What Caused the Financial Crisis and Recession

Post on: 10 Июль, 2015 No Comment

Kip Beckman . Principal Research Associate, Forecasting and Analysis

February 16, 2010

On September 15, 2008, Lehman Brothers went under. In the two incredible weeks that followed, the Federal Reserve (Fed) and the United States Treasury nationalized the country’s two largest mortgage entities, Fannie Mae and Freddie Mac, and took over the world’s largest insurance company, AIG. Global capital flows and trade flows spiralled downwards and a vicious cycle of credit withdrawal, halting of investment, weaker growth, and debt impairment took hold. These developments eventually resulted in the first synchronized global recession since the 1940s.

Lehman Collapse a Result, Not a Cause

The dramatic moves by the U.S. government and the Fed were desperately needed; the Lehman bankruptcy led to a panic in global financial markets and an ensuing plunge in equity markets. However, the collapse of Lehman Brothers—while the catalyst for the frightening developments of autumn 2008—did not the cause the crisis. The crisis emerged from decisions made following the mild recession in the U.S. in 2001 caused by the high-tech bust. This recession led the Fed to pursue an accommodative monetary policy and to reduce interest rates sharply. Not surprisingly, low interest rates, which lasted until early 2006, and strong U.S. economic growth led to a surge in home buying that caused house prices to rise sharply.

Suspect Lending Practices

To entice homeowners into the mortgage market, lenders started offering “sub-prime” mortgages. These mortgages had characteristics that appealed to low-income families, including low or zero down payments, long amortization periods, and low “teaser” interest rates that accelerated quickly after the initial year or two of the loan. To push mortgage sales, many unregulated lenders engaged in unscrupulous practices, such as approving loans to borrowers who weren’t required to provide proof of employment and income, or didn’t possess any assets.

Homes as ATMs

The growing use of home prices to finance increasing consumer spending also contributed to the crisis. Households used the extraordinary run-up in home prices to refinance their debt and used some of the extra cash to buy more goods—boats, cottages, and new consumer electronics—while foregoing savings. Why save money when the prevailing wisdom at the time was that home prices could only go up, never down?

The mix of lax regulation, aggressive and dishonest lenders, naive borrowers, inappropriate policy responses by the Fed, and low household savings eventually led to a housing market meltdown beginning in late 2006 and a severe U.S. recession that just came to an end last summer. However, that doesn’t explain why some bizarre lending practices in the United States came close to toppling the entire global economy.

Crisis Spreads Through Securitization

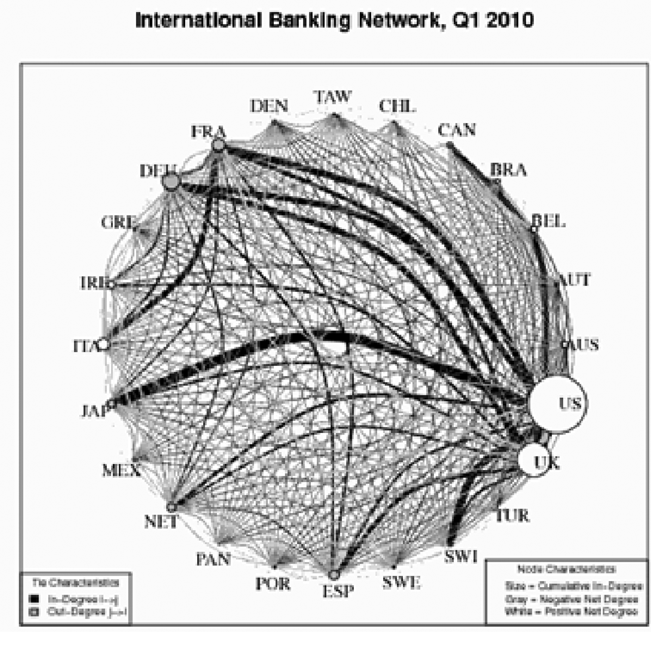

Rapid innovation in global financial markets spread the American housing market meltdown to the rest of the world. The surge in U.S. housing prices coincided with the rise of new financial techniques, notably securitization, a process that became quite common in developed countries. Banks bundled the mortgage loans on their books and sold them as securities in secondary markets. These loans became known as mortgage-backed securities (MBS).

MBS were very attractive investments, since on the surface they offered much higher returns than government bonds did. Banks, hedge funds, pension funds, and even municipalities all over the world snapped them up. When home prices started to collapse in the latter half of 2007, a growing number of homeowners were forced into foreclosure, and the securities backed by these mortgages started to default. The bad loans quickly started to erode the balance sheets of financial institutions that had purchased MBS.

Warning Signs

The first sign of trouble came in the summer of 2007, when the market for asset-backed commercial paper in the United States froze. The Fed stepped in and provided liquidity to the market, but this intervention offered only a short respite. The wave of mortgage defaults grew and the balance sheets of certain financial institutions continued to deteriorate. In March 2008, the investment bank Bear Stearns collapsed under the weight of bad debt. Equity markets sank, recovered briefly, then quickly resumed their downward course—culminating in the events of September 2008.

Financial Crisis Causes Global Recession

Credit is a crucial input for both households and firms; once it dried up, both business and consumer confidence plunged. Firms stopped investing and households slashed spending. The combination of tumbling confidence and a loss of credit created the conditions for recession in the United States that quickly spread around the globe. As the global financial crisis gained momentum, it became virtually impossible for the economy to avoid slipping into recession.