What Happens When Interest Rates Rise

Post on: 16 Март, 2015 No Comment

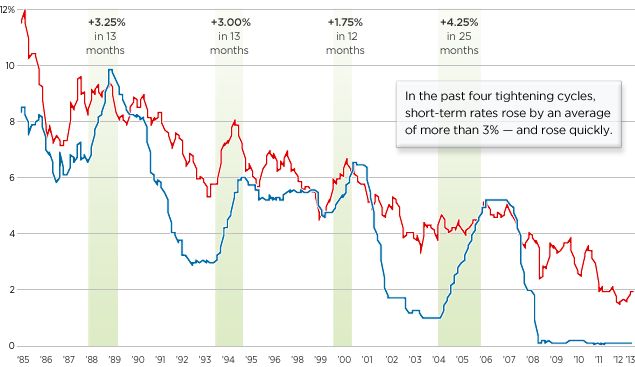

Around the world interest rates are at their lowest levels ever. What does that mean for economic growth prospects, and what happens when rates inevitably go back up? Let’s consider the chart show below. This represents the yield on the 10-year U.S. Treasury note from January 1980 to the present (September 5, 2012 being the last date). Over this time period, the 10-year yield fell from a high of just under 16% in the early 1980s to a low of 1.4% in 2012. Moreover, the overall trend has been pretty much downhill the entire way. We could reasonably conclude that at some point rates have to rise again from where they are today. What should you, as an investor, be paying attention to and possibly concerned about in the context of rising interest rates?

Interest Rates and Business Growth

Low interest rates act as a stimulus for economic growth. That is because access to credit is what enables businesses to invest in the resources they need—equipment, technology, people—to grow their businesses. When borrowing costs are cheaper, more businesses are able to afford to take out lines of credit, and a virtuous activity cycle can result. This is why monetary policymakers, particularly central bankers, use interest rate mechanisms to stimulate the economy when it appears to be headed into a downturn. The historically low rates we are witnessing at present are where they are largely because of deliberate intervention into credit markets by the U.S. Fed and other central banks throughout the world.

Interest Rates and Inflation

But—at least according to most mainstream strands of economic thought—interest rates cannot stay low forever because at some point they will engender inflation. Inflation happens when too much money chases too few goods and services. If lower interest rates increase the amount of money in circulation, then that money goes out in search of things to buy—businesses buy more capital equipment and consumers buy more fancy dinners out and spend more on their wedding festivities. That pushes up prices, then people find their paychecks don’t go as far as they used to, then they cut back, then recession ensues. So part of the trick to monetary policy is knowing how to manage rising interest rates in a way that cools off an overheating economy without sending it into the deep freeze. It’s not an easy task!

Interest Rates and Bond Prices

As a household consumer, you care about interest rates because they can affect the price of gas and groceries. As an investor, you care about interest rates because they affect the price of the assets in your portfolio—especially the fixed income assets. What happens to your portfolio when interest rates rise? Well, first and foremost, your bond prices go down. Bond prices and bond yields (i.e. rates) move inversely—when yields go up prices go down. Does it matter? Probably not in the short term. The intraday market price of a bond will not affect the coupon interest payments you receive from the bond (assuming they are fixed rate bonds, like most traditional corporate and government issues). It won’t affect the par value you receive at maturity, because that is a contractual obligation on the part of the issuer. It will affect you if you own an individual bond that you want to sell before it matures, and it will affect the paper returns you see when you get your quarterly portfolio statement.

The larger concern some professional market watchers have is that with rates as low as they are, they are going to have to rise substantially just to return to historic averages (something you can clearly see form that yield chart shown above). A sustained rise from 1.5% to 6%, which was near where the 10-year yield spent a good part of the 1990s, would indeed be very bad news for bond market prices. But is that inevitable? It’s hard to say. For one thing, the economy is in very little danger of overheating anytime soon—quite the opposite. It may well be that rates don’t return to the neighborhood of 6% for as much as decades to come. Still, as an investor you should keep an eye on what’s happening in credit markets. When interest rates rise your assets are affected in one way or another.