What Is An ETF An Infographic_1

Post on: 16 Март, 2015 No Comment

Latest Research

2014 ETF Investor Study by Charles Schwab: Even with a perceived proliferation of ETFs on the market today, 66 percent of investors say there is room for more and more than a quarter say that more product choice is the industry trend that has been most beneficial to investors over the past few years, according to the 2014 ETF Investor Study by Charles Schwab. The study, conducted by Koski Research in May 2014, is the fourth installment of an annual online survey of more than 1,000 U.S. individual investors between the ages of 25-75 with at least $25,000 in investable assets who have purchased ETFs in the past two years or are considering doing so in the near term. Media Contact: Erin Montgomery

Read the press release

View infographic More ETFs, Anyone? Investors Say Yes, Please (PDF)

View infographic Confidence is Key (PDF)

View slides. Survey findings from the 2014 ETF Investor Study by Charles Schwab (PDF)

Workers Bank On 401(k) For Retirement: The majority of American workers in a new survey accept responsibility for financing their own retirement and are relying primarily on their 401(k) to get them there, but many lack the confidence to effectively manage their retirement savings. The nationwide survey of more than 1,000 401(k) plan participants, commissioned by Schwab Retirement Plan Services, shows a high level of self-reliance among respondents. Roughly nine in ten (89%) say they are counting on themselves for the money to support their retirement, and just five percent expect to rely mostly on the government for financial help after they stop working full time. Media Contact: Mike Peterson

Bargain Hunting For Bonds: How Investors Shop was an online survey of U.S. investors developed to compare and contrast shopping habits around high-ticket household products and consumer items with financial products, including bonds. The survey, conducted by Koski Research for Charles Schwab, was completed by a total of 514 respondents between the ages of 25 and 75 who held a minimum of $100,000 in total investable assets and invested on their own. All respondents had heard of bonds or fixed income investments, and fifty-one percent of survey respondents own or have owned individual bonds. Media Contact: Alison Wertheim

- Read the press release

- View Slides: Survey findings from the Bargain Hunting For Bonds: How Investors Shop by Charles Schwab (PDF)

Advice and the Affluent Investor: According to a recent study from Schwab, seven in 10 affluent investors feel todays financial markets are too complicated to navigate without an advisor. One-third of study participants also say their desire for investment advice has increased in the past year, and three-quarters say they are most confident making investment decisions when they collaborate with their investment professional; just one-third say they feel that same level of confidence when making investment decisions by themselves. Advice and the Affluent Investor: A Study of Attitudes and Behavior by Charles Schwab (AAIS ) surveyed more than 1,000 affluent Americans who receive some form of professional financial advice. Media Contact: Alison Wertheim

- Read the press release

- View Slides: Survey findings from Advice and the Affluent Investor: A Study of Attitudes and Behavior by Charles Schwab (AAIS) survey (PDF)

Todays Engaged Investor: A majority of Americans who are highly engaged across many aspects of life also grab hold of the wheel when it comes to investing, according to a new study by Charles Schwab. Around 1,000 Americans surveyed express a significant degree of personal ownership in their everyday lives. The study found that a majority are also highly engaged in investing: nearly two-thirds (61 percent) are actively involved in their investment portfolios. Media Contact: Michael Cianfrocca

More Research Topics

- Bond Investor Study : Exploring the perceptions of individual investors about investing in the U.S. bond market.

- The Global Investing Study was designed to assess retail investors interest and attitudes toward investing in equity markets outside the United States. More than 200 individual investors participated in this online survey during June 2012.

- Independent Advisor Research : Including the recent Advisors Turning Independent (ATI) study and the twice-a-year Independent Advisor Outlook Survey.

- Retirement Research : Including the quarterly Real-Life Retirement pulse survey on American consumers plus scholarly studies on employer-sponsored retirement plans, such as the 401(k).

- Corporate Stock Plan Study: Exploring how that most companies view stock plans as a tool to motivate and reward workers at all levels.

Links to Additional Studies

- 2011 Teens & Money Survey: Schwab takes a look at 16- to 18-year-olds and their attitudes, behaviors and expectations about money. Nine out of 10 teens say the Great Recession caused major shifts in their mindset, including a greater appreciation for what they have and an increased awareness of financial hardship. Read the press release. or check more statistics on the survey fact sheet .

- Reading the Signs in the Current Bond Market: This white paper provides perspective on four topics that are top-of-mind for many fixed income investors.

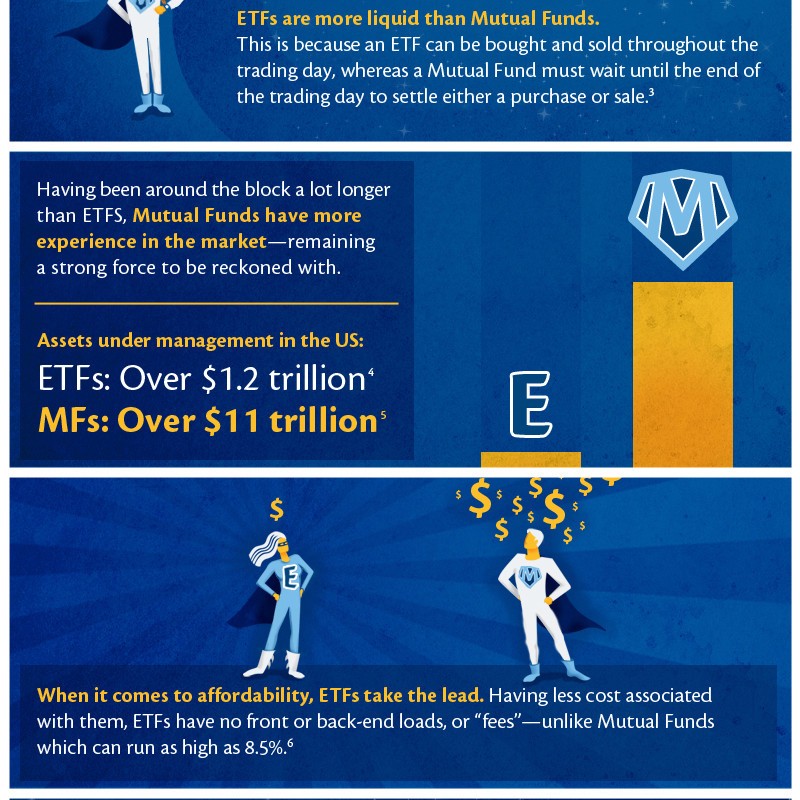

- Schwabs Mutual Fund OneSource at 20. This white paper traces the 20-year history of Mutual Fund OneSource, and its impact on mutual fund investors. Also, read the press release and watch interviews with Chuck Schwab .