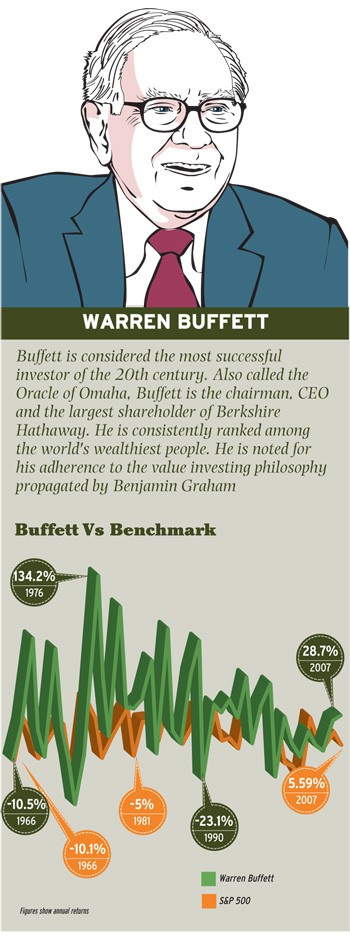

Value Investing Legends Warren Buffett

Post on: 16 Март, 2015 No Comment

When it comes to value investing. Warren Buffett is the most well known and most successful value investor to date.

In this article well present a brief background of his philosophy and why its important followed by a simple stock screen built upon his investing principles. If you follow the guidelines in the stock screen youll find the best value stocks to buy , the ones that even Warren Buffett himself would be proud to invest in. Those stocks have the best chance to trounce the stock market averages in the long-term while minimizing your risk and draw-downs. While you can skip down to the stock screen itself we recommend that you peruse this entire article and take advantage of the various presentations on how to find Warren Buffett stocks to invest in. If you find yourself short on time the Value Investors Association provides two stock newsletters, the Value Arch Stock Report and the Worthington Stock report that do the hard work for you.

If you have the discipline we also recommend reading the Berkshire Hathaway Annual and Interim reports . They give you great insight into the mind of Warren Buffett, his guiding principles and value investing philosophy.

Background

Warren Buffett got his start working at his father’s brokerage firm. While there he discovered the book “The Intelligent Investor” written by Benjamin Graham. Buffett was so taken by the work that he applied to Columbia University to study under him. He eventually ended up working for Graham and they developed a lifelong friendship. Benjamin Graham had a profound impact on Warren Buffetts investing approach which can be seen in many of his investment philosophies.

Buffett further refined his value investing approach by incorporating what he learned from other successful investors. In particular he incorporated Philip Fisher’s focus of looking at the strength of management and business’s growth potential to calculate the true value of a company. An overlooked factor in his success is that during his career Warren Buffett built a strong advisory network including his good friend Charlie Munger.

Warren Buffett: Two Rules of Investing

1) Dont lose money

2) Dont forget Rule No. 1.

No elaboration needed here. You follow these two rules by only investing in companies that you truly understand and buy them only when they become attractively priced relatively to their intrinsic value.

The Value Investing Foundation

While Warren Buffett has never laid out the details of his value investing approach in detail, many insights can be found in books written about him and the explanations for his holdings in his Berkshire Hathaway annual reports.

Dont Over Diversify

Warren Buffett does not believe in modern portfolio theory or diversifying for the sake of diversification. He believes diversification is aimed at protecting people from their own stupidity. In fact he argues that the only investors who need broad diversification are those that don’t know what they’re doing.

One of the biggest mistakes that management and investors make according to Buffett, is that they always have to be busy. They cannot control their desire to do something which leads to bad decisions when there’s nothing that needs to be done.

In accordance, Warren Buffett believes that the path to success is not in actively trading stocks. Instead its best to patiently wait for the very best companies to be offered at the right price and then invest in them heavily. This is best demonstrated by his recent investments of $5 billion in Goldman Sachs, $3 billion in General Electric and his purchase of the Burlington Northern Sante Fe railroad for $26 billion.

Warren Buffett starts by searching for companies that he’d be interested in buying. These are the companies that have a strong competitive advantage in their market. We will cover this in more detail later. Allowing for a margin of error he does a detailed financial analysis of the company to estimate its current and future value.

