Understanding Leveraged and Short ETFs

Post on: 16 Март, 2015 No Comment

Leveraged and short ETFs attempt to magnify their gains and to provide inverse market performance to various stock, bond and commodity indexes on a daily basis. Because they aim to achieve investment results that usually target the daily returns of their underlying benchmarks, theyre probably best suited for investors with a short-term investment time horizon. Since leveraged and short ETFs are principally designed to achieve daily returns, their long-term performance is likely to deviate from the long-term performance of their respective underlying indexes.

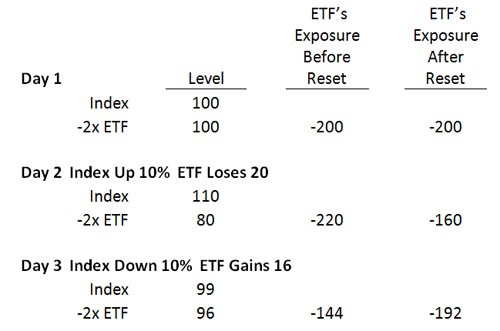

Lets analyze an example of how the performance for leveraged and short ETFs works.

FIGURE 2: Market Close on Day 2

What role, if any, should leveraged and short ETFs play inside your portfolio? Its a good idea to consider the following three issues before deciding whether these specialized ETFs are right or wrong for you.

Your Time Horizon

If you have a very short investment time horizon of just a few days, then leveraged and short ETFs could be right for you. Thats because the investment objective of virtually all leveraged and short ETFs is to achieve short-term investment results that correspond to the daily inverse or daily magnified performance of their respective indexes.

For instance, the Direxion Daily Emerging Markets Bull 3x Shares (EDC) aims to deliver three times the DAILY performance of emerging market stocks within the MSCI Emerging Markets Index. If this particular benchmark increases in value by 1% on any given day, EDC tries to obtain a 3% gain. If emerging market stocks decline by 1% on any given day, EDC should fall by 3%.

Investors that want to bet on the long-term gains or losses of a particular asset class or industry sector should probably not be using daily leveraged and short ETFs. Its that simple. Product developers are already working on ETFs that attempt to achieve magnified performance returns over longer time periods, not just daily returns. The next iteration of these funds might be better suited for investors that have an intermediate time horizon.

Your Level of Risk Tolerance

A careful assessment of your own willingness to tolerate risk is crucial to your investment success. You should do this before you invest money, not afterwards. Your age, your income and your current investment mix are just a few points to consider. Once youve gotten a satisfactory answer, then you can make informed investment decisions. If youre thinking about investing in leveraged and short ETFs or already own them, have you completed your self-examination?

Your Investment Goals

Any investments you decide to buy should always be compatible with your ultimate investment goals. If youre an income oriented investor, for example, it would make little sense if the vast majority of your investments consist of growth investments which produce little or no income.

Always make sure the investments inside your portfolio match your goals. This is true for any type of investment, leveraged and short ETFs included.

Tax Considerations

Even though most ETFs limit the amount of tax distributions, there are exceptions. Over the past few years several leveraged and short ETFs had record tax distributions that caught some investors by surprise. In one particular year, a leveraged ETF had a short-term capital gains distribution that was 86% of the funds NAV!

Since the underlying securities inside leveraged and short ETFs are options, futures contracts and swaps rather than individual stocks or bonds, the in-kind redemption process does not work to create the same tax-efficient results as conventional ETFs. For example, if a short ETF is redeemed, the fund company is forced to liquidate some of the underlying derivatives to raise cash to pay exiting investors. This is likely to result in a tax distribution gain or loss for remaining ETF investors holding the fund.

Typically, most ETF providers will distribute their annual tax gains or losses during the fourth quarter of each year. While some companies may announce tax distribution dates a few weeks in advance, others may only give a few days notice. Stay alert! If a certain ETF is expected to have a large tax liability and you already own it in a taxable account, it may be wise to sell the fund just before the distribution date. On the other hand, if youre thinking about buying an ETF with a large pending tax liability, it may be in your best interest to delay the purchase of the fund until after the distribution record date.

Conclusion

Generally, leveraged and short ETFs do well of tracking their indexes when markets are trending in one direction for a short period of time. However, during volatile times or range-bound markets the performance of leveraged ETFs tends to deviate significantly from underlying indexes, especially over longer periods of time.

You should examine the entire spectrum of key factors along with your own financial situation before youve convinced yourself that leveraged and short ETFs are right or wrong for you.