What are municipal bonds

Post on: 16 Март, 2015 No Comment

What are municipal bonds?

August 20, 2011

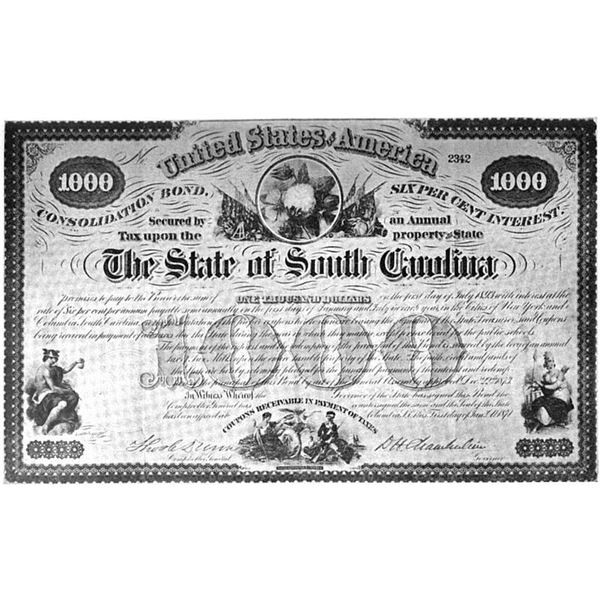

Municipal bonds are debt issued by local governments, state governments, districts, and other entities that serve a civic purpose. This includes states, towns, cities, counties, school districts, hospitals, transportation authorities, universities and colleges, housing projects, road and highway authorities, water districts, and power districts.

Governments and special purpose entities borrow money to finance infrastructure projects, make capital improvements, and build or make improvements to schools, roads, bridges, hospitals, power systems, and for other general purposes. In the bond market, any entity that borrows money by issuing bonds is known as an issuer. There are over 80,000 issuers of municipal bonds in the United States. We will refer to issuers throughout our guide, so make a note of it.

Examples of Issuers:

- State of California

- Beverly Hills Unified School District

- New York Metropolitan Transportation Authority MTA

When a government issues municipal bonds, they are borrowing money to be paid back at a later date. The date that the bonds need to be redeemed, meaning paid back, is known as the maturity date .

To entice bondholders to buy the bonds, issuers pay interest. For most municipal bonds, the interest received by the bondholder is exempt or tax-free from federal income taxes; munis can also be free from state income taxes. We will cover taxation in a later chapter.

To save you time, you should know that municipal bonds are usually only available in increments of $5,000 of face value. This means you can buy $5,000, $10,000, $15,000, and so on as long as the face value of the bonds is a multiple of $5,000. The minimum increment is $5,000 of bonds. (Unfortunately, you cannot buy $1,000 or $2,500 of municipal bonds.) In most instances, interest is paid every six months until the maturity date, when you get the face value of the bonds paid back to you. The annual rate of paid on a bond is known as the coupon .

Key Takeaways:

- Municipal bonds are issued by local governments, state governments, and other governmental entities.

- Municipal bond interest is federally tax-free in most instances.

- Municipal bonds may be free of state income taxes as well.

- You can buy munis in increments of $5,000