What is a Prime Money Market Fund

Post on: 24 Апрель, 2015 No Comment

Function

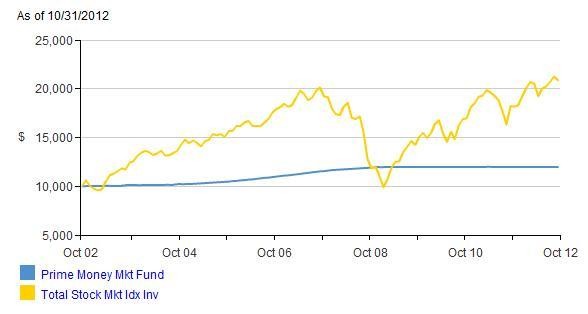

When you and other shareholders pool your money in a prime money market fund, the funds managers use the collective balance to purchase short-term securities. Because prime money market funds look for quality, they typically hold a high percentage of highly rated government bonds and a very small percentage of corporate bonds or certificates of deposit. For example, the prime money market run by mutual fund giant Vanguard holds more than 80 percent of its assets in U.S. government-related bond and debt instruments.

FDIC Insurance

While bank money market accounts are insured under the Federal Deposit Insurance Corp. prime money market funds offered by mutual fund companies do not have this protection. If a mutual fund holding your prime money market account goes bankrupt, you will lose your investment. However, money market funds are regulated by the U.S. Securities and Exchange Commission, and the largest U.S. mutual fund firms are in little danger of going bankrupt; Forbes reports that holding a prime money market with a large fund firm is a safe investment.

Minimum Balances

Opening a prime money market fund account often requires an initial investment of $1,000 to $3,000, and these funds typically require you to maintain a minimum balance in your account. Depending on their individual regulations regarding prime money market accounts, fund firms can charge a fee when your balance falls below the minimum required.

Expenses

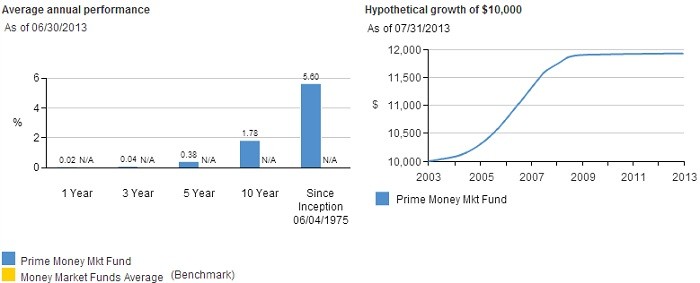

Prime money market funds carry annual expenses to pay for administrative and operating costs. These expenses are expressed as ratios, and the lower the expense ratio, the less fund managers extract from the total assets at the end of the year. Expense ratios for these funds hover in the range of 0.2 to 0.5 percent.

Check-Writing Privileges

References

More Like This

Tax-Exempt Vs. Taxable Money Market Accounts

Definition of Money Market Redemption

What are the Best Money Market Returns?

You May Also Like

The Federal Open Market Committee (FOMC) controls the money supply in the United States. The FOMC indirectly controls the prime rate by.

Vanguard offers nine money market funds. Five of them invest in the short-term obligations of the state governments of California, New Jersey.

For investors there is a significant difference between a money market and a capital market. A capital market is one in which.

Investing your money smartly is essential to building a substantial savings. The savings can be used for life expenses, but also for.

A money market fund is invested in debt securities that are very liquid and largely risk-free. The majority of money market funds.

Once you have a PayPal account, you can invest in the PayPal Money Market Fund. Although investing in the fund involves some.

A money market mutual fund is a type of investment that buys short term debt obligations from highly rated companies and reliable.

Money market funds have been in existence for almost four decades, although only a handful of people are aware of their long.

The Federal Funds Target Rate — federal funds or fed funds rate — and the prime rate are closely linked. The fed.

The Prime Minister's National Relief Fund is a program of the office of the Prime Minister of India. It allows for private.