What Are Mutual Funds

Post on: 25 Июнь, 2015 No Comment

Most of the people are aware of the term of mutual funds but very few of them can answer what are mutual funds and how do they work. These funds are designed while considering different factors of investment business including risk tolerance, time horizon, investment objectives, and diversification requirements. We are going to answer some of the common questions related to mutual fund investment like what are mutual funds investment and how to invest in hedge funds.

Mutual funds are defined as companies pooling money from all the investors and investing the combined portfolio in a single portfolio which is professionally managed. In order to minimize the risk factors, the fund investment is diversified into different areas of business. Each investor shares certain percentage of the fund and the profit obtained from the investment is accordingly distributed among all the investors. If you are looking for the answer for questions like what are mutual funds classes, then continue reading, as we will discuss them in detail.

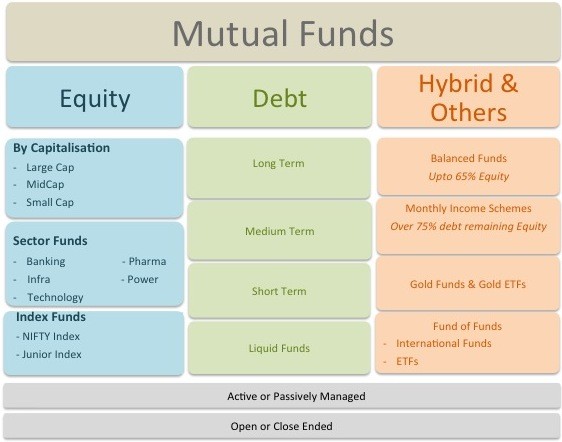

What Are Mutual Funds Classes And Types Of Mutual Funds

Non-traditional mutual funds are funds which are speculative in nature and depend on the performance of market or index changes. These funds use short shelling and complex leverage strategies. Many people question the investment strategies of a fund or want to about what are mutual funds investment strategies. There are different types of mutual funds which use different strategies, and non-traditional mutual funds are based on leverage and inverse mutual fund strategies.

Target date mutual funds are also known as life cycle funds and these include simplified investment strategy with a one-time investment. These mutual funds are focused on a particular time horizon and the strategy of the fund is changed according to the arrival of the target date. Some people even ask about what are mutual funds risks and how to avoid these risks. Target mutual funds are based on a particular time in the future which makes it risky, as nobody can predict the trends of market at that particular moment of time. Thus it is wise to make sure to invest in a diversified manner rather than focusing on a single type of fund.

Fixed income mutual funds are mainly targeted towards portfolio of bonds or equal debt securities for achieving the objective of the bond. Generally the investment is done in a single bond of multiple bonds for reducing the risk of the investment. One of the major concerns with these bonds is that they can lose value on times of increasing interest rates and do not have a fixed maturity date.

Complex mutual funds are funds using complex investment strategies and special investment techniques. These funds use a flexible investment strategy and invest in a wide variety of assets to minimize overall risk.

Exactly What Are Mutual Funds Cost And Fees

There are different type of charges and fees applicable against different mutual funds. These charges include the operating charge, the sales charge, the redemption fee, and other associated fees. If you are wondering what are mutual funds charges, you might be interested in finding out more about the details of these charges. Sales charges are the compensation to the fund company which helps you in selecting your funds and achieving your financial objectives. Let us find out what are mutual funds operating expenses. These are the expenses involved in running a mutual fund or simple the charge of doing business. You may be wondering what are mutual funds redemption fees, this fee is charged at the time of the redemption of the fund and it is charged to discourage frequent trading of the fund. Some of these charges are charged as a brokerage amount whereas others are designed for better profitability of the fund. I hope that by now you are aware of the answers for your questions about what are mutual funds paying and how you can make educated choice while investing in these funds.

Rating: 9.1 out of 10 based on 14 ratings