What are MortgageBacked Securities (MBS)

Post on: 20 Июль, 2015 No Comment

You can opt-out at any time.

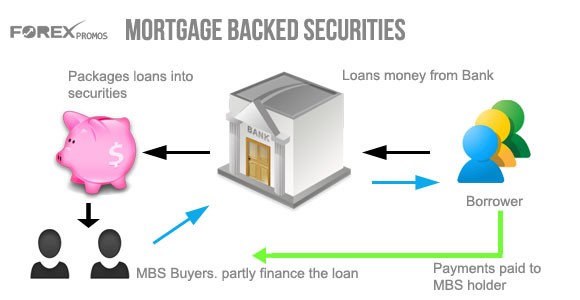

Mortgage-backed securities (MBS) are groups of home mortgages that are sold by the issuing banks and then packaged together into “pools” and sold as a single security. This process is known as “securitization.” When homeowners make the interest and principal payments, those cash flows pass through the MBS and flows through to bondholders (minus a fee for the entity that originates the mortgages). Mortgage-backed securities generally offer higher yields than U.S. Treasuries, but they also carry a different set of risks.

Prepayment Risk – What is it, and How Does it Impact MBS?

The most unique aspect of mortgage-backed securities is the element of prepayment risk. This is the risk that investors decide to pay back the principal on their mortgages ahead of schedule. The result, for investors in MBS, is an early return of principal. This means that the principal value of the underlying security shrinks over time, which in turn leads to a gradual reduction in interest income. Prepayment risk is typically highest when interest rates are falling. since this leads homeowners to refinance their mortgages. In this scenario, the owner of the MBS is forced to reinvest the returned principal at lower rates – a problem known as “reinvestment risk .”

Since prepayments cause a reduction in the principal of a mortgage-backed security over time, there usually isn’t much left of an MBS when it reaches maturity. As a result, individual bonds are measured not by their stated maturity, but by “average life” – or the estimated time until half of the principal in an MBS is paid back. The average life declines more rapidly when rates are falling (since homeowners refinance more when rates are going down), and it declines more slowly when rates are rising (since nobody would refinance into a mortgage with a higher rate). This leads to uncertain cash flows from individual MBSs.

As a result of this phenomenon, mortgage-backed securities tend to produce smaller gains when bond prices are rising, but they also tend to fall more when bond prices are going down. (There is a term for this: “negative convexity.”) This tendency is one reason why MBS pay higher yields than U.S. Treasuries. In short, investors need to be paid to take on this added uncertainty. It should be noted that mortgage-backed securities tend to generate their best relative performance when prevailing rates are stable.

Agency Versus Non-Agency MBS

Mortgage pools can be created by private entities or (in most cases) by the three quasi-governmental agencies that issue MBS: Government National Mortgage Association (known as GNMA or Ginnie Mae), Federal National Mortgage (FNMA or Fannie Mae), and Federal Home Loan Mortgage Corp. (Freddie Mac).

The most succinct explanation of the differences among the three comes from the Securities and Exchange Commission website:

”Ginnie Mae, backed by the full faith and credit of the U.S. government, guarantees that investors receive timely payments. Fannie Mae and Freddie Mac also provide certain guarantees and, while not backed by the full faith and credit of the U.S. government, have special authority to borrow from the U.S. Treasury. Some private institutions, such as brokerage firms, banks, and homebuilders, also securitize mortgages, known as private-label mortgage securities.”

The key takeaway from this quote: MBS backed by GNMA aren’t at risk of default, but there is a small degree of default risk for bond issued by Fannie Mae and Freddie Mac. Still, Freddie and Fannie bonds have a stronger element of backing than it appears on the surface, since both were taken over by the federal government in the wake of the 2008 financial crisis.

MBS’ Historical Returns

Mortgage-backed securities have provided respectable long-term returns. Through June 30, 2013, the Barclays GNMA Index had generated a 10-year average annual total return of 4.78%, in line with the 4.52% return of the broader domestic investment grade bond market, as measured by the Barclays U.S. Aggregate Bond Index. Although the returns are similar, it’s also important to keep in mind that many funds that invest in mortgage-backed securities have lower average maturities than the typical broad-based fund.

How to Invest

Investors can buy individual mortgage-backed securities through a broker, but this option is limited to those with the time and sophistication to conduct their own fundamental research regarding the average age, geographic location, and credit profile of the underlying mortgages. Most investors who own a broad-based bond mutual fund or exchange-traded fund have some exposure to this sector, since it is such a large portion of the market and therefore one that is heavily represented in diversified funds. Investors can also opt for funds that are dedicated solely to MBS. The list of funds that invest exclusively in GNMAs is available from Morningstar here if you search “GNMA” and “mortgage” using Control-F. The ETFs that invest in this space are:

- Barclays Agency Bond Fund (ticker:AGZ)

- iShares Barclays MBS Fixed-Rate Bond Fund (MBB)

- Mortgage-Backed Securities ETF (VMBS)

- iShares Barclays GNMA Bond Fund (GNMA)

- SPDR Barclays Capital Mortgage Backed Bond ETF (MBG)

Learn about two types of securities similar to MBS: