Wall Street Cooks Up New CMBS CDS Alphabet Soup MarketBeat

Post on: 22 Июль, 2015 No Comment

By Matt Wirz

Two of the most notorious financial acronyms of the credit crisis – CDS and CMBS – are back. Markit, the leading provider of credit default swap indexes, is preparing to launch in January the first index of swaps on commercial mortgage backed bonds since 2008, called CMBX 6.

Commercial mortgage backeds are bonds secured by bundles of commercial real estate loans. Credit default swaps are contracts that give buyers payouts if borrowers default on their debts.

The combination of the two in the last decade allowed investors to buy exposure to hundreds of mortgages at once and to hedge that risk, which meant they could buy even more of the asset-backed bonds. It also allowed bearish hedge funds to bet against the resulting credit bubble, and to profit when it popped in 2008.

The CMBS market went mostly fallow in the ensuing years but it revived in 2012 and banks have brought 20 new deals worth $15 billion year-to-date, according to Royal Bank of Scotland Group. That’s still well short of the $335 billion Wall Street churned out in 2007, but it’s enough to warrant the creation of a new CDS index.

Investors in recently issued deals have had to buy into Markit’s 2008-vintage index, dubbed CMBX 5, as a proxy to hedge their exposure. That index now trades around 94 cents on the dollar compared to around 90 cents at the start of the year.

The new index planned for launch in January would include 25 new CMBS deals expected to have priced by then.

As to why investors would want to buy into this once-toxic asset class again – its defenders say things are different this time. Really.

For one thing, the new deals have a new name CMBS 3.0. But, the change s in 2012-vintage deals go far beyond the name, said Richard Hill, director of CMBS strategy at RBS.

The new mortgage pools are sliced into fewer tranches of bonds, meaning that even the junior-most bonds have better credit protection, Hill said. Underwriting standards have also improved dramatically since the crisis and, on average, loans backing CMBS 3.0 deals only amount to 62% of the value of their underlying properties, he said. That compares to loan-to-value ratios that regularly exceeded 100% in the 2006-2007 period.

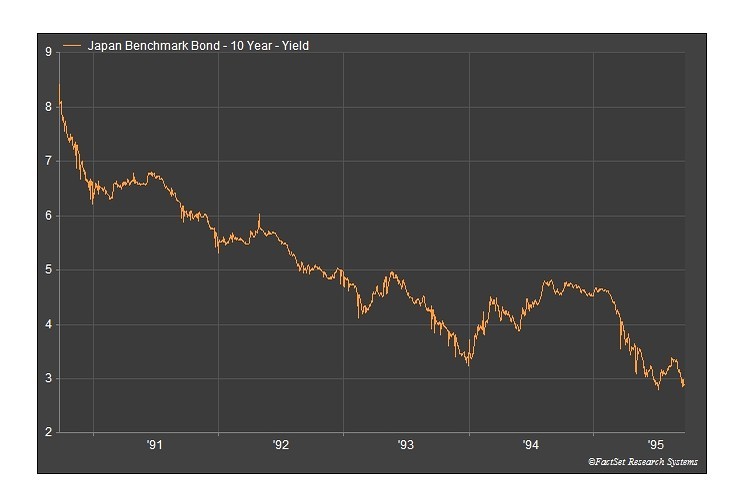

Resurgent investor demand might also have something to do with the 1.6% yield on 10-year Treasurys. CMBS 3.0 bonds with 10-year maturities give buyers a big pickup, with yields in the 2.75%-3% range.

Also, at triple-A, they’re rated higher than Treasurys to boot.

Dow Theory Still Says Sell Next