US Debt Crisis Summary Timeline and Solutions

Post on: 10 Сентябрь, 2015 No Comment

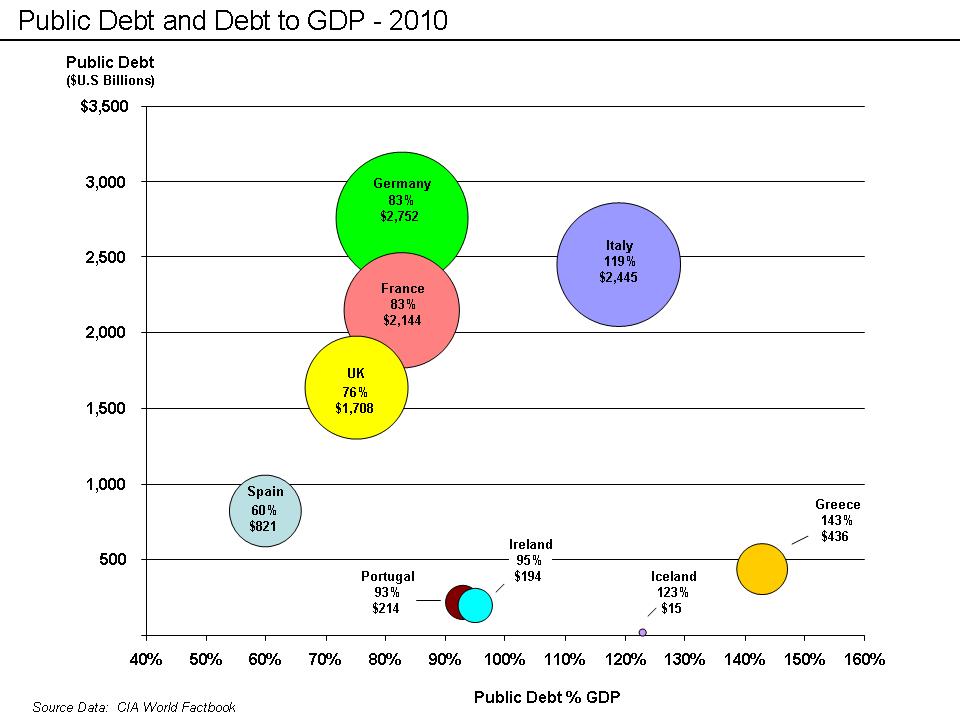

On December 15, 2014, the U.S. national debt exceeded $18 trillion, more than America’s annual economic output as measured by Gross Domestic Product (GDP ). The last time the debt to GDP ratio was more than 100% was to pay for World War II. For details, see National Debt by Year .

A true debt crisis is when a country is in danger of not meeting its debt obligations. The first sign is when the country finds it cannot get a low interest rate from lenders. Why? Investors become concerned that the country cannot afford to pay the bonds, and it will go into debt default .

As lenders start to worry, they require higher and higher yields to offset their risk. The higher the yields, the more it costs the country to refinance its sovereign debt. In time, it really cannot afford to keep rolling over debt, and it defaults. Investors’ fears become a self-fulfilling prophecy.

However, this didn’t happen to the U.S, as demand for U.S. Treasuries remained strong throughout 2011 and beyond. In fact, interest rates in 2011 reached 200-year lows. as investors required little return for their safe investment. That’s because U.S. debt is considered to be 100% guaranteed, backed by the power of the country with the largest economy in the world.

U.S. Debt Crisis Explained

The debt crisis was created by a political battle between Democrats and Republicans who were stalemated over ways to curb the debt. Democrats blamed the Bush tax cuts and the 2008 financial crisis. both of which lowered tax revenues. They advocated increased stimulus spending or consumer tax cuts. The resultant boost in demand would spur the economy out of recession, increase GDP and tax revenues. In other words, the U.S. would do as it did after World War II, and grow its way out of the debt crisis. This is known as Keynesian economic theory.

