WACC Cost of Capital

Post on: 3 Июнь, 2015 No Comment

Stock, ETF and Mutual Fund Ratings | Commodity, Currency Research

WACC Analysis

The weighted average cost of capital (WACC) is the rate companies must pay to finance their assets; in other words, the minimum return a company must earn on their existing assets to satisfy creditors, owners, and other providers of capital. Click here to experiment with a Simple WACC Calculator or the more complicated Industry WACC Calculator / Template .

Company WACC (Cost of Capital)

WACC (weighted average cost of capital) Information

How does Wikiwealth use the WACC?

Why is an industry WACC more accurate?

Determine the cost of equity (required return of equity)?

What is Alpha ?

Why do we round the WACC calculation?

- We at Wikiwealth are not genius, so we round the WACC to indicate that the value is very difficult to predict with accuracy. A non-rounded number creates the illusion of perfection and contributes to manipulation of the results. Hopefully, only fundamental changes will cause differences in the value of the WACC and thus the company’s value.

WACC (weighted average cost of capital) Definition

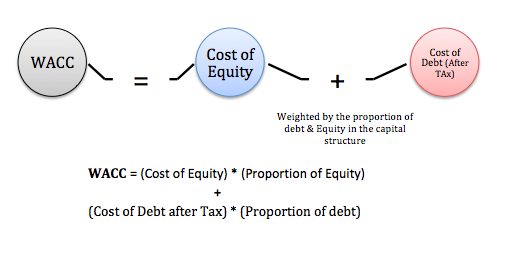

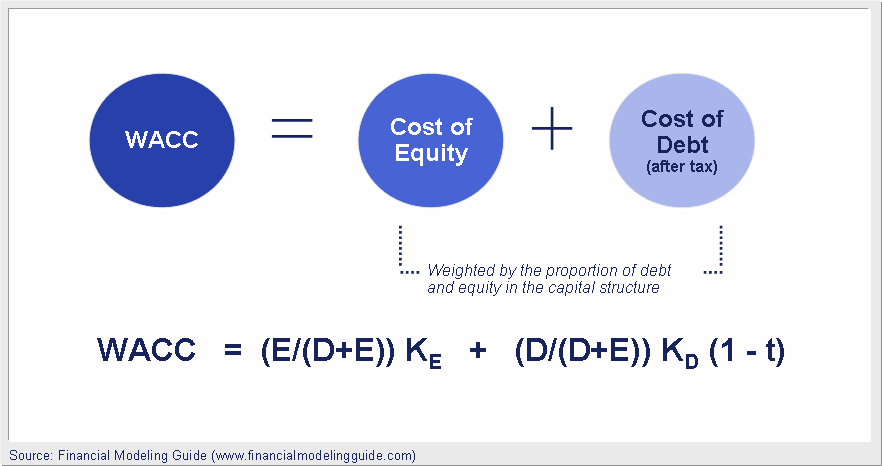

Weighted Average Cost of Capital (WACC). The two components of capital include the cost of debt and the cost of equity capital. The weighted average cost of capital (WACC) is the rate that a company is expected to pay to finance its assets. WACC is the minimum return that a company must earn on their existing asset base to satisfy its creditors, owners, and other providers of capital.

The Industry WACC is an average WACC measurement for companies in an industry. The Industry WACC used statistics such as debt, equity, tax rate, beta measurements to find the correct average WACC for an industry. Wikiwealth applies the industry WACC to individual companies to find a stable and optimal WACC discount rate for that particular company. All individual companies are expected to converge to the industry WACC over time.

Companies raise money from a number of sources: common equity, preferred equity, straight debt, convertible debt, exchangeable debt, warrants, options, pension liabilities, executive stock options, governmental subsidies, and so on. Different securities are expected to generate different returns. WACC is calculated taking into account the relative weights of each component of the capital structure. Calculation of WACC for a company with a complex capital structure is a laborious exercise.

WACC = wd (1-T) rd + we re

wd = debt portion of value of corporation

T = tax rate

rd = cost of debt (rate)

we = equity portion of value of corporation

re = cost of internal equity (rate)

How it works

Since we are measuring expected cost of new capital, we should use the market values of the components, rather than their book values (which can be significantly different). In addition, other, more exotic sources of financing, such as convertible/callable bonds, convertible preferred stock, etc. would normally be included in the formula if they exist in any significant amounts — since the cost of those financing methods is usually different from the plain vanilla bonds and equity due to their extra features.

WACC is a special way to measure the capital discount of the firms gaining and spending.

Sources of information

How do we find out the values of the components in the formula for WACC? First let us note that the weight of a source of financing is simply the market value of that piece divided by the sum of the values of all the pieces. For example, the weight of common equity in the above formula would be determined as follows:

Market value of common equity / (Market value of common equity + Market value of debt + Market value of preferred equity).

So, let us proceed in finding the market values of each source of financing (namely the debt, preferred stock, and common stock).

- The market value for equity for a publicly traded company is simply the price per share multiplied by the number of shares outstanding, and tends to be the easiest component to find.

- The market value of the debt is easily found if the company has publicly traded bonds. Frequently, companies also have a significant amount of bank loans, whose market value is not easily found. However, since the market value of debt tends to be pretty close to the book value (for companies that have not experienced significant changes in credit rating, at least), the book value of debt is usually used in the WACC formula.

- The market value of preferred stock is again usually easily found on the market, and determined by multiplying the cost per share by number of shares outstanding.

Now, let us take care of the costs.

- Preferred equity is equivalent to a perpetuity, where the holder is entitled to fixed payments forever. Thus the cost is determined by dividing the periodic payment by the price of the preferred stock, in percentage terms.

- The cost of common equity is usually determined using the capital asset pricing model.

- The cost of debt is the yield to maturity on the publicly traded bonds of the company. Failing availability of that, the rates of interest charged by the banks on recent loans to the company would also serve as a good cost of debt. Since a corporation normally can write off taxes on the interest it pays on the debt, however, the cost of debt is further reduced by the tax rate that the corporation is subject to. Thus, the cost of debt for a company becomes (YTM on bonds or interest on loans) × (1 − tax rate). In fact, the tax deduction is usually kept in the formula for WACC, rather than being rolled up into cost of debt, as such:

WACC = weight of preferred equity × cost of preferred equity

weight of common equity × cost of common equity

weight of debt × cost of debt × (1 − tax rate).

And now we are ready to plug all our data into the WACC formula.