Wealthfront Review Your Online Financial Investment Advisor

Post on: 22 Июнь, 2015 No Comment

Wealthfront is an online financial advisory firm that provides a low-cost way for people to diversify their investments among a variety of asset classes according to the precepts of modern portfolio theory, a concept pioneered by the Nobel Prize-winning economist Harry Markowitz. Markowitz showed mathematically that by combining multiple asset classes into a single portfolio, investors could achieve better performance with less risk than a mere arithmetic analysis would suggest.

Modern portfolio theory, or MPT, has since become the guiding light for many institutional investors and individual portfolios alike.

What Is Modern Portfolio Theory?

Modern portfolio theory is a technique investors use to combine different investments to maximize their returns for a given level of risk. Alternatively, they may use MPT techniques to try to minimize their theoretical exposure to risk for a given amount of return.

The approach is based on assumptions about how asset classes behave, including the expected return and variance of each asset class, as well as the correlation between each pair of asset classes. Its especially important for investors to form proper forward-looking return expectations when constructing portfolios using MPT.

An MPT theorist may notice that while both asset A and asset B sport long-term returns of 10% per year over the last 20 years, they tend to move in opposite directions a significant amount of the time. For example, they may find that high-yield bonds and real estate investment trusts tend to move in opposite directions 40% of the time. In mathematical terms, the two investments therefore have a relatively low correlation coefficient, and therefore tend to balance each other out. This results in less overall volatility, while still allowing the investor a reasonable expectation of the same long-term return they each provide individually.

The lower the correlation coefficient, the more theoretical diversification benefit a new asset brings when added to the portfolio. The MPT investor seeks to combine assets to gain the most diversification benefit possible, consistent with a targeted return.

MPT and Indexing

While MPT isnt necessarily predicated on indexing, the indexing strategy translates extremely well to using MPT approaches to building a portfolio. Consequently, Wealthfronts approach is index-based, and relies on exchange-traded funds to capture the performance of the different asset classes in their portfolio.

You may be saying, Big deal. Everybody does that! Why dont I just buy the Vanguard Bond Market Index, the Vanguard Total Stock Market Index, season to taste with a few percentage points of the Vanguard REIT Index and the Vanguard Emerging Market Index, and be on my way? Heck, why not even a target fund ?

Well, you could do that. And if you did, youd be well ahead of a lot of people. But Wealthfront adds features and expertise you wont get from simply opening an unassisted account with Vanguard or another low-cost, no-load mutual fund company.

How Wealthfront Works

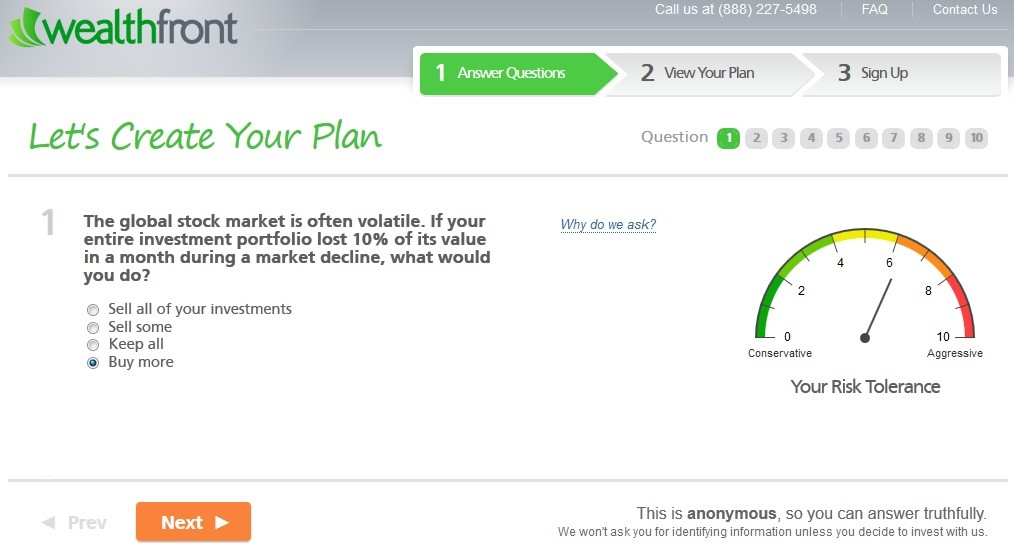

Users log into the site, and immediately begin to answer risk tolerance questions.

1. Answer Risk Tolerance Questionnaire

There are about 10 questions, which are all very easy and intuitive, and require less than a minute to complete.

2. Receive Portfolio Recommendation

Next, Wealthfront recommends a portfolio and asks if you want to open an account. Its that simple, really.

The Wealthfront Portfolio

The portfolio Wealthfront recommends is simply based on your responses to the risk management questions. An allocation is suggested using these five asset classes:

- U.S. stocks

- Foreign developed markets

- Emerging markets

- Real estate/REITs

- Natural resources

- Bonds

In addition, Wealthfront also recommends a specific exchange traded fund for your allocation to each asset class. In my case, Vanguard ETFs were recommended for each category except for natural resources, for which the iPath DJP ETN was recommended.

The site goes further than that, though. It actually provides a rationale as to why each selection has been made. For example, the iPath fund was selected for me because it is less energy-heavy than other ETFs in its category, and therefore presumably more diverse. Expenses were comparable to the competition, but the iPath fund isnt structured as a partnership, and therefore doesnt issue a K1 form, which could cause tax headaches come next April.

Key Features

Wealthfront has the following features:

- A gauge that quantifies your risk tolerance level on a scale from 1 to 10.

