What Is a Diversified IRA

Post on: 13 Июнь, 2015 No Comment

Diversified IRAs can maximize earnings while giving you acceptable safety.

Jupiterimages/Comstock/Getty Images

More Articles

Individual retirement accounts can be administered by banks, credit unions and investment firms. Your choice of investments within your IRA will influence your earnings. The range of investments available for your IRA will vary widely depending on who administers it. Some banks or credit unions may only offer a few options, while some investment firms offer a wide array of choices in which you can invest. When you open an IRA, you must decide on your investment preferences, such as income, growth or safety options, and instruct your IRA administrator to put your money in the investment vehicles you prefer. Diversified IRAs that allow you to invest in a number of different options can better protect you from investment risks.

Risk Vs Reward

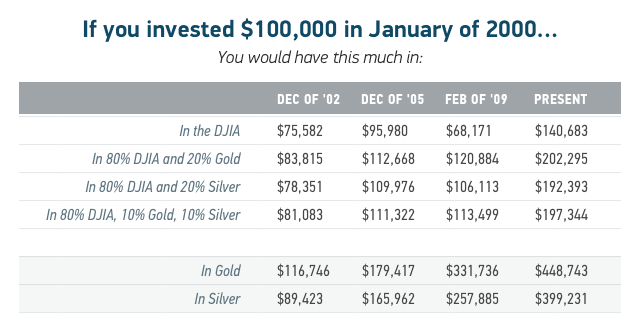

All investments include risk vs. reward trade-offs. IRA investments are no exception to this rule. Diversified IRAs help minimize risk while maximizing reward. For example, investing your IRA in bank certificates of deposit offers you safety, but you’ll only realize modest earnings. Conversely, choosing the stock market involves the potential of strong rewards matched with higher risk than bank CDs. Diversified IRAs, however, might bring you the investment balance you want to maximize earnings, while maintaining high safety standards.

Stock Diversification

If you have moderate risk tolerance, you may still want to choose the stock market as your preferred investment strategy. It is wise to keep your age and financial goals in mind when choosing stocks that diversify your IRA portfolio. For example, when you are young, you might prefer growth companies that could deliver strong profits in the future. Conversely, as you get older and approach retirement, you might reinvest into safer, income-producing stocks that offer more earnings in the short-term.

Safety Issues

However risk tolerant you are, consider including safe investments in your IRA. Safe investments include bonds, US Treasury securities, bank CDs and money market accounts; bank accounts are insured, and highly rated bonds and US treasury obligations are backed by the federal government, so they come with little risk. Although your earnings will be modest, you face little probability of generating a loss within your IRA. A combination of higher risk and reward investments coupled with safer options equals a diversified IRA.