Use Mutual Funds To Create Retirement Income

Post on: 28 Май, 2015 No Comment

Follow Comments Following Comments Unfollow Comments

If you are searching for reliable retirement income you might find yourself in a tough situation these days. Bank CD’s pay close to nothing. Bonds are expensive and aren’t paying very much interest either. What’s an investor to do?

One option you may not have considered is to use equity growth to provide the income you are looking for. Specifically invest in balanced or growth mutual funds and take a fixed withdrawal each month out of your account come rain or shine.

Of course this approach is not for the faint of heart. It’s easy to do when the overall market is rising. But when the market declines, it’s tough to stick with this program. But let’s explore this option together. I think you’ll agree that despite the drawbacks and dangers this is probably one of the strongest income plays an investor could make right now.

The investment strategy is simplicity itself:

- Invest a portion of your portfolio in equity growth.

- Calculate what 4% of your account value is.

- Divide that figure by 12. Then arrange to sell off that amount from your funds automatically each month and have it sent to you.

- After doing this for 12 months recalculate your annual withdrawals by multiplying your new account value by 4%. If your account earned more than 4% over the last year, your values will be higher and your income will increase. If your account earned less than 4% your account value will decline and so will your income.

Why This Approach Could Be Your Best Option – The Trinity Study

In 1998 three finance professors from Trinity University got together to try to figure out the best investment strategy that would maximize retirement income over a 30-year time frame. They looked at every 30 year rolling period starting in 1925 and considered various asset allocations and withdrawal rates. The professors were looking for the least risky way for investors to invest, create the income they need and not run out of money over 30 years. For them, not going broke was considered success.

The professors concluded that portfolios dominated by equity growth had the highest success rate if the investor withdrew not more than 4% of the account value and adjusted their withdrawal amounts by the Consumer Price Index inflation rate each year. In contrast, investors who stuck all their money in bonds had the highest chance of going broke before the 30 year period ended.

The Trinity Study was updated in 2009 and the new results confirmed the old conclusions with a few minor twists.The bottom line is that investors increase the odds of not running out of money over a 30 year withdrawal period if they have at least 50% of their money in equity and are willing to be flexible with their withdrawals when the market declines.

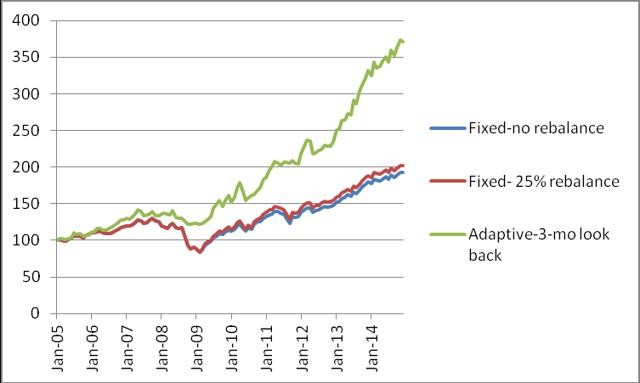

Because I like to check things out myself, I did my own research. I also looked at using equity to create retirement income just like the professors did. I considered the years 1988 through 2011 – a 23 year period containing two very sharp stock market declines. I tracked what happened to a hypothetical account that invested in the S&P 500 and withdrew 4% of the year end value.

Over the period I examined the investor saw their account values and income drop (using the 4% account value approach) at times. But overall they did far better than an investor who bought bonds. In fact the hypothetical investment in the S&P 500 yielded more than 3 times what the bonds yielded towards the end of the study.

Obviously the past is no guarantee of the future and you can’t invest directly in the S&P 500. But if you consider the results of my study and the Trinity update, you can see that it clearly makes sense to consider using equity to create long-term income.

Objection #1 – I could lose capital.

When you invest in equity you have to accept that you will lose money. There will be situations when the market suffers sharp declines which will whack your account values and income. Please refer back to the study I did. This is clearly reflected.

Seeing your capital decline is no fun but it’s still better than completely running out of money. Remember, when you plan your retirement. your time frame is very long. Your income has to last all your life. So if you are 60 years old today, you should plan on withdrawing your money until you are 85 or 95. That’s 25 to 35 years.

Once you start thinking like that and consider the alternatives, you’ll see that equity could be a great way to maximize your withdrawals. And while it may not always be comfortable, what happens to your account values in any one year doesn’t matter in the least. The goal is long-term retirement income.

Objection #2 – My income could decline.