What are REITs

Post on: 16 Март, 2015 No Comment

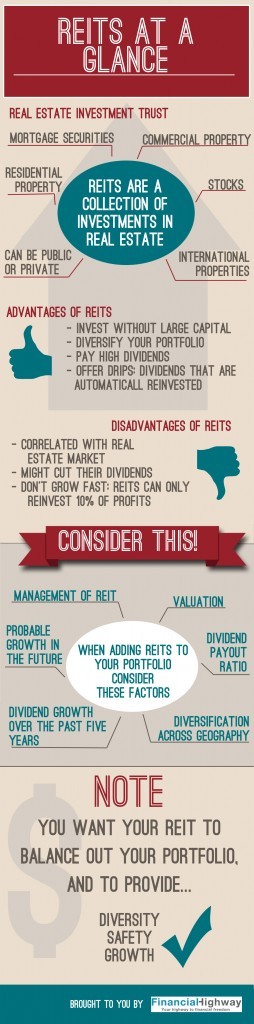

Real estate investment trusts, or REITs, are a type of investment often used by those who want to boost the yield on their portfolio. REITS are simply companies whose business is owning and operating real estate properties and that by law must distribute 90% of their profits in the form of dividends. By doing so, the REIT (pronounced “reet”) is able to avoid the corporate income tax, and investors have the opportunity to own a high-yielding investment.

REITs offer people that are unable to participate directly in the real estate market with the opportunity to establish a long-term investment in the asset class. But beware: with the higher yield also comes a higher degree of risk than an investment in a lower-yielding choice, such as government bonds. As is the case with all equity investments, REITs shouldn’t be considered appropriate bond substitutes for risk-averse investors.

Types of REITs

Broadly speaking, there are three categories of REITS: equity, mortgage, and hybrid. Equity REITs own and operate income-producing real estate, while mortgage REITs lend money to real estate owners and operators or deal in the acquisition of mortgage-backed securities or loans. The largest publicly-traded mortgage REITs in the United States are Annaly Capital Management (ticker: NLY), American Capital Agency Corp. (AGNC), and Chimera Investment Corp. (CIM). A hybrid REIT operates in both business lines – equity and mortgage.

Returns of REITs

As of August 31, 2013, U.S. REITS had produced an average annual return of 9.5% in the prior 10-year period, as measured by the MSCI U.S. REIT Index. The S&P 500 Index, a broad measure of performance for the U.S. stock market, averaged a return of 7.1% in the same period. It’s important to keep in mind that this is simply a measure of performance over an extended interval, not an indication that REITs are a superior investment. In fact, REITs trailed the S&P 500 in the one-, three-, and five-year periods ended on August 31, 2013.

Risks of REITs

REITs are traded on the stock market, and they involved the risk that would typically be expected of an equity investment. Also, due to their investments in property, they are subject to potential weakness in real estate prices. The result is that although REITs’ long-term returns are impressive, there have also been periods in which they have underperformed significantly. In 2007, the iShares Dow Jones US Real Estate ETF (IYR) returned -20.35%, then it followed that with a return of -40.03% during the bursting of the real estate “bubble” in 2008 – and that includes dividends. As a result, investors who are looking for alternatives to bonds need to be aware of the risks involved.

REITs also have the potential to produce negative total returns during the times when interest rates are elevated or rising. When rates are low, investors typically move out of safer assets to seek income in other areas of the market. Conversely, when rates are high, investors often gravitate back to U.S. Treasuries or other fixed income investments.

How to Invest in REITs

REITs are available to investors in a number of ways, including dedicated mutual funds, closed-end funds. and exchange-traded funds. Among the exchange-traded funds that focus on REITS are: iShares Dow Jones US Real Estate (ticker:IYR) Vanguard REIT Index ETF (VNQ) SPDR Dow Jones REIT (RWR), and iShares Cohen & Steers Realty (ICF).

Investors can also open a brokerage account and buy individual REITs directly. Some of the largest individual REITs are: Simon Property Group (SPG), Public Storage (PSA), Equity Residential (EQR), HCP (HCP), and Ventas (VTR).

Investors also have a growing number of ways to gain access to the overseas REIT markets. These investments are typically riskier than U.S.-based REITs, but they also have higher yields and the potential to provide greater diversification. The largest ETF focused on non-U.S. REITs is SPDR Dow Jones International Real Estate ETF (RWX).

REITs in Portfolio Construction

REITs tend to have a modest correlation with other areas of the market – meaning that while they are affected by broader market trends, their performance can be expected to deviate somewhat from the major stock indices. An allocation to REITs can therefore reduce help reduce the overall volatility of an investors’ portfolio at the same time as it can increase the yield. And unlike bonds, REITs have the potential for longer-term capital appreciation and the ability to prosper during periods of inflation. Keep in mind, REIT dividends are fully taxable. Consult a financial advisor before making asset allocation decisions.

Disclaimer. The information on this site is provided for discussion purposes only, and should not be misconstrued as investment advice. Under no circumstances does this information represent a recommendation to buy or sell securities.