USD Currency Index & Volatility

Post on: 16 Март, 2015 No Comment

Relative Currency Strength

Against the background of a downwardly revised global outlook by the International Monetary Fund, the USD and JPY outperformed majority of their counterparts. The U.S. Dollar appreciated the most against the Swedish Krona (+1.25%) and New Zealand Dollar (+1.3%), whereas USD/CAD currency couple was the only USD cross that declined since October 3 by 0.51%.

The reason for such unconventional behaviour of the loonie lies within data on Canadian labour market, unexpected improvement of which increased the likelihood of the country’s central bank raising the key interest rate.

While during the previous week the U.S. Dollar has been largely sold off, this week the context of the foreign exchange market has slightly changed, being that safe haven currencies, namely the greenback and the Japanese Yen, found themselves being in demand. Currency index of the USD gained 0.57% within the last five trading days, since eurozone problems appear to be far from being fully resolved at the moment, as evidenced by Angela Merkel’s visit to Greece and associated with it social unrest there. Moreover, speech of the president of the European Central Bank on October 9 was not full of optimism, but implied protracted period of slow growth.

Volatility

Judging by volatility indices, EUD/USD is usually more responsive during European trading sessions than the market in general, while the rest of the day the pair’s volatility is consistently lower than the average across the pairs. The only exception from this rule was observed last Friday, when investors were surprised by better-than-expected data on employment change in Canada and plummeting unemployment rate in the United States.

This Monday volatility was exceptionally low, hardly rising above a level of 1, even despite a publication of a dismal report by the IMF with pre-emptive warning of problems that still lie ahead and will have to be faced by world economies.

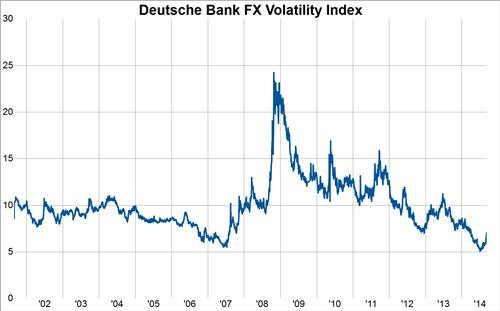

On certain occasions volatility index of the market (DBVI) exceeded the historical turbulence, but given short duration of elevated variability and relatively low peaks attained by it, we may predicate that overall the currency pairs are comparatively calm. None of the recent news were able to shake market or significantly change its perception of the current events. Considering that the Federal Reserve is unlikely to hastily alter lately announced policy, since it requires time for the effectiveness to be assessed, value of the U.S. Dollar should not become a subject to large changes. Accordingly, USD crosses are highly unlikely to exhibit volatility similar to the one demonstrated during announcement of the third round of quantitative easing in the coming weeks.

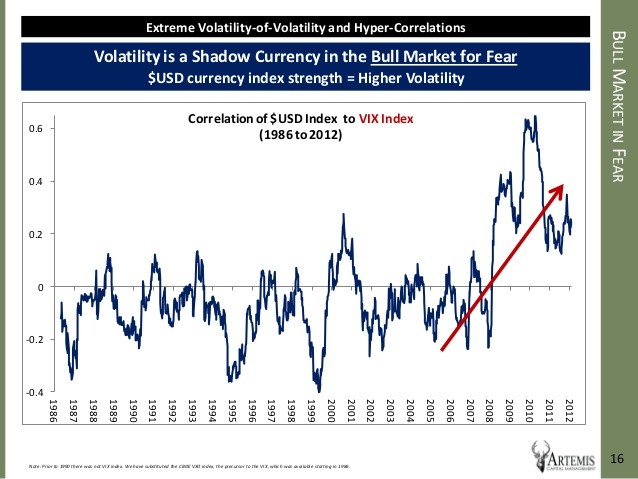

Currency Significance

Provided that the issue of economically and in some cases politically distressed peripheral eurozone countries persists, U.S. Dollar is expected to move into the background for now and allow different currencies to take the lead. If we compare 50-hour rolling correlation for the last 20 and 130 days, we may spot gradual transition to lower values. Both medians and means are lower for the last month than for the last half of a year. Even though declines might not seem considerable at the moment, if we review each correlation separately, the tendency is observed for nearly all of the interrelationships between USD crosses.

Thursdays the U.S. Dollar conventionally elicits a stronger response in the markets than its peers due to abundance of releases on the U.S. economy (such as unemployment claims), as revealed by the rally of the average correlation coefficient for the USD (within Turquoise Area), which imitates significance of the currency, determined by the extent it impacts exchange rates. The next day, consequently, the Dollar did not enjoy increased level of attention paid to it by the market (average correlation fell 0.23), since different currencies and events (in this case CAD and Canadian labour data) defined market sentiment on October 5.