Using Merk Hard Currency Fund for Cash

Post on: 23 Июль, 2015 No Comment

by Craig Rowland 2 July, 2012

Over on the forum a poster had a question about cash in the Permanent Portfolio. His is a variation of various questions I see about this asset class. In this case, he wanted to know if it would be OK to use the Merk Hard Currency Fund (Ticker: MERKX ) as a proxy for cash. This fund holds assets that are not U.S. dollars and therefore has a lot of currency risk.

I think owning another countrys currency is riskier than keeping put in the currency where you live. This applies whether you spend in U.S. dollars, Japanese yen, British pounds or whatever it is you use in your country. The problem with owning another countrys currency as your cash allocation is you introduce the volatility of currency risk right into the part of your portfolio you want very stable.

In terms of this particular fund (Merk Hard Currency Fund), it has a 1.30% expense ratio which is very high. That means the fund needs to earn 1.30% a year just to break even after expenses and thats really hard to do for a cash like fund. They will have to take very big risks to do that. This fund is basically for currency speculators and would not be a good fit for the Permanent Portfolio cash allocation. It may be fine though for your Variable Portfolio if you have money you can afford to lose.

Also there are no hard currencies any more as none I know are linked to gold convertibility. So Im not sure what they mean by calling it a hard currency fund. They hold a lot of New Zealand bonds for instance which is fine for what it is and I think New Zealand is a great country. But it isnt a hard currency thats for sure! The New Zealand economy has also had ups and downs as any economy so the worm can always turn and the exchange rate could go against you at any moment.

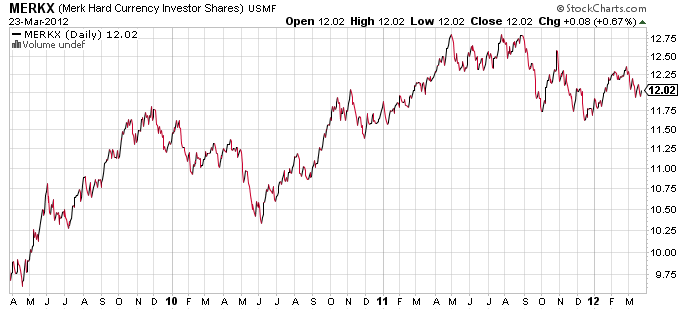

I also see that this fund was significantly more volatile than the short term treasury or intermediate term treasury funds as well. This is so even though the fund has a current duration of 0.45 which means it mirrors that of cash in a T-bill fund. Below is a chart comparing the MERKX fund with iShares Short Term Treasury (Ticker: SHY ) and iShares Intermediate Term Treasury (Ticker: IEF ) over various periods. The MERKX fund has only been around since 2005 so the history is not much longer than what is shown. iShares offers a newer fund with very short term treasuries (Ticker: SHV ) which would be more appropriate for the cash in the Permanent Portfolio, but the short-term treasury fund shown would be a good proxy over this time period.

Here is the chart over the entire period of 2005-2012 showing that the Merk fund is pretty volatile for a cash fund. The green line is the SHY ETF, the blue is the IEF ETF and the Red is the Merk fund.

Merk Hard Currency Fund vs. iShares Intermediate Term Treasury vs. iShares Short Term Treasury 2005-2012

Now in terms of currency risk, let me illustrate what happened in 2008 between these three funds. In that year the dollar experienced very strong growth during the real estate crash (which many thought wouldnt happen):

Merk Hard Currency Fund vs. iShares Intermediate Term Treasury vs. iShares Short Term Treasury 2008

You can see in that year the Merk fund took a pretty big dip for cash (-15% at the worst) but the Treasury funds did much better. The more cash-like SHY ETF was very stable which is what we want. The intermediate term treasury IEF ETF posted good gains, but the volatility could be a warning that it could swing the other direction, which we dont want for our cash!

From 2008-2012 you can see what happened as the dollar moved around from relative weakness to strength. Here the Merk fund has basically matched the return of the much safer short term treasury fund ETF while the intermediate term treasury ETF easily beat it. Thats currency risk!

Merk Hard Currency Fund vs. iShares Intermediate Term Treasury vs. iShares Short Term Treasury 2008-2012

I think this fund is too volatile to use for cash and the currency risk cannot be ignored. It may again be fine for currency speculation purposes if thats what you really want to do. Id also say though that the Permanent Portfolio holds 25% in gold bullion which is the best currency protection you can possibly own. So, holding other currencies may not be a big advantage.

I advise sticking to a T-Bill fund or a short term treasury fund if you feel so inclined for your cash. You want cash very safe and stable in the Permanent Portfolio and thats what the treasury funds on the shorter maturity side of things give you.