Value and Growth Why Investors Need Both US News

Post on: 4 Июнь, 2015 No Comment

Experts say every investor’s portfolio should contain a combination of the two.

Value versus growth investing: which one is right for you? It’s a question that’s been debated for decades. Managers of value funds search for unloved, discounted companies and dividends, while growth managers look for companies whose earnings are expected to grow at an rapid rate. Often, the categories outperform each other in different market climates. Value funds typically offer investors more protection during selloffs, while growth funds tend to lead the pack in market rallies. Comparisons aside, you don’t have to choose between one or the other, and most financial advisers will tell you the same thing: every investor should have a combination of the two.

Fund investors have plenty of options for investing in growth and value stocks. Growth-oriented industries include technology and healthcare, while value stocks can usually be found in sectors like financial services, utilities, and consumer staples. Value stocks are generally defined as shares of undervalued companies with lower prospects for growth. Growth stocks, on the other hand, are generally defined as shares of companies that have high profit margins and higher growth rates. Large-cap funds, mid-cap funds, and small-cap funds come in three varieties: growth, value, and blend (which is typically a mix of growth and value stocks). It’s extremely difficult for anyone, regardless of their stock-picking prowess, to predict what’s in store for the stock market in the short term. So, just as it’s essential to diversify among stocks, bonds, and other asset classes, it’s also important to allocate between growth and value funds. Choosing between value or growth isn’t really an either-or proposition, says Cameron Short, senior vice president with investment firm Stifel Nicolaus. It’s more about skewing towards one discipline versus the other.

Recent Performance. From the beginning of the year through the end of May, large-cap value funds outperformed large-cap growth funds. The large-cap growth category has lost 3.2 percent, while the value group is down 1.7 percent, according to Standard & Poor’s equity analyst Todd Rosenbluth. If you’re looking for dividends, value is typically your best bet. Currently, the average dividend yield of the growth companies included in the S&P 500 (made up of the 500 largest U.S. companies) is 2.7 percent, while the average for the value companies is 3.4 percent, according to Rosenbluth.

Before you crown value king, take a look at the average three-year trailing returns of the two peer groups. Large-cap growth funds, on average, have lost 6.4 percent compared with their value counterparts that have lost 10.9 percent on average, according to S&P. Value held up better than growth in 2008, then in 2009 we had the inverse, and now we’re back to value doing slightly better than the growth stocks, Rosenbluth says.

Generally, when the market is down, large-cap growth funds tend to lag large-cap value funds, and on the upswing, large-cap growth has outperformed large-cap value. The typical large-cap fund has a higher dividend yield and invests in stocks that have lower price-to-earnings multiples, and as a result has some defensive characteristics, Rosenbluth says. Large-cap growth, while they pay dividends, tends to pay a lower dividend and they invest in stocks with a little bit higher earnings characteristics. Regardless of your strategy, there are high-quality, less volatile funds on both sides of the ledger.

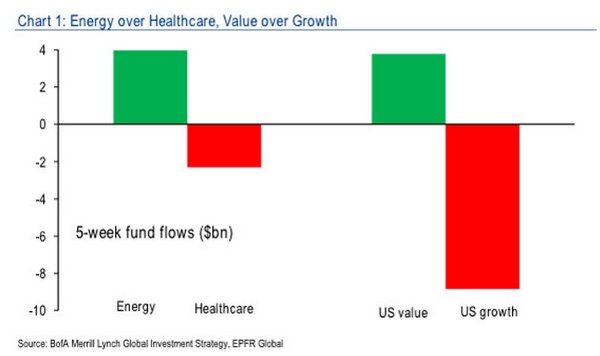

In the large-cap value category, Rosenbluth favors Van Kampen Growth and Income (ACGIX). A large portion of its assets are invested in traditional value sectors like financials (21 percent), energy (13 percent), and consumer discretionary (12 percent). Some of the fund’s largest holdings include JPMorgan Chase, Bank of America, and Occidental Petroleum. Among large-cap growth funds, Rosenbluth recommends Harbor Capital Appreciation (HCAIX). which has heavy weightings in two traditional growth sectors (39 percent in technology and 19 percent in healthcare). Some of its largest holdings include Apple, Google, and Medco Health Solutions.