What are ExchangeTraded Funds and How to Use ETFs in Your Portfolio

Post on: 16 Март, 2015 No Comment

Recently, someone asked about exchange-trade funds (ETFs). He was interested in what they are, as well as how they could be included in his investment portfolio. ETFs are a relatively recent development in the world of investing, and in some cases, they can be ideal for beginning investors. as well as for more advanced investors. They are easy to trade, and they can be used to create a portfolio that works for you. Of course, like all investments, you also need to be careful, since you could lose money investing in ETFs.

A Brief Explanation of ETFs

Basically, ETFs are collections of investments. They track the performance of a group of investments. They are bundled into shares, and they are easy to buy and sell, since they are bought and sold like stocks, on a regular exchange.

Even though there are numerous ETFs comprised of stocks, it is also possible to find ETFs that follow bonds, commodities, real estate, and currencies. One of the reasons that many investors like ETFs is that it is possible to add diversity to a portfolio with the help of exchange-traded funds. You can invest in commodities or currencies without having to worry about trading assets on futures exchanges, since you can just purchase shares of an ETF on the regular stock exchange.

Since ETFs are bought and sold like stocks. you can buy partial shares, and you can employ some of your more boring investment techniques. like dollar cost averaging, to your portfolio while using ETFs. And, because ETFs are traded like stocks, your transaction fees are going to be the same that you would pay for stocks with the broker in question.

However, you also need to be aware that ETFs are also considered a type of fund. This means that you will have a fund fee. However, the fees are usually quite low, often between 0.15% and 0.75% a year. As a result, many buy and hold investors and other long-term investors. like ETFs (particular all-market stock ETFs), since they can be held for long periods of time without racking up a lot of expenses.

Using ETFs in Your Investment Portfolio

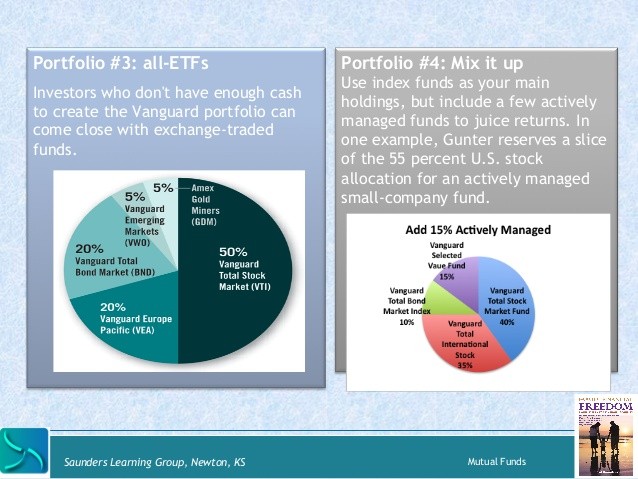

You can use ETFs as a way to easily diversify your investments. You can add exposure to real estate, bonds, commodities, and currencies to your portfolio easily and relatively inexpensively with the help of ETFs. Some investors even create entire portfolios with ETFs.

Because ETFs can be found for different asset classes, its possible to get the asset allocation you want using nothing but ETFs. You can even rebalance your portfolio so that your asset allocation remains the way you wish over time. And, because ETFs are bought and sold like stocks, its relatively easy to make the changes you want, whether you want more real estate, or you are wary of so much invested in currencies.

You do need to be careful, though. As with all investments, there are risks to using ETFs. First of all, you have to realize that you dont actually own the underlying investments in an ETF. Another thing to realize is that you can see gains or losses, depending on market conditions. If real estate tanks, your real estate ETF is going to drop in value. And, if you invest in ETFs that deal with futures, like commodities and currencies, you run the risk of a situation known as contango .

Before you invest in an ETF, you should have an idea of how the underlying investments work. If you dont understand how the currency market operates, its not a good idea to invest in a currency ETF. Wait until you have a better understanding of the investments before you decide on an ETF.

Bottom Line

ETFs can make great additions to your portfolio. You can add diversity, and enjoy the ability to trade quickly and easily and for small fees. However, you still need to make sure that you are doing your due diligence. These are still investments, and you need to make sure that you are researching them.