Weigh Tax Impact on Your Investment Strategies in 2014 and Beyond

Post on: 25 Май, 2015 No Comment

Diversifying your portfolio on the basis of taxes as well as by classes of investments and specific product recommendations can make the difference between playing golf every day and not working, or needing a part-time or full-time job in retirement. Wayne Titus, CPA/PFS, Accredited Investment Fiduciary AnalystTM, weighs in on this important issue.

Wayne B. Titus lll

If your advisor is not explaining how to arrange a portfolio to minimize the impact of tax law changes, that’s a warning sign about the professional’s ability to provide advice in your best interests.

Plymouth, Michigan (PRWEB) January 31, 2014

Last year’s tax law changes made rebalancing investment portfolios imperative for almost every investor. “If your advisor is not explaining how to arrange a portfolio to minimize the impact of those tax changes, thats a warning sign about the professionals ability to provide advice in your best interests,” says Titus, a fee-only wealth manager and owner of AMDG Financial in Plymouth, Michigan.

Here’s what you should know: You can make pre-tax deposits and receive tax-deferred growth in retirement accounts; the money will be taxed when taken out as ordinary income, which is typically higher than capital gains. So if your retirement account buys stocks that appreciate in value, when you sell the stock you will pay tax at the ordinary rate on the entire amount. “If you are not structuring your equity investments outside your retirement account, you may end up paying taxes at the ordinary rate rather than the capital gains rate,” Titus explains.

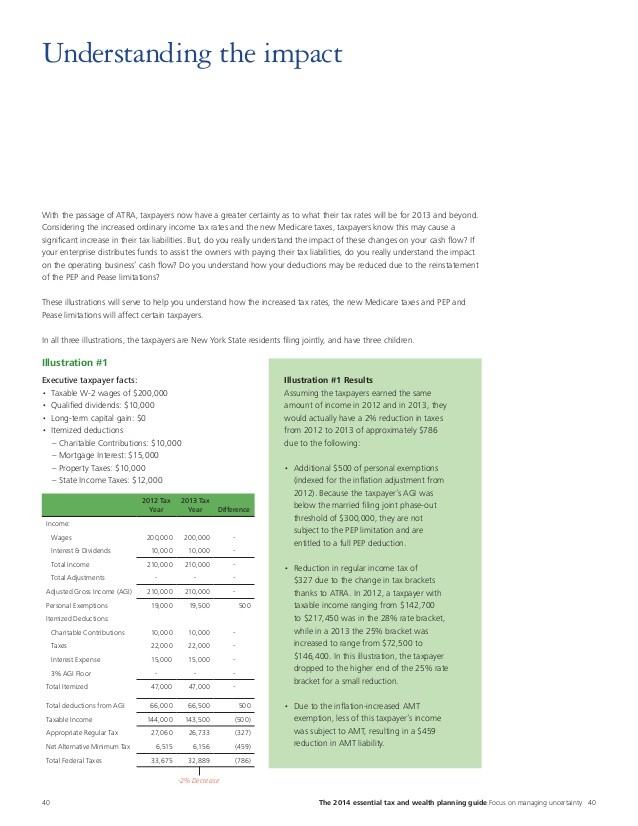

Under the new law, the capital gains tax rate for marrieds with earnings up to $250,000 of modified adjusted gross income (MAGI) remains 15%, plus an additional 3.8% surtax on investment income over $250,000 MAGI. The 3.8% is the Medicare surtax to pay for the Affordable Care Act (ACA). For marrieds earning over $450K MAGI, the capital gains tax has risen to 20% plus 3.8% surtax on investment income over $250,000 MAGI.

“To address these changes, we met with each of our clients in late 2012 to decide whether to sell capital gains assets and pay the 15% at that time to avoid the possible hike to 20% and the related 3.8% surtax,” Titus explains. “This is referred to as harvesting gains. The move reset their tax cost base higher for a lower future tax impact at a higher rate and saved our clients significant future tax dollars at higher tax rates. As new clients come on board, we continue to evaluate opportunities to implement the appropriate tax strategy.”

According to Titus, an additional strategy to consider for individuals who are investing in retirement accounts and non-retirement accounts is a portfolio structure that includes placement of ordinary income producing assets into retirement accounts (bonds & mutual funds that hold bonds). Stocks and mutual funds that hold stocks generally should go into their capital gains taxable accounts.

To refine this even more, individuals should consider conversion of traditional IRAs to Roth IRAs, or place asset classes that are expected to grow the most over time into either taxable accounts or more preferably Roth IRAs, which are tax free. Advisors should determine how a client can put the most into retirement accounts, then into Roth IRAs, then into their taxable account. For most clients, this is the order in which they should save money.

“People often think about paying tax on an annual basis, so they make contributions to their 401(k) or other retirement plan throughout the year, and for some, this is the only way they know to cut down on their taxes.” Titus observes. “But tax considerations should go beyond short-sighted annual decisions to inform tax-efficient investment strategies long term.

“The implementation of an appropriate tax strategy is extremely complex and should consider cash flow and the tax impact of that cash flow over the next 5-25 years,” Titus continues. “Your financial advisor should be knowledgeable enough to take the lead in making this happen. If they are not, you may be losing a significant opportunity for long-term tax savings.”

If investors can eke out even a small tax savings over time, it can have a dramatic difference on how well they retire and how well their portfolios perform in the long run. A 1% improvement can be the difference between playing golf every day and not having to work versus having to work a part-time or full-time job in retirement.

www.cefex.org ) as following global best practices for investment adviser fiduciaries.

PDF Print