Republicans advocated further tax cuts for businesses, who would then turn around and invest the cuts in expanding their companies, creating new jobs. That is known as Supply-side Economics.

However, both sides lost focus by concentrating on the debt instead of continued economic growth. Whether you lower taxes or increase spending is not worth arguing about until the economy is in the expansion phase of the business cycle. The most important thing is to take aggressive action to restore business and consumer confidence. This provides the gasoline to fuel the economic engine.

Both political parties compounded the crisis by arguing over how much to cut spending, and whether the cuts should come from entitlement programs, such as Social Security and Medicare, or defense. To recover from a recession, government spending should remain consistent. Any cuts will remove liquidity and raise unemployment through government layoffs.

The time to cut spending is when the economic growth is greater than 4%. Then, spending cuts and tax hikes are needed to slow growth and prevent the economy from entering the bubble phase of the business cycle.

What Happened During the Debt Crisis in 2011?

The debt crisis started in April 2011, when Congress almost caused a government shutdown by delaying approval of the FY 2011 budget. Republicans were concerned about a $1.3 trillion deficit, the third highest in history. To reduce the deficit, Democrats suggested a $1.7 billion cut in defense spending, to coincide with the wind-down of the Iraq War. Republicans wanted $61 billion non-defense cuts, including Obamacare. The two parties compromised on $81 billion in spending cuts, mostly from programs that couldn’t use the funds, anyway. For more, see Government Shutdown .

The debt crisis escalated a few days later when Standard & Poor’s lowered their outlook on whether the U.S. would pay back its debt to negative. This meant there was now a 30% chance the U.S. would lose its AAA S&P credit rating within two years. S&P was concerned that Democrats and Republicans would not be able to resolve their approaches to cutting the deficit. Each had plans to cut $4 trillion over 12 years — the Democrats by allowing the Bush tax cuts to expire at the end of 2012, while Republicans, as outlined in Ryan’s Road Map. by replacing Medicare with vouchers.

By July, Congress was stalling on raising the $14.294 trillion debt ceiling. Many thought this was the best way to force the Federal government to stop spending, and that’s true. The Federal government would then be forced to rely solely on incoming revenue to pay ongoing expenses. However, it would also wreak economic havoc. For example, millions of seniors would not receive Social Security checks. Ultimately, the Treasury Department might in fact default on its interest payments, causing an actual debt default. It’s a clumsy way to override the normal budget process.

In August, Congress did raise the debt ceiling. However, it attached a caveat in the Budget Control Act. This required a Congressional Super Committee to create a proposal to reduce the debt by $1.5 trillion. If this wasn’t successful, it would trigger a sequestration that would trim roughly 10% of FY 2013 Federal budget spending. However, the Committee could not agree on a proposal, allowing the debt crisis to leak into 2012.

Debt Crisis 2012

In 2012, the debt crisis took center stage throughout the 2012 Presidential Campaign. For more, see First Presidential Debate Summary. After the election, difficulties in resolving how to cut the deficit remained, as the country headed toward the fiscal cliff. For more, see U.S. Fiscal Cliff 2012 .

Debt Crisis Solution

The solution to the debt crisis is economically easy, but politically difficult. First, agree to cut spending and raise taxes an equal amount. Each will reduce the deficit equally, although they have different impacts on economic growth and jobs creation. For more, see Do Tax Cuts Create Jobs?. Job Creation. and Unemployment Solutions.

Whatever is decided, make it crystal clear exactly what will happen. This will restore confidence, allowing businesses to put the assumptions into their operational plans.

Second, and perhaps most important, delay any changes for at least a year. This allows the economy to recover enough to grow the 3-4% needed to create jobs and reduce unemployment. An increase in GDP, combined with tax increases and spending cuts, will eventually reduce the debt-to-GDP ratio enough to eliminate the debt crisis. Article updated January 4, 2015.