US Treasury Bonds How They Work

Post on: 7 Июнь, 2015 No Comment

I n the world of investments, many investors are looking for safe vehicles where their money will be safe until retirement age. There are several types of bonds available to use in your retirement savings portfolio but one in particular is considered to be the safest of all investments. The US Treasury Bond is considered one of the lowest risk investments you can make. The bonds are offered by the US government and investors, and while there is some risk involved, most people consider US Treasury Bonds to be essentially guaranteed investments.

How US Treasury Bonds Work

A bond is essentially a loan where an agreement is made between the lender and the borrower that states the borrower will pay interest on the principal amount and then return the total amount at a set time. The rate of interest on a bond is referred to as a ‘coupon rate’ and the date when the money is to be paid out is known as the ‘maturity’ dates.

A US Treasury bond is a special breed of bond issued by the United States government. The money is used to raise money for governmental initiatives. When you purchase a Treasury bond, you are loaning money to the US government.

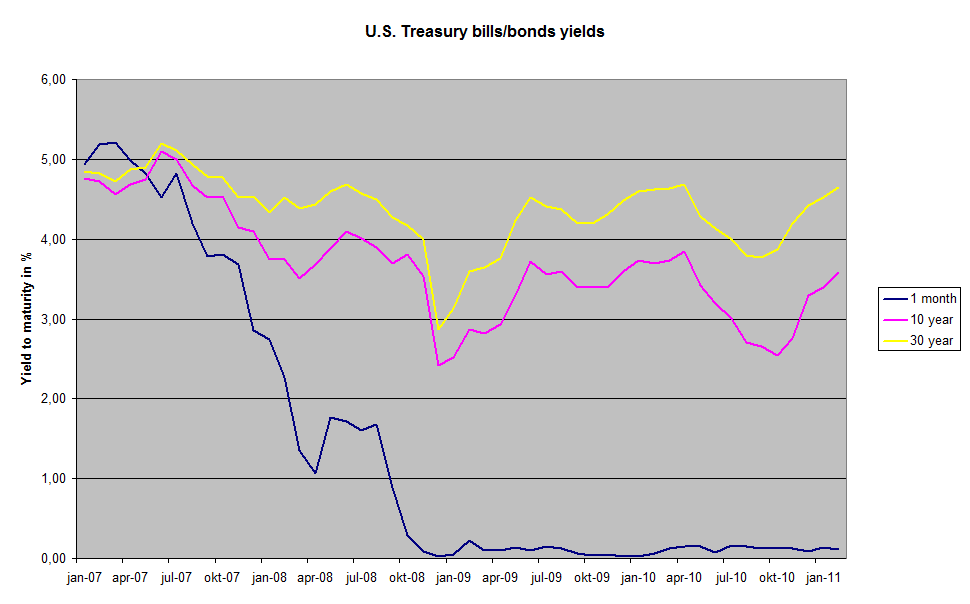

Since the government bonds are considered so safe, they often have a lower yield than other types of bonds. The benefit of such a bond besides the lower risk is the fact that interest payments on the bonds are exempt from state and local taxes. Individuals still have to pay Federal income tax, however.

The Treasury bonds must reach their date of maturity before they can be redeemed. They are typically issued with thirty-year maturity dates and pay interest twice a year.

Where Can You Buy US Treasury Bonds?

US Treasury bonds are issued in several denominations which range from $100 to $1 million. The bonds are sold through an auction by the government and can be purchased through the auction at Treasury Direct or through a professional broker. In the event the auction bidding is particularly competitive, the maximum amount of the bond that can be purchased is $5 million. Bidders do not have control over the bond pricing. It is pre-set and must be accepted as it stands.

Buying and selling US Treasury Bonds on the secondary market. After an auction, a bond can be resold on a secondary market for a price higher than paid for at auction which is referred to as ‘selling at a premium’. If the bond is sold at a lower price, it is referred to as ‘selling at a discount’. Treasury bonds have two values; the face value is the original buying priced used to calculate the coupon interest rate and the price value which is the price the bond was sold at in the secondary bond market.

Buyers can hang on to their Treasury bonds and collect the interest until it reaches its maturity date. For more aggressive investors, you may be interested in trading on the bond market. Either way, a US Treasury bond is one of the least risky investment vehicles an investor can purchase, which is particularly important during times of recession when other investment values are declining in value.