Understanding the Risks and Rewards of Callable Bonds

Post on: 20 Апрель, 2015 No Comment

The Risks and Rewards of Bonds That Can Be Redeemed Early

Please refer to our privacy policy for contact information.

If you’ve ever had a mortgage or a car loan, you probably had an option to pay the loan early.

For a borrower, there are some distinct advantages to paying off a loan early. But for the guy who is owed the money, early payment isn’t so great.

In the world of bonds, the equation is the same.

Early payment is good for the bond issuer (the borrower), but not so great for the bond buyer (the loan maker).

Hearing the call

When you buy a bond you’re locking up your money in exchange for a particular rate of return. If, for example, you buy a nice, safe, 15-year, Aaa-rated corporate bond that pays 4%, then you expect to collect 4% for the next 15 years.

Most of the time, the corporation that sold the bond has agreed to pay you that 4% for the next 15 years. But sometimes a bond seller reserves the right to change its mind and “call” the bond early — paying off the principal and ending the loan before it matures.

Such bonds are referred to as “callable.” They are fairly common in the corporate market and very common in the muni-bond market.

The risks of a callable bond

At first glance, buying a callable bond doesn’t appear any riskier than buying any other bond. But there are reasons to be cautious.

- First. a callable bond exposes an investor to “reinvestment risk .”

Issuers tend to call bonds when interest rates fall. That can be a disaster for an investor who thought he had locked in an interest rate and a level of safety.

Let’s look again at that nice, safe Aaa-rated corporate bond that pays 4% a year. Imagine that Federal Reserve Bank begins cutting interest rates. Suddenly, the going rate for a 15-year, Aaa-rated bond falls to 2%. The issuer of your bond looks at the market and decides it’s in its best interest to pay off those old bonds and borrow again at 2%.

You the investor will get back the original principal of the bond — $1,000. But you won’t be able to reinvest that principal and match the return you were getting. Now you’ll have to either buy a lower-rated bond to get a 4% return or buy another Aaa-rated bond and accept at 2% return.

In that situation, an investor can fork over his $1,000, pay a commission, and then promptly find that bond is called. He’ll still get back his $1,000, but he’ll have paid a commission for nothing.

Should I buy a callable bond?

Buying any investment requires that you weigh the potential return against potential risk.

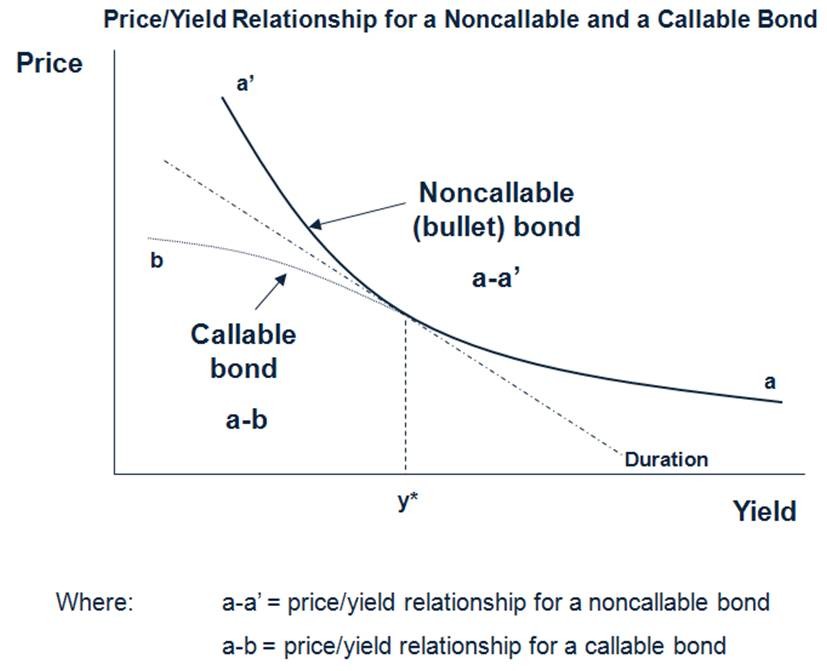

And the truth is that for entry-level investors, callable bonds may be too complex to consider. For example, the prices of callable bonds in the secondary market move quite differently from the prices of other bonds. When interest rates fall, most bond prices rise. But callable bond prices actually fall when rates fall – a phenomenon called “price compression.”

But despite such quirks, callable bonds offer some interesting features for experienced investors.

If you’re considering a callable bond, you’ll want to look at two important factors.

Callable bonds pay a slightly higher interest rate to compensate for the additional risk. Some callable bonds also have a feature that will return a higher par value when called, i.e. an investor may get back $1,050 rather than $1,000 if the bond is called.

So make sure that the bond you buy offers enough reward to cover the additional risks.