What is an ETF

Post on: 5 Май, 2015 No Comment

In talking to first-time or newer investors who are looking to invest money outside of a 401K, the discussion often goes something like this:

Newbie: What are some good stocks or funds I should invest in?

Me: Well, I dont really give specific recommendations. What are you investing in now?

Newbie: A and B mutual funds. (more commonlyNothing Yet)

Me: Have you looked at ETFs?

Newbie: What is an ETF?

Me: A cheap way to distribute your risk.

Newbie: Oh.

(P.S. There is nothing wrong with being a newbie and Im definitely not a pro).

As you can see, ETFs are not easy to explain in a conversation, so I tend to just focus on the benefits. ETFs are often misunderstood at best, or avoided out of fear at worst, despite the fact that they tend to outperform mutual funds and have similar risk distribution. They are a relatively new kid on the block in the investing world and arent as well known as mutual funds. So I wanted to take some time to go into detail on what they are and why they are not something to fear, despite their weird name.

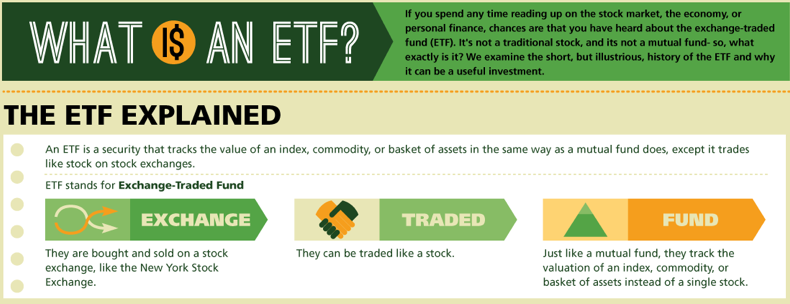

What is an ETF?

An ETF (short for Exchange Traded Fund ) is a type of investment fund that combines elements of a mutual fund and elements of a stock.

ETFs are like mutual funds in that each has ownership in a number of assets (i.e. stocks, bonds, currencies, etc.). The ownership of multiple assets diversifies the risk for the investor, much like a mutual fund is intended for.

Where they differ from mutual funds is in how you can buy and sell them. Here, they are similar to stocks in that they are traded throughout the day on the market like a stock is.

I thought Id go through each individual attribute of an ETF as it relates to you and compare it to other investments to break it down for you:

Investment Diversification:

- Mutual funds/index funds: Diversified in that they invest in a group of securities like stocks, bonds, currency, etc.

- Stocks: Not diversified. It is only one company.

- ETF: Diversified like mutual/index funds by investing in a group of securities.

Share Price:

- Mutual funds/index funds: Share price is determined by calculating the NAV (net asset value) of all the holdings in that fund, once at the end of the trading day.

- Stocks: Share price is determined throughout the day based on buy and sell trade volume for that stocks shares.

- ETF: Share price is determined throughout the day based on buy and sell trade volume for that ETFs shares. Market price may be influenced by the NAV of the holdings (i.e. investors may see value, leading to higher demand for shares and an upward movement in price), but it is based on the actual trading and not the value of the holdings.

Trade Price:

- Mutual funds/index funds: Can be bought directly through the managing mutual fund company, usually without a fee. If bought through an online broker to consolidate, some are free (no load funds), but others require a one-time buy and sell fee (no fee to buy additional shares). For example, TradeKing charges $9.95 to buy in or sell out of most mutual funds.

- Stocks: You pay a trading fee every time you buy or sell shares. TradeKing charges $4.95 per trade.

- ETF: Same as stocks. You pay every time you buy or sell shares. TradeKing charges $4.95 per trade.

Ownership Fees (Expense Ratio):

- Mutual funds/index funds: You pay a % of total assets to the mutual fund manager. This fee generally ranges between 0.5% and 1.5%, but index funds are almost always cheaper than mutual funds because the investing is more automated based on the index.

- Stocks: There are no ownership fees with stocks.

- ETF: You pay a % of total assets to the ETF manager. ETFs have historically had significantly lower management fees than similar mutual/index funds. For example, Vanguards S&P 500 ETF, VOO. has an expense ratio of 0.06% while its S&P 500 index fund counterpart has a 0.17% fee. Meanwhile, Vanguards REIT ETF, VNQ. has a 0.12% expense ratio, while its REIT index fund counterpart charges 0.26%. The more infrequently you buy or sell shares, the more ETFs come out in your favor.