What Bill Gross s Arrival Means To Janus Capital (JNS BLK STT)

Post on: 16 Март, 2015 No Comment

To the untrained investor, one investment management firm might seem indistinguishable from the next. 50 years ago, that might have been the case. But in the late 1960s/early 1970s a series of young, dynamic managers created a new breed of firms – ones beholden to hard mathematical analysis and little else. Janus Capital Group, Inc. (JNS ) was among those firms, and soon grew to become one of the dominant players in the industry.

Under three brands – Janus, INTECH and Perkins – Janus Capital operates dozens of funds in multiple categories. Janus Capital defines its funds by geography (e.g. Overseas, Asia Equity), by objective (U.S. Value, Growth and Income), and by risk level (Global Allocation – Conservative, Global Allocation – Moderate). The firm’s funds also include meta-funds, such as the Global Allocation Fund, composed entirely of Janus Capital funds.

Well-Known Name, But No Giant

Janus Capital has about $175 billion in assets under management, which sounds colossal only until you compare it to other firms. $175 billion is barely enough to crack the global top 100. BlackRock Inc. (BLK ) is 20 times the size of Janus Capital, and that multiple is growing. Janus Capital’s assets under management have shrunk by half from their 2000 zenith, even without adjusting for inflation. In 2011 the firm suffered the ignominy of being officially reduced in rank from large-cap to mid-cap, coupled with delegation to the appropriate Standard & Poor’s index.

What makes Janus Capital worthy of mention is its past laurels. The company was among the first to employ avant-garde research methods to its investment decisions. Unfortunately for Janus Capital and its stockholders, the early 20th century saw investors shy away from actively managed funds and move into boring and conservative passively managed ones. Janus Capital refused to board that train, and the reader can deduce whether the decision to refuse to offer exchange-traded funds was a wise one. (For more, see: The Key Differences Between ETFs and Mutual Funds .)

Better Late Than Never?

Except that Janus Capital finally came around, albeit at least a decade after most of its competitors. In October 2014 the firm purchased VS Holdings, Inc. the parent company of VelocityShares, a small asset management firm that specializes in ETFs and exchange-traded notes. So why would Janus Capital would move into passively managed funds now, so late in the game?

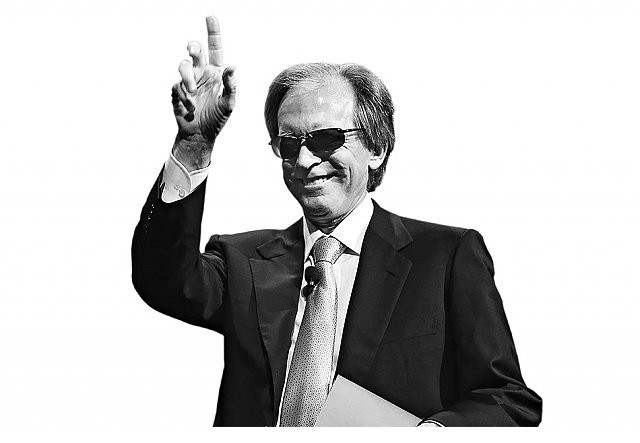

Because now they have the appropriate personnel. The previous month, Janus Capital undertook one of the biggest human resources moves in investing history, hiring the legendary Bill Gross away from Pimco. The 70-year-old Gross was immediately named portfolio manager of Janus’s Global Unconstrained Bond Fund, putting him several strata below the CEO in the company hierarchy. It’s hard to come up with a historical parallel, in any industry, for Gross’s move to Janus Capital. Imagine if the Portland Trail Blazers had signed Tim Duncan as a swingman – or more aptly, a video coordinator – only if Duncan had founded the San Antonio Spurs and led them since their inception. (For related reading, see: What to Expect from Pimco After Bill Gross .)

Signing on a Superstar

Gross’s immediate impact on Janus’s fortunes was…well, “large.” Also “flagrant,” “extreme,” “bulky,” and other synonyms. Shortly after signing him, Janus Capital’s market capitalization rose by close to a billion dollars. Management put Gross – a billionaire several times over, with a legacy well cemented – in charge of a new development in the company’s strategy. Gross made his reputation on bond funds, taking a previously underappreciated type of security and using it to create the largest fund in the world: Pimco’s Total Return Fund, the size of which is comparable to Gross’s new employer’s total assets under management. An unconstrained bond fund means one not beholden to such arbitrary objectives as beating a particular benchmark. Unconstrained bond funds can take positions in any sector of the fund manager’s choosing. If Gross wants to buy the entire issue of the City of Chaska, Minn. Series A Bonds issued to raise funds for refunding its water and sewer systems, then turn around and purchase all the Treasury Inflation-Protected Securities he can find, he’s welcome to. (For related reading, see: Alternatives to Pimco’s Total Return Fund .)

The idea is that Gross will now create passively managed funds for Janus Capital and launch the firm on a trajectory to where it can again compete with the current titans of asset management: Vanguard Guard, State Street Corp. (STT ) et al. Janus Capital has already started filing the paperwork with the Securities and Exchange Commission to create an ETF or series of ETFs. Should the firm begin issuing such funds, it’s reasonable to assume that inflows would be comparable to the half a billion dollars that Pimco investors redeemed upon Gross’s exit, if not the total $50 billion+ in outflows of assets under management since he left to join Janus Capital.

The Bottom Line

After reaching localized nadirs in 2012 ($850 million in revenue, $102 million in profit, and apparently on its way down to the S&P SmallCap 600 index), the firm has rebounded somewhat. Even with (or perhaps because of) its smaller size, its profit margins are dwarfed by those of State Street and BlackRock. With the recent addition of a hall of fame money manager to its roster, Janus Capital is the proverbial position in which there’s nowhere to go but up. (For related reading, see: Fund Firm Jolts: Pimco’s Isn’t the First or Worst .)