What are Dim Sum Bonds

Post on: 5 Июнь, 2015 No Comment

A dim sum bond is a bond denominated in Chinese yuan and issued in Hong Kong. The yuan, also known as the renminbi, is China’s national currency. China- or Hong Kong-based companies typically issue dim sum bonds, but foreign companies that want to take advantage of this growing market can also issue them. According to the Barron’s article “Enter the Yuan,” published on November 14, 2011, McDonald’s, the equipment maker Caterpillar and the consumer products company Unilever are among those that issued bonds denominated in Chinese currency during 2011. Volkswagen and the Swiss bank UBS are also major global companies that have sought to take advantage of this expanding market.

A Small But Growing Market

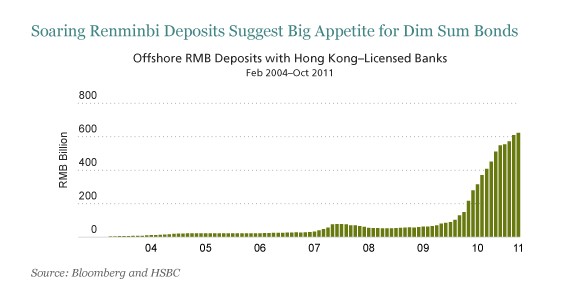

According to Barron’s, the market was born in 2007 when the China Development Bank issued the first yuan-denominated bonds. The market is still small, but it is growing quickly. The Wall St. Journal, in an article published on November 17, 2011 (“A Broader Pitch for Dim Sum Bonds), reports that the market had a total value of 198 billion yuan, or $31 billion, as of that date. However, a total of 108 billion yuan were issued in 2011, compared to the 35.7 billion yuan of dim sum bonds sold in 2010 and 16 billion yuan sold in 2009. In the first half of 2012, issuance came in at 67.2 billion ($10.58 billion in U.S. dollar terms) compared to 44.2 billion in the same period one year ago (source: Wall St. Journal

Currency Movements Play a Key Role

Dim sum bonds typically offer low yields, as high demand has helped drive up prices. (prices and yields move in opposite directions ). Despite these low yields, the bonds have attracted investors because the Chinese government is allowing the yuan to appreciate gradually against a basket of foreign currencies. (Unlike the U.S. dollar, which trades freely and has its value set by the market, the Chinese currency is managed by the government). The yuan is still seen as being too inexpensive relative to the basket it is priced against, meaning that investors are buying dim sum bonds partially on the expectation that this gap will close over time as the government allows the currency to continue rising in value.

How to Invest

Individual investors can’t invest in individual dim sum bonds directly just yet, and that’s probably for the better given that many issuers in the market are of lower quality. But there are three exchange-traded funds available for those interested in dim sum bonds:

- Guggenheim Yuan Bond ETF (Ticker: RMB)

- PowerShares Chinese Yuan Dim Sum Bond Portfolio (Ticker: DSUM)

- Market Vectors Renminbi Bond ETF (Ticker: CHLC)

Keep in mind that this is a small, immature market that will be subject to volatility, so these ETFs aren’t necessarily appropriate for someone whose primary goal is preserving their capital. Still, dim sum bonds are an asset class investors will likely be hearing much more about in the years ahead.