Once he’s determined the fair value of the company he patiently waits for the stock price to drop down to a level that gives him an extremely high probability of achieving a minimum 15% annual return in the long-term. When the stock price falls below the predetermined price, he buys the company’s stock hand over fist.

The best buying opportunities have occurred during cyclical market corrections or when a company had to face a temporary problem. During these times the stock market or company stock goes out of favor and the price drops precipitously presenting great buying opportunities.

During strong bull markets Warren Buffett believes it’s best to sit and watch. Stocks become overpriced as investors become over optimistic and miscalculate the future growth prospects of a company. Buffett does the opposite of what most investors do during bull strong bull markets, he sits on his hands watching the investments he made during bad times grow and grow.

Step 1; Finding Attractive Companies

Warren Buffett invests in companies that have a “monopoly” within their industry. Monopolies are defined as companies that sell products or services that are protected by a patent, a strong brand name or a business model that is hard to duplicate.

You’ll often hear this advantage termed as the companies moat like the moat around a castle. The wider and deeper the moat, the harder it is for a competing company to penetrate their market advantage. The real advantage of a monopoly other than high profit margins is that they are able to raise prices relative to inflation without risking a significant loss in sales and profits.

Financially monopolies are characterized by:

- Strong Cash Flows

- Little need for long-term debt (other than for purchasing other monopoly type businesses),

- Strong consistent upward trend in earnings and long-term price appreciation.

- Operating margins, net profit margins and return on equity are all above industry averages.

The Best Monopolies To Invest In

Warren Buffett prefers companies that provide products and services that wear out fast and are used up quickly. They must always be needed or in demand regardless of the current economic condition. Examples include companies that sell food, clothing, insurance, delivery services, communication, drugs, investments and tax preparers. If you look at the companies that he invests in youll notice that they all have a strong brand name and provide services that need to be constantly purchased. His more recent acquisitions that support this conclusion include Goldman Sachs, Direct TV, Walmart, Coca Cola and Wells Fargo.

The Commodity Comparison

Consumers buying what they perceive to be a commodity type product or services make their decision largely based on price. If two products are considered comparable and lack brand differentiation, it only makes sense to buy the one with the lowest price.

Therefore companies that sell commodity products or services are unable to raise prices without the fear and consequence of losing sales to a competitor. This is particularity hurtful during inflationary periods.

In the midst of slow economies commodity companies also suffer because of excess market capacity due to all the competition.

The end result is that they have low profit margins, low return on equity and profits tend to be erratic with wild swings due to changing market conditions. Because of all these negatives it is less desirable to invest in a commodity type company.

Criteria For Investing In A Company

Here are the guidelines to follow once you have found a company that has a successful track record as a leader in its industry due to a competitive edge;

- Look for a history of increasing earnings for the company. The shorter term earnings trend (3-5 year) should be better than the longer term trend (5-10 years) taking the overall economic conditions into account. Buffett finds more success focusing on the longer three to five year averages as opposed to quarterly or yearly results.

- The company should have a strong and consistent return on equity that is achieved without excess leverage or tricky accounting.

- Operating margins, net profit margins and return on equity should all be above the industry averages.

- The company should carry little long-term debt measured according to industry standards.

- Prefer companies that have been producing the same product or service for a number of years.

- Invest in companies that have historically used their cash flow in ways that benefit the company and shareholders. These can include stock repurchase plans, purchases of related monopoly type businesses or paying reasonable dividends.

- Prefer larger companies, 5 billion and up. They tend to have a longer track record of growth and are able to better weather any market downturns.

Management and Reporting History

Buffett also looks for a strong management team that is open and truthful in their reporting of events. He determines this by reading through past annual reports paying particular attention to the management’s statements regarding future strategies and growth. By seeing how those strategies and estimates unfold, he is able to gain a perspective on how well the company is managed.

Another thing to look for in the annual report is how accurately the management team discloses information. Do they fully disclose company performance, reporting both mistakes and successes? Do they report information beyond what is required by generally accepted accounting principles (GAAP ) How do their annual reports compare to others in the industry?

Warren Buffett looks for companies that provide him with enough information in their financial reports to determine the approximate value of the current and future business prospects for the company. He models his Berkshire Hathaway reports based on the type of information and disclosure he looks for in other companies.