- The ability to change your answers to see what happens to your recommendations.

- A graph of the historical performance of the recommended asset mix against the various component asset classes.

- The estimated probability of gain vs. loss, based on the historic volatility of the components of your recommended portfolio, over as much as 10 years.

- Support for traditional IRAs. Roth IRAs. SEPs, and SEP IRA accounts.

- $5,000 minimum account size.

- No advisory fee on accounts under $25,000. The fee is a reasonable 0.25% on your assets after that, each year. That is more than most popular index funds. but less than nearly any actively managed fund.

- SIPC protection (Wealthfront opens your account via Interactive Brokers ).

- Interactive Brokers also charges a commission of $0.0035 per ETF share it buys or sells on your behalf.

Advantages

1. Simplicity

Sure, its best to have a financial advisor sit down with you over a couple of hours and complete a very detailed fact-finder. However, a lot of people never get around to that. Wealthfront, on the other hand, sticks simply with the securities side of the equation and is able to boil down the process to its very essence: How much risk are you comfortable taking?

2. Effective Risk Tolerance Questionnaire

Of course, trying to define and quantify risk tolerance is like trying to hang a smoke ring on a hanger. So Wealthfront comes at the equation from a few different directions, and measures not just your stated risk tolerance, but also the consistency of your answers. If you state you are very risk tolerant in some ways but not in others, the Wealthfront model actually dials back your risk exposure.

This is a very smart idea. Most people overestimate their tolerance for risk it hurts more to lose 50% than it feels good to gain it, and losses are more damaging to portfolios than unexpectedly modest gains, particularly when you need to draw income from that same portfolio.

4. Ease of Diversification

Most working stiffs dont have much business trying to identify individual stocks particularly at asset levels of under a few hundred thousand to a million dollars. There just isnt enough money available to meaningfully diversify, unless you use funds of some sort.

Wealthfronts approach is successful in saving the retail investor the significant fees that actively-managed mutual funds charge. It also results in a much more diversified portfolio than most lay people would ordinarily select on their own.

5. Expertise

Wealthfront also taps its expertise to see what the smart money is doing, and builds its own model portfolios based on what professional, sophisticated money managers at educational institutions are doing with their endowments.

Disadvantages

1. Insufficient Emphasis on Valuation

MPT also involves a very strange idea of risk. Consider two people walking down the street: One is an efficient market theorist and modern portfolio theory adherent, and the other is a traditional Warren Buffett-style value investor. The second man says, Oh, look! I think I see a dollar on the sidewalk! and goes over to pick it up. The MPT investor says, Nonsense. If there were really a dollar on the sidewalk, someone like you would have picked it up already!

The moral of the story: Modern portfolio theory has its limitations. Its not a holy writ to be blindly followed. The professional investors at the endowment funds are well aware of this, and Wealthfront does manage to mitigate this limitation of MPT by keeping one eye on what the pros are doing at the institutions, and building portfolios accordingly. That said, extremely high or low valuation levels could sustain for an extended period of time before mean reversion occurs. The exact timing and magnitude of mean reversion is largely a difficult guessing name.

2. Lack of Insured Options and Guaranteed Investments

Another disadvantage is that none of the asset classes represented in the Wealthfront menu are guaranteed or risk-free. This is fine for institutions, which have unlimited theoretical lifespans. But in the real world, people do have a financial life cycle, and a bear market that would be an inconvenience to an institutional fund (even as they use continued donations and other revenues to scoop up assets at bargain prices) would be a disaster to an individual, who cannot afford a bear market in stocks in the early years of drawing his or her portfolio down in retirement.

In addition to considering the asset classes Wealthfront uses, many families can be well served by allocating a portion of their resources to products with some guarantees in them, such as annuities. participating whole life insurance. and CDs .

3. Home Is Disregarded

Wealthfronts system assumes that you plug in pretty much everything you own into their model. Their system is not optimized to take into account your exposure to various classes in your 401k. and disregards the role your personal residence may play in your portfolio. But if you own a home, you have a substantial exposure to the real estate asset class already. You may want to make some adjustments to counter this if you use Wealthfront.

Wealthfront is fine for allocating the part of your portfolio you want to put to risk, in the hope of better-than-money market returns. But it does not substitute for a holistic approach to financial risk management.

Suitability

If you have a fairly simple financial picture for example, if youre single, or you and your spouse both work, have no children, and are fairly young and in a position to take some risk Wealthfront may be just the ticket. The combination of instant diversification across multiple asset classes and very reasonable fees, plus the nod toward risk mitigation at the outset and a rational strategy for rebalancing, can serve you very well, as long as you keep your eye on the big picture.

Dont expect Wealthfront to do everything for you. It can, however, do quite a bit for you with the portion of your portfolio you expose to market risk that is, stocks, bonds, mutual funds , and REITs. Indeed, its probably just as good as a lazy fee-only planner, but at a fraction of the cost.

It is probably not as good as a very good fee-only planner, however, because the good planners have a broader view of your finances, goals, and risk tolerance. If you have a more complex financial situation, consult a professional planner preferably one with a CFP or ChFC designation, or comparable experience.

Wealthfront is also not a system for those who take a DIY approach. Wealthfront doesnt allow you to hold individual stocks or do much in the way of mixing and matching ETFs within your Wealthfront account, though you can tweak your allocations.

Final Word

If you have a straightforward financial situation, are fee-conscious, and have better things to do than research ETFs and stress over your portfolio, Wealthfront is an excellent system to use. Just bear in mind its limitations, and only allocate to Wealthfront the part of your portfolio you are willing to expose to risk.

Have you ever used Wealthfront to invest? Would you recommend it to others?