Vanguard Long Term Tax Exempt Fund (VWLTX)

Post on: 18 Июль, 2015 No Comment

# 1 Muni National Long

U.S. News evaluated 55 Muni National Long Funds. Our list highlights the top-rated funds for long-term investors based on the ratings of leading fund industry researchers.

Summary

The Vanguard Long-Term Tax-Exempt fund has been doing a fine job of navigating the municipal bond market.

As of February 04, 2015, the fund has assets totaling almost $8.85 billion invested in 1,197 different holdings. Its portfolio consists of municipal bonds (debt issued by state and local governments, as well as their agencies).

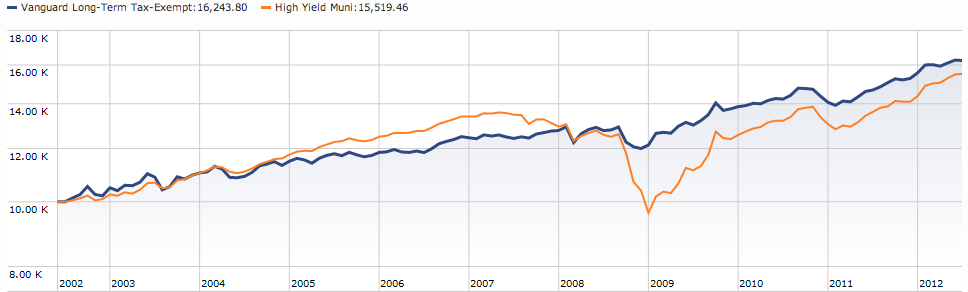

This municipal bond fund performed relatively well during the turbulence of the credit crisis. In 2008, when the muni market imploded, funds that focus on longer-dated bonds got hit particularly hard. Notably, the average fund in Morningstar’s national long-term municipal bond category lost upwards of 9 percent that year as a massive sell-off triggered panic among investors. This fund, however, managed to hold its losses to 5 percent. In 2009, when an injection of stimulus money into state and local governments restored confidence, longer-term bonds came rocketing back, and this fund tacked on a 14 percent gain. Lately, management has been focusing on quality, with upwards of half of its bond holdings rated AA or better. Going forward, one of the bigger risks for the fund is rising interest rates. Rates, which are at historic lows, can only go up, and when that happens, bond prices will go down. Funds that invest in bonds with longer durations (as this one does) will be particularly vulnerable. Meanwhile, state and local governments will continue to face challenges, which send many muni investors toward the exits in late 2010. “The fiscal condition of state and local governments remains a concern, with many still reeling from recession-induced revenue losses. As the broad economy continues to bounce back, the condition of state and municipal finances may improve, but we would expect any improvement to be slow and uneven,” Vanguard said in a semiannual report from April 2010. The fund has returned 10.51 percent over the past year and 4.95 percent over the past three years.

Historically, the fund has done a fine job of achieving its goal: providing investors with steady income and tax advantages (muni investors traditionally do not need to pay federal income taxes on their interest). As of the end of October, the fund’s trailing 10-year returns landed it in the top fifth of its Morningstar category. The fund has returned 5.86 percent over the past five years and 4.77 percent over the past decade.

Investment Strategy

According to the fund’s prospectus: “The Fund has no limitations on the maturity of individual securities, but is expected to maintain a dollar-weighted average maturity of 10 to 25 years. At least 75% of the securities held by the Fund are municipal bonds in the top three credit-rating categories as determined by a nationally recognized statistical rating organization.”