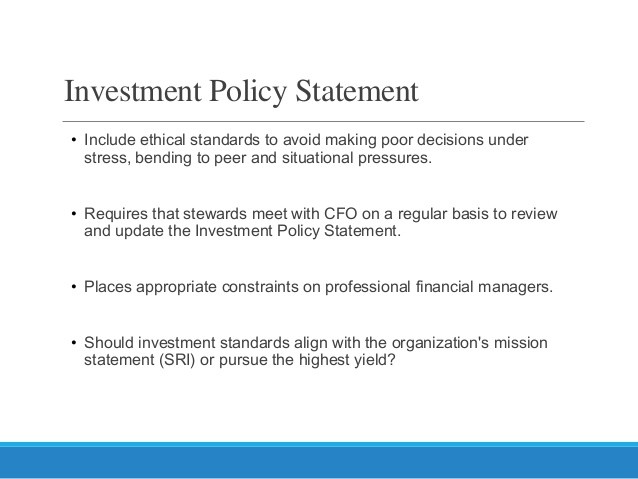

A well-crafted IPS covers the following areas:

Purpose : This section outlines what exactly the invested funds are to be used for. It also reminds everyone, from committee members to investment managers, that they must at all times act in the best interest of the organization.

Definition of Duties: Spelling out core duties helps everyone from board directors to custodians complete their tasks and avoid confusion.

Investment Objectives: Is the organization’s investment goal to grow fund assets or is preservation of principal more important? A clear understanding of the organization’s time horizon (the length of time that an investment can be held before being liquidated) helps determine an acceptable balance between risk and return. A specific rate of return objective also lets committee members establish realistic internal goals and performance benchmarks for investment managers.

Investment Strategy and Asset Allocation: This section translates the objectives outlined above into specific investment guidelines. Asset Allocation targets (the mix of major asset classes such as stocks, bonds and cash) and ranges typically expressed in percentage terms are included along with risk control guidelines relating to security concentration. A list of excluded assets and strategies should also be clearly identified.

Spending and Liquidity Policy: A key purpose of most endowments is to help support the organization’s activities through some form of annual withdrawal. Language determining a sustainable withdrawal rate should be included as well as processes for approving deviations from this rate. Policies to ensure that adequate cash levels are on hand in the event of unforeseen events are also helpful.

Unique Circumstances: If the organization has any unique investment related requirements such as socially responsible criteria or items specific to its founding or charter, these need to be clearly spelled out.

Monitor and Review Procedures: The best defined investment policies are of little value if not followed. A clear review process, often involving quarterly or semi-annual meetings, should be established to ensure that portfolio guidelines are adhered to and long-term performance goals met.

Many non-profits have IPS documents in place but either fail to follow them or keep them up to date. Often the language used in existing documents is too vague or too restrictive to be useful. And more recently, we have seen outdated documents contain unrealistic return goals given the now low level of prevailing interest rates. To ensure that portfolio objectives are met, IPS documents should be reviewed at least every three years.

While creating and reviewing an IPS can be time consuming, the process provides an excellent opportunity to educate key stakeholders in all aspects of the organization’s investment related activities. These documents also help safe-keep organization funds and serve as a road map for the inevitable transitions which occur within boards, committees and managers.