Companies To Avoid

Here is a short list of the types of companies that are best to avoid.

- Turnarounds and hostile takeovers. Turnarounds rarely succeed.

- Companies that are diversifying into industries that aren’t core to their current operations or who seem to be buying commodity type businesses. These companies rarely perform as well as expected going forward.

- Companies in a commodity type situation.

Buffett compares the potential returns of stocks to bond yields and likes to view stocks as bonds with variable yields.

Step 2: Stock Valuation

Buffett uses various models to evaluate what a company is currently worth taking future growth into consideration. For those interested in more detail than I’ll cover here, I suggest picking up a copy of the book The New Buffettology.

One step Warren Buffett uses to determine the fair net present value for a company is to use the past 10 years of financial data to project a baseline for future earnings growth.

A simple way of doing this is to take the current earnings per share and the average historical earnings per share over the past 10 years and multiply those two by the average high and low price-earnings ratios for the stock over those past 10 years. If the company pays dividends, you would add those into your calculations. This process provides an estimated price range for the company 10 years out.

This analysis is dependent upon the predictably of future earnings which explains Warren Buffetts preference for investing in monopoly type companies with strong and consistent track records.

Monopolies are more easily evaluated because their earnings are more consistent. They are not subject to the wild profit/loss fluctuations of commodity type firms. Having a high level of certainty for future earnings is critical to determining whether a company is currently overvalued or undervalued.

The 15% Rule

In his calculations Warren Buffett is essentially trying to determine the net present value of a company based on projected returns for the next 10 years. As a guideline he’s looking for companies that can fully be expected to return at least 15% or more annually for the next 5-10 years based on the current purchase price. Another way to put this is that hes looking for companies that will achieve a higher risk adjusted return than investing in bonds.

If he can reasonably achieve a 15% plus return it’s a buy. If he can’t achieve those returns at the current stock price, he’ll simply wait until the stock meets his price target.

The Tricky Part

Even using similar data investors and stock analysts can come to different conclusions about the future value of a stock. The valuation is not only dependent on the numbers, but also on the talent of the evaluator in determining the probability that the company can repeat or exceed past performance. If an important trend, demographic or new technology is not taken into consideration it can make the evaluation completely worthless, therein lays Buffett’s genius.

Understanding Warren Buffetts basic investment approach is not difficult. Essentially he’s looking for companies with a “monopoly” in the marketplace, a history of above average earnings growth and the ability to deliver returns of 15% or more per year well into the future. At the very minimum the stock has to be projected to out-perform bonds on a risk adjusted basis to be considered for investment.

Because projections are guesses Buffett uses a margin of safety in his calculations to make sure he still gets paid well if even if his numbers are off.

Here’s a quick screening process to find Buffett type stocks that can outperform the market;

- Market Cap of 5 billion or higher.

- Positive gross operating income for the last 5 years, preferably 10.

- Operating margins, net profit margins and return on equity all above industry averages. Prefer return on equity of 15 or higher.

- Debt to equity ratio is below the industry average

- Total liabilities to assets below the industry average

- Price-to-free-cash-flow ratio divided by the free-cash-flow growth rate is less than the industry average

Once the screen has spit out qualifying stocks you have to add in other factors.

- Avoid turnarounds and hostile takeovers. Turnarounds rarely succeed.

- Filter out companies that are diversifying into industries that aren’t core to their current operations or who seem to be buying commodity type businesses. These companies rarely perform as well as expected going forward.

- Look for companies that have been pro-investor. Have they had or are they announcing a stock buy-back or dividend increase? Have they made successful acquisitions in the past?

- Look for companies that have products and services that continue to be market leaders and in strong demand. Are they must have brands?

- Do you understand the company and the industry it’s in? Is there any reason not to expect that it will continue to be a monopoly within its industry and grow at a 15% or higher clip?

It takes a considerable amount of time and effort to properly evaluate stocks the Warren Buffett way. You have to analyze the industry the company is in, comb over annual reports and financial statements and be able to accurately weigh possible future earnings scenarios. This is a difficult task for many people who already have other commitments.

If you would like assistance finding value stocks that outperform the market consider joining us at the Value Investors Association. We have also provided access below to a copy of one of the better books to find Warren Buffett type stocks.