Vanguard Target Retirement Funds Bogleheads 2015

Post on: 17 Июль, 2015 No Comment

Target Date Mutual Funds Performance. Vanguard Target Retirement Funds Bogleheads. View Original. [Updated on 03/14/2015 at 08:03:41]

Pick The Fund With The Lowest Fees And Expenses. Vanguard Target Retirement Funds Bogleheads. View Original. [Updated on 03/14/2015 at 08:03:41]

7Ewpfau/images/MonteCarlo1.jpg?w=500#q=Vanguard /%

With A Vanguard Not So Hot With Secret Mutual Fund Key. Vanguard Target Retirement Funds Bogleheads. View Original. [Updated on 03/14/2015 at 08:03:41]

Investing Mistakes That Could Destroy Your Portfolio Business. Vanguard Target Retirement Funds Bogleheads. View Original. [Updated on 03/14/2015 at 08:03:41]

Big Mistakes Investors Make And How To Avoid Them. Vanguard Target Retirement Funds Bogleheads. View Original. [Updated on 03/14/2015 at 08:03:41]

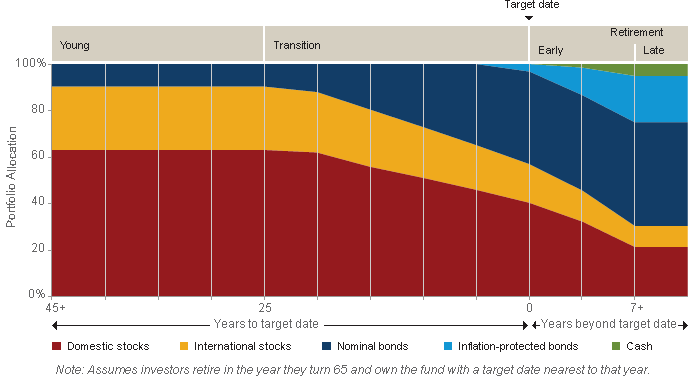

3A%2F%2Fwww.bogleheads.org%2F?w=250 /% Target retirement funds are marketed for investors who want simplicity of managing their investments. These funds make assumptions about their potential investors

3A%2F%2Fwww.bogleheads.org%2F?w=250 /% On February 6, 2013 Vanguard announced the creation of four fund portfolios by adding a strategic allocation of international hedged bonds to the firm’s series of

3A%2F%2Fwww.bogleheads.org%2F?w=250 /% Vanguard announced the addition of a fourth asset class, international bonds, to the LifeStrategy fund asset allocation matrix on February 6, 2013. The new asset

3A%2F%2Fwww.moolanomy.com%2F?w=250 /% What are Target Retirement Funds? A target retirement fund is a mutual fund designed with a specific retirement year in mind (usually in 5 year increments).

3A%2F%2Fwww.mymoneyblog.com%2F?w=250 /% It is quite clear that the T. Rowe Price funds are more aggressive, and hold more stocks even very close to retirement. This is also the primary reason why you may

3A%2F%2Fmoney.usnews.com%2F?w=250 /% See Vanguard Target Retirement Income (VTINX) mutual fund ratings from all the top fund analysts in one place. See Vanguard Target Retirement Income performance

3A%2F%2Fwww.vanguard.com%2F?w=250 /% I’m an individual investor and I want to: • Access my existing Vanguard account. • Open a new account. • Roll over my 401(k) or 403(b) to a Vanguard IRA®

3A%2F%2Fwww.bogleheads.org%2F?w=250 /% Support This Site • Amazon — If you buy anything on amazon after entering from this link (or one of our book links), we get a small referral fee.

3A%2F%2Fwww.morningstar.com%2F?w=250 /% Vanguard Target Retirement 2025 Inv — (vttvx) Fund – Morningstar Analysis. Fund information includes analysis, NAV, ratings, historical returns, analyst research

3A%2F%2Fwww.obliviousinvestor.com%2F?w=250 /% A reader writes in, asking: “I enjoyed the Bogleheads piece. [Editor’s note: He’s referring to this recent Money article by Penelope Wang.]

3A%2F%2Fwww.usatoday.com%2F?w=250 /% A few things to bear in mind: •If you’re a young investor with 30 years or so to retirement, you probably don’t need a target-date fund. Invest in a low-cost, highly diversified stock fund and keep your mitts off it. One good choice: Vanguard Total World

3A%2F%2Fwww.wsj.com%2F?w=250 /% Retirement fund takes is crucial in deciding whether it matches an investor’s risk tolerance. As with any fund, investors should also be aware of fees. The largest providers of target-date funds— T. Rowe Price Group. Fidelity Investments and

3A%2F%2Fseekingalpha.com%2F?w=250 /% In fact, Fidelity’s Freedom 2030 Fund has a nearly identical composition to that of Vanguard’s Target Retirement 2040 Fund (MUTF:VFORX). The moral of the story is obviously to know what you’re investing in and don’t just count on the fund’s name to be your

3A%2F%2Fwww.newsmax.com%2F?w=250 /% Waggoner lists several funds that shine in those areas and should be included in a retirement portfolio. The first is the Vanguard Target Retirement Income (VTINX). This is a fund of funds designed as an all-in-one solution for retirees who want to see

3A%2F%2Fwww.nasdaq.com%2F?w=250 /% A little over one-third of the big Vanguard retirement-plan products are index funds, a concept with which the firm is synonymous. Also prominent on the list are Vanguard’s target-date funds, a solid choice for investors who want a one-stop, no-fuss option.

3A%2F%2Farchive.delawareonline.com%2F?w=250 /% Here are five funds you should consider as part of a retirement portfolio. You may not want to invest in all of them, or any of them. But each could form a component of your retirement portfolio. Vanguard Target Retirement Income (VTINX). This is a fund of

3A%2F%2Fwww.philly.com%2F?w=250 /% The Vanguard funds in Montco’s portfolio returned 7.99%, with investments in a real estate stock (REITs) indexed portfolio leading total returns above the target. Indeed, Vanguard’s indexed REIT investments returned 30% in 2014, according to Montco

3A%2F%2Fwww.bizjournals.com%2F?w=250 /% VALLEY FORGE, Pa. Feb. 26, 2015 /PRNewswire/ — Vanguard is expanding its family of low-cost target-date funds, with plans to introduce a new Institutional Target Retirement Fund lineup. Twelve new funds with an estimated expense ratio of 0.10% will be

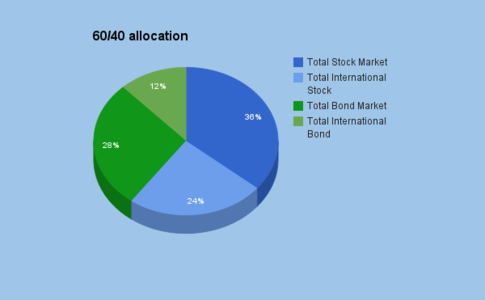

3A%2F%2Fwww.forbes.com%2F?w=250 /% His article explores how you can create a better life-cycle fund than Vanguard’s Target Retirement Income Fund. Vanguard’s fund is designed for people currently in retirement who need to draw income. It is a fund consisting of other funds. Dan provides