What Are Eurobonds (European Bonds)

Post on: 14 Август, 2015 No Comment

Joint European Bonds And How They Might Help

You can opt-out at any time.

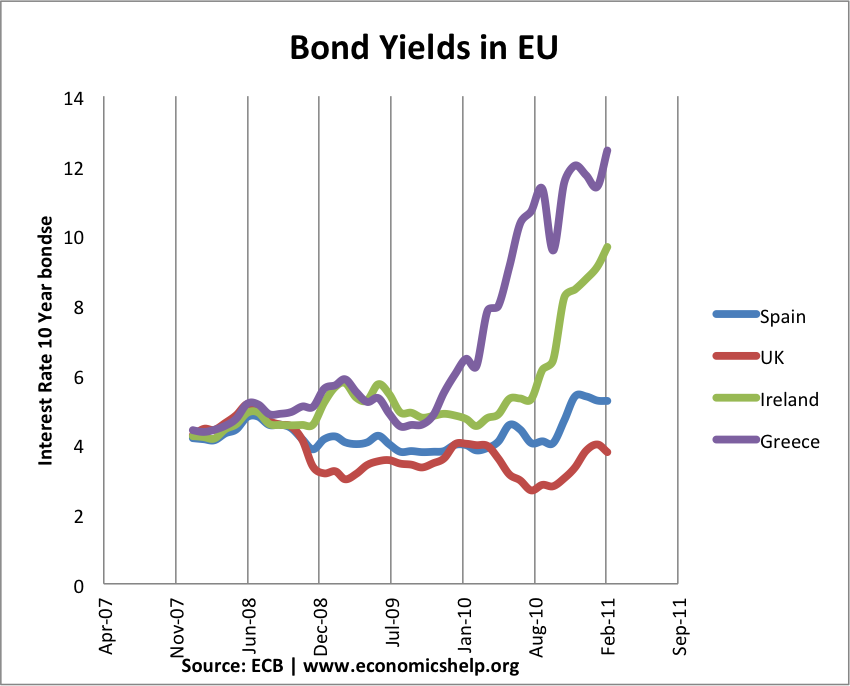

Eurobonds are proposed government bonds that would be jointly issued by the eurozone nations. Since the bonds would be secured by all eurozone economies, member countries would be able to borrow at lower interest rates than otherwise possible. These dynamics suggest that the sovereign bonds could be useful in solving the European Sovereign Debt Crisis.

History of Eurobonds

Eurobonds were first proposed in May 2010 by economists Jakob von Weizsacker and Jacques Delpla as a solution to sovereign debt crises. who proposed a mix of traditional national bonds (red bonds) and jointly issued Eurobonds (blue bonds). In particular, the proposal would enable member states to pool up to 60% of their national debt in Eurobonds to lower borrowing costs.

In 2011 and 2012, the European Commission began work to introduce Eurobonds as an effective way to tackle the region’s financial crisis. The proposed sovereign bonds would be introduced step-by-step based on a deeply integrated economic and fiscal governance framework, in order to prevent potential problems like the potential moral hazards attached.

In June of 2012, however, German chancellor Angela Merkel voiced opposition to Eurobonds in any form, due to their potentially negative effects on Germany’s economy.

Effects of Eurobonds

The effects of introducing Eurobonds are hotly debated. Supporters believe that they would lower interest rates for the entire eurozone, with even Germany benefiting from lower interest rates under some scenarios. Moreover, Eurobonds would support the ongoing integration of the euro into the global economy as an alternative reserve currency to the U.S. dollar.

Opponents suggest that the introduction of Eurobonds will come at a cost to countries like Germany, while those experiencing fiscal problems will get a free ride. After all, Germany and other successful countries will presumably be assuming the credit risk of troubled eurozone nations, while potentially also causing moral hazards in the region.

In general, successful countries like Germany, Finland and the Netherlands tend to oppose the issuance of Eurobonds, while weaker countries like Italy and Greece have voiced their support. But while a short-term agreement seems elusive due to the crisis, many larger countries like Germany do not appear to be permanently opposed to tighter financial integration.

Alternatives to Eurobonds

There have been a number of proposed alternatives to Eurobonds. Germany, France and four other AAA-rated member states have considered issuing common AAA bonds to raise money at lower interest rates for themselves, and in certain scenarios, help indebed eurozone members. Economists project these bonds could have an interest rate of between 2.0 and 2.5%.

Separate proposals have called for Eurobonds with a very limited scope. The European League for Economic Co-Operation (ELEC) proposed Euro T-Bills with a maximum maturity of two-years, as part of a temporary four-year program to supplement existing programs. Given their short-term nature, they would likely be considered very safe and low-risk bonds by investors.

Other Important Considerations

The term Eurobond is also used to represent an international bond denominated in a currency other than the bond’s native currency. For example, Eurodollar bonds are denominated in U.S. dollars, but may be sold in Japan by a Canadian company. The benefit is that issuers have the flexibility of choosing the country in which to offer their bond with a desired currency.