What Are Central Banks

Post on: 16 Март, 2015 No Comment

The central bank has been described as the lender of last resort, which means that it is responsible for providing its economy with funds when commercial banks cannot cover a supply shortage. In other words, the central bank prevents the country’s banking system from failing. However, the primary goal of central banks is to provide their countries’ currencies with price stability by controlling inflation. A central bank also acts as the regulatory authority of a country’s monetary policy and is the sole provider and printer of notes and coins in circulation. Time has proved that the central bank can best function in these capacities by remaining independent from government fiscal policy and therefore uninfluenced by the political concerns of any regime. The central bank should also be completely divested of any commercial banking interests.

The Rise of the Central Bank

Today the central bank is government owned but separate from the country’s ministry of finance. Although the central bank is frequently termed the government’s bank because it handles the buying and selling of government bonds and other instruments, political decisions should not influence central bank operations. Of course, the nature of the relationship between the central bank and the ruling regime varies from country to country and continues to evolve with time. To ensure the stability of a country’s currency, the central bank should be the regulator and authority in the banking and monetary systems.

Historically, the role of the central bank has been growing, some may argue, since the establishment of the Bank of England in 1694. It is, however, generally agreed upon that the concept of the modern central bank did not appear until the 20th century as problems developed in the commercial banking system. Thus, the central bank’s modern function emerged in response to an already present commercial banking structure.

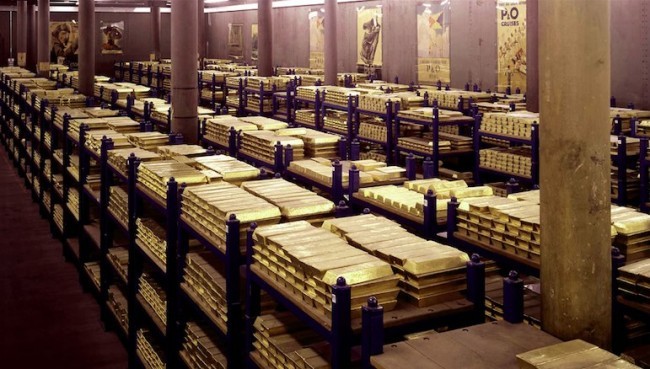

Between 1870 and 1914, when world currencies were pegged to the gold standard (GS), maintaining price stability was a lot easier because the amount of gold available was limited. Consequently, monetary expansion could not occur simply from a political decision to print more money, so inflation was easier to control. The central bank at that time was primarily responsible for maintaining the convertibility of gold into currency; it issued notes based on a country’s reserves of gold. (For more insight, read The Gold Standard Revisited .)

At the outbreak of WWI, the GS was abandoned, and it came apparent that, in times of crisis, governments, facing budget deficits (because it costs money to wage war) and needing greater resources, will order the printing of more money. As governments did so, they encountered inflation. After WWI, many governments opted to go back to the GS to try to stabilize their economies. With this rose the awareness of the importance of the central bank’s independence from the political machine.

During the unsettling times of the Great Depression and the aftermath of WWII, world governments predominantly favored a return to a central bank dependent on the political decision making process. This view emerged mostly from the need to establish control over war-shattered economies; furthermore, countries with newly-acquired independence opted to keep control over all aspects of their countries — a backlash against colonialism. The rise of managed economies in the Eastern Bloc was also responsible for increased government interference in the macroeconomy. Soon after the effects of WWII, however, the independence of the central bank from the government came back into fashion in Western economies and has prevailed as the optimal way to achieve a liberal and stable economic regime.

How the Bank Influences an Economy

A central bank can be said to have two main kinds of functions: (1) macroeconomic when regulating inflation and price stability and (2) microeconomic when functioning as a lender of last resort. (For background reading on macroeconomics, see Macroeconomic Analysis .)