Utility Stocks v Bonds

Post on: 29 Май, 2015 No Comment

Nilus Mattive takes a closer look at utility stocks and treasury bonds. In this issue of Money and Markets, Mr. Mattive discusses the long term benefits of investing in utilities verses treasury bonds.

Jupiter, Fla. (PRWEB) April 24, 2008

Nilus Mattive takes a closer look at utility stocks and treasury bonds. Mr. Mattive discusses the long term benefits of investing in utilities verses treasury bonds.

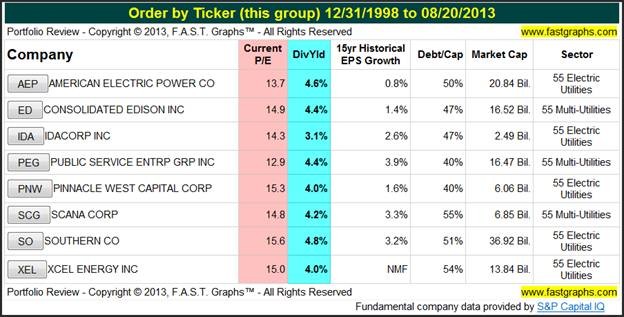

A recent article on Forbes website attempted to help income investors compare the merits of utility stocks and U.S. Treasury bonds. On the bad news side, the column noted that the yields on both utility shares and 10-year Treasuries are down about 50% since the beginning of 1995. It also asserted:

But with a few short-lived exceptions, the 10-year Treasury bond has delivered higher yields than the average utility stock. Since 1995, the T-bond has averaged a 5.2% yield, while the average utility has yielded 4.2.

But the Forbes article also pointed out that this is the first time since 2003 that the average utility stock (as measured by the S&P 1500 Utility index) has yielded more than 10-year Treasuries.

In Mattives opinion, there are very compelling reasons to invest in utilities over 10-year Treasuries. A 10-year Treasury purchased today virtually guarantees an annual yield of 3.7%. While there is not guarantee on the yield of a stock, if a utility with the same yield is purchased, the outcome after 10 years is vastly different. The 10-year Treasury provides an annual yield of 3.7% while the utility provides an annual yield of 9.6% based on the initial purchase price.

While the stock was purchased for $10 and its annual dividend was $0.37 a share, every year since, the dividend payment increased 10%. End result: ten years later, the purchaser is receiving an annual payment of $0.96 a share. Divide that $0.96 a share by the original purchase price of $10 and the effective yield equals 9.6%.

Mattive feels that income investors are best served by buying and holding companies that consistently raise their payments. Its very reasonable to expect dividend stocks to increase in value over time. By their nature, these are profitable companies that are growing at fairly predictable rates. So, naturally, investors will bid the share prices up over time.

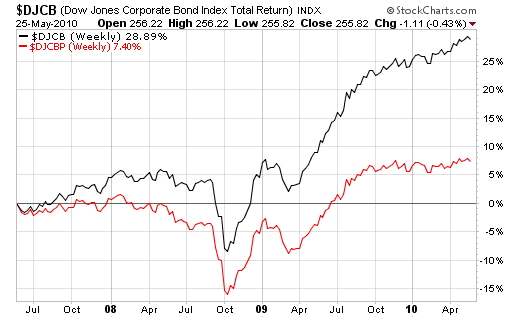

In the last four years, utilities have been posting very strong capital appreciation. The Standard & Poors utility index has risen solidly in each of the last four years. So far in 2008, utilities have on the low key side.

But given the fact that these companies tend to see steady demand during rough economic patches, and given their relatively big, stable yields, I continue to think theyre a smart addition to long-term income portfolios. Any long-term capital gains are just icing on the cake, said Mattive.

To read this issue online, please visit:

About NILUS MATTIVE & MONEY AND MARKETS

Nilus Mattive, a financial analyst at Weiss Research, is the editor of Dividend Superstars, a monthly publication and is also the editor of the companys daily e-letter, Money and Markets. Formerly a senior editor of Standard & Poors The Outlook, the oldest continuously published investment newsletter in the country, he has written for a number of investment websites, including BusinessWeek and Individual Investor. Mr. Mattive is the author of The Standard & Poors Guide for the New Investor (McGraw-Hill, 2004) and has appeared on the popular investment radio show, Traders Nation, to discuss his views on personal finance.

Mr. Mattive graduated cum laude from the University of Scranton.