Using Commitment of Traders Report to Trade Forex

Post on: 12 Май, 2015 No Comment

November 4, 2013 (Last updated on November 16, 2013)

It is a widely know fact that CFTC (Commodity Futures Trading Commission) is a regulatory institution for the Forex market in the United States. It is a less known fact among spot FX market participants that this institution releases Commitment of Traders report every Friday (normally).

Commitment of Traders (CoT) is a series of simple reports for all types of futures contracts regulated by CFTC (except holidays or special cases, e.g. government shutdown). They release weekly data at 15:30 (EST) on Fridays. Besides that, traders have access to historical data going as far back as 1986.

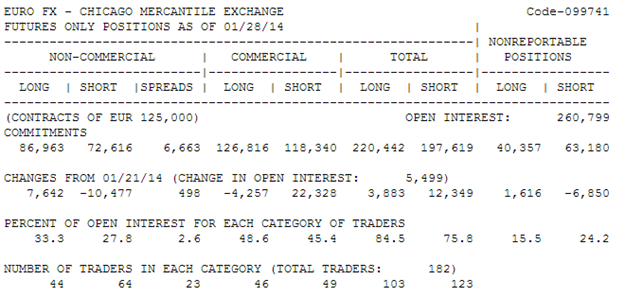

The CoT reports contain data about futures trading positions reported to CFTC by qualifying participants of all US futures exchanges. The data reported on Friday is for Tuesday of the previous same week (i.e. 10 3 days old). Of 22 currently produced weekly report types, only two are useful to currency traders Futures Only and Futures-and-Options Combined of the Traders in Financial Futures long format report. The latter adds information on futures options, which might be improving the overall picture or adding noise to it, depending on how you perceive it. The reported currencies are: CAD, CHF, GBP, JPY, EUR, AUD, RUB, MXN, NZD and Dollar Index. It also contains information for other, non-currency. financial instruments (stocks, bonds, etc.)

Financial CoT reports show number of long and short contracts held by the following five categories of traders:

- Dealer/Intermediary the sell-side of the market, e.g. brokers, dealers, market makers, etc.

- Asset Manager/Institutional institutional investors, the buy-side of the market.

- Leveraged Funds money managers or proprietary trading on behalf of speculative private clients; also the buy-side .

- Other Reportables market participants who use futures to hedge their risks; they are also considered a buy-side .

- Nonreportables positions created by small traders who do not need to report. Mostly small speculators and smaller business clients. This category is calculated using the previous four.

Before 2010, CoT reports consisted of 3 categories commercial. non-commercial and nonreportable. It was considered that non-commercial represent the smart money (big investment banks) and are worth following, while commercial are hedgers who do not aim to earn profit from futures trading. Nonreportable could be regarded as small traders the crowd, which is always wrong.

The current classification of traders is not such straightforward as the previous one, but, nonetheless, you can still draw some general conclusions from CoT reports on currency positions. Dealer/Intermediary is the representation of smart money, the traders you would probably want to follow, except for some very rare occasions (e.g. financial crisis). Unfortunately, the data on them is delayed by 3 days, so only long-term following is possible. You might still consider nonreportables as the crowd and avoid siding with them when their positions grow too big.

I personally, check almost every CoT report, but I rarely use the data in my analysis, I check it out of pure interest and desire to stay up-to-date with any major changes in sentiment. And how about you?

Do you follow Commitment of Traders report by CFTC?

- No, I didn’t know about it at all.

- No. I know about it, but I don’t read it.

- Yes, but on rare occasions.

- Yes, sometimes I refer to it in fundamental research.

- Yes, I take direct trading signals from CoT report.