Use threshold rebalancing to lower your portfolio’s risk

Post on: 30 Май, 2015 No Comment

A powerful technique for controlling risk in your portfolio is threshold rebalancing. Like other rebalancing strategies its used to prevent your asset allocation veering too far off-target due to the diverging returns of the various assets you hold.

There is endless debate about the best rebalancing strategies and whether they can juice up returns. It ultimately depends on future market conditions and the unique contents of your portfolio – in other words, whip out your crystal ball.

It’s better for passive investors with a broadly diversified mix of equities and bonds to be aware of the rebalancing techniques available, and to choose a mix that best suits them.

The two main schools of rebalancing are calendar rebalancing and threshold rebalancing. Calendar rebalancing is the simplest option, but the threshold approach enables you to fine tune your operations to take more control over costs and to reduce the impact of choppy markets .

Threshold rebalancing

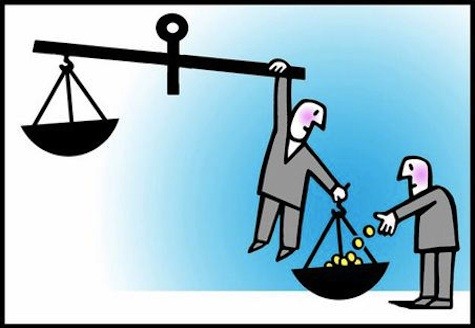

As its name implies, with threshold rebalancing you set asset allocation boundaries and then rebalance whenever they are breached, as opposed to automatically rebalancing your portfolio on a pre-determined date.

- Picture a portfolio with a 50/50 equity/bond allocation.

- If the rebalancing threshold is set at 5% then you would swing into action when either asset accounted for 55/45 of the mix.

- At that point you would sell enough of the dominant asset to rebalance the portfolio back to its original 50/50 asset allocation split.

The idea of threshold rebalancing is that you’re only forced to act when there’s a significant shift in your asset allocation. You don’t tinker with tiny percentages that make little real difference, just because the calendar tells you to.

This helps to control costs. In a steady market you may not need to rebalance for a number of years, if you can live with a generous threshold. The less you rebalance, the less you’ll pay out in trading fees. Youll also save on taxes (assuming you haven’t squirreled everything away in ISAs and pensions).

Choosing your threshold

The first step is to choose a threshold that suits your risk tolerance: