What Bond ETFs Are Saying About The Economy In 2014 iShares TIPS Bond ETF (NYSEARCA TIP)

Post on: 15 Июнь, 2015 No Comment

On June 24th 2013, stock and bond markets stabilized after their late spring swoon generated by fears the FED would begin to taper their monthly purchases of treasury securities. While the market has had other distractions in the interim — Syria in August, Government shutdown in October, emerging markets in January — on balance, eyes have been focused almost exclusively on our Central Bank.

Seeking Alpha readers know I let markets tell me what will happen to the economy, rather than government-based bureaucrats and their fawning admirers in the mainstream news media. Whenever times like now arise, as statistics come in suggesting the economy might not be doing that well, I always have to endure comments akin to see, markets aren’t all that accurate!

It reminds me of the old joke about two backpackers running from a grizzly bear.

- you can’t run very fast, ha ha ha.

- I don’t have to run fast. I just have to run faster than you.

Much the same with pundits. Markets don’t have to be good. They just have to be better than pundits are. I’ll listen to what markets are telling me anytime, since they are the collective verdict of millions of intelligent investors with their money on the line.

Stock prices have been working their way higher since June, in a series of higher highs and lows. But recent selloff has placed some doubt about recent economic performance, which appears to be verified by unemployment and jobs data in recent weeks.

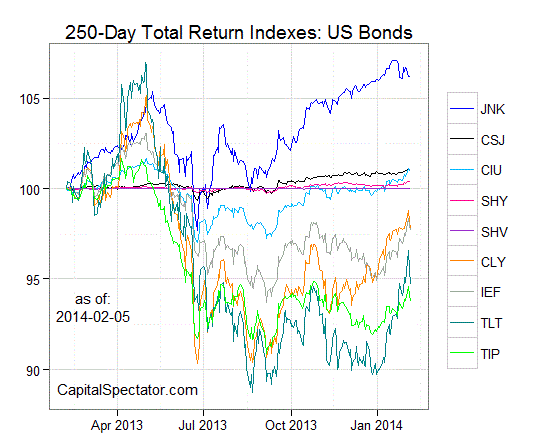

Perhaps we should turn to a different market for additional information and guidance, specifically the market for US Treasury bonds. If the economy indeed is getting stronger, we would expect interest rates to rise and bond prices to fall. Thus we would expect prices of iShares 20+ Year Treasury Bonds (NYSEARCA:TLT ) to be working their way lower.

More than just growth can spook bonds however. Inflation erodes the purchasing power of both interest and principal. To control for this, we also look at iShares TIPS Bond Fund (NYSEARCA:TIP ), which provide these protections.

The verdict? Mixed. But there is still plenty of useful information for investors.

We can draw a number of conclusions from the chart above.

- Both Tbonds and TIPS have formed an important bottom over the last eight months.

If the economy was truly getting stronger, we would expect bond prices to continue to fall. This does not appear to be the case.

- TIPS has outperformed TLT over this span.

Notice that TLT was lower over this period, sometimes much lower, down more than 6% in some cases. TIPS are higher. The markets appear to sniff some higher inflation in the air. Hard to believe a slowing economy means price pressures, though the stagflation of the 1970s proves it can happen. It is true that TLT has made great strides recently.

- Both bond ETFs are near their rally highs of the past few months.

To make the numerical values clear, I will show the charts for TIP and TLT alone below, over a full year to make the importance of the current levels more evident.

The important levels are $114 on the TIPs and $110 on the TLTs. If these levels are broken upside in the near future, than we must adjust our expectations about 2014 economic growth sharply lower.

In contrast — and this is what I expect, though I will let the markets be the final arbiter — if prices of these two ETFs tail off and especially if they pierce their August and December lows, the case for a strong economy in 2014 is reiterated.

There are times when investors should sit back and let the markets make up their mind. This is one of them.

Disclosure: I am long XLK, XLV, IHI. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Conduct in-depth research on TIP and 1,600+ other ETFs with SA’s ETF Hub