Understanding Investor Due Diligence

Post on: 16 Март, 2015 No Comment

Jan 10 2012 | 5:10am ET

By Patrick J. McCurdy, Merlin Securities — The investor due diligence process has evolved with the growth of the hedge fund industry. What was once a short and rather perfunctory process has grown into one which today is highly quantitative and detailed. While there is no one-size-fits-all formula for investors, one certainty is that managers who understand the components of the due diligence process will have an easier time meeting the requests of investors.

This article and the related white paper. which are based on numerous conversations with investors, seeks to identify and describe the components of a professional due diligence process—from simple annual return figures to detailed attribution analysis. The end goal is to provide a basic roadmap that can help fund managers understand the depth and breadth of this process and ultimately to help them achieve their fundraising goals.

Prior to the institutionalization of hedge fund investing, investment decisions and allocations were largely made on the basis of performance numbers and the qualitative aspects of a fund: people, process and philosophy. Over the past decade, the needs of professional fund investors have resulted in the evolution of the investor due diligence process. Today, this process has expanded to encompass both qualitative and quantitative aspects of a fund and its performance. In order to successfully raise capital, managers must be able to articulately convey their value proposition, the components of their performance and the risks they take to achieve that performance.

This white paper represents an effort to describe the investor due diligence process, with a specific focus on the quantitative performance metrics. We have conducted dozens of interviews with fund of funds and direct investors in hedge funds in order to articulate the process as described by the professional fund investor. We found that the process has become very data driven and time intensive, requiring greater transparency and granularity than ever before.

It is not our intention to present an introduction to hedge fund statistics and reporting, but rather to write a white paper that helps managers better position their funds in a competitive capital raising environment.

Moving Through the Due Diligence Process — From Qualitative to Quantitative

Prior to selecting an investment target, hedge fund investors first determine the investment strategy to which they will be allocating capital. Strategies include:

- Equity fundamental value, fundamental growth and market neutral

- Event-driven funds

- Global macro-oriented products

- Relative value strategies, including fixed income

After generating a manager list within the strategy subset, the natural entry point for an analysis of a fund is a qualitative look at its people, process and philosophy. These elements comprise the backbone of all funds and are the source of their performance.

These three main qualitative factors build a framework for a fund and are the first of a multi-step due diligence process. If a manager fails to meet an investor’s standard on the qualitative front, then that manager will not have the opportunity to move forward in the due diligence process. That being said, qualitative analysis alone is not enough to form a complete picture or to ensure an allocation. As our friend Paul Platkin of Arden Asset Management explained, “Any manager can tell a good story, due diligence is the process to make sure the story makes sense and that the numbers support it.”

Demystifying the Elements of a Fund’s Performance

Performance is the result of a fund’s people, process and philosophy. A fund’s net performance number, however, is only the first step of the quantitative portion of the due diligence process. Investors will also want to understand what risks were taken along the way and where the money was made to determine if performance was a result of the process.

After a full review of returns and risk, an investor will take a deeper look at the numbers to understand the factors behind performance generation. The most common method, absolute attribution analysis, will answer questions regarding active versus passive investing and determine whether returns fall inside a manager’s stated strategy and where managers are risking investor capital.

An investor conducting quantitative due diligence is similar to a painter painting a picture. With each layer of paint that is added to the canvas, the image begins to take shape and become clearer. Similar to a painting, hedge fund due diligence should be thought of in terms of overlays, with each overlay providing additional clarity to an investor’s understanding of a fund and its returns. Once all of the overlays are in place, they provide the investor with a complete picture of the hedge fund manager. For the purposes of this white paper, we have identified three overlays that comprise the quantitative due diligence process:

- First overlay: Performance

- Second overlay: Risk

- Third overlay: Attribution Analysis

In the full version of the white paper. Merlin examines each of these overlays in greater detail, outlining numerous due diligence tools and the most widely-used quantitative performance metrics.

Portfolio Fit

The final step for investors will be to determine if, based upon their findings, an investment is warranted. Investors will look at the risk-adjusted return figures and run a correlation between the manager and the investor’s existing portfolio. There are a whole host of good managers who do not receive allocations because they do not beat out the great managers already in the investor’s portfolio. Today, it is not good enough to simply have positive performance, to be successful raising capital you must create a truly differentiated fund that consistently adds value.

The investment process is about trading risk for reward. The investor due diligence process, which once was simply an evaluation of a hedge fund manager’s people, process and philosophy, has matured in line with the hedge fund industry so that today, these qualitative aspects have become only the first step of the full due diligence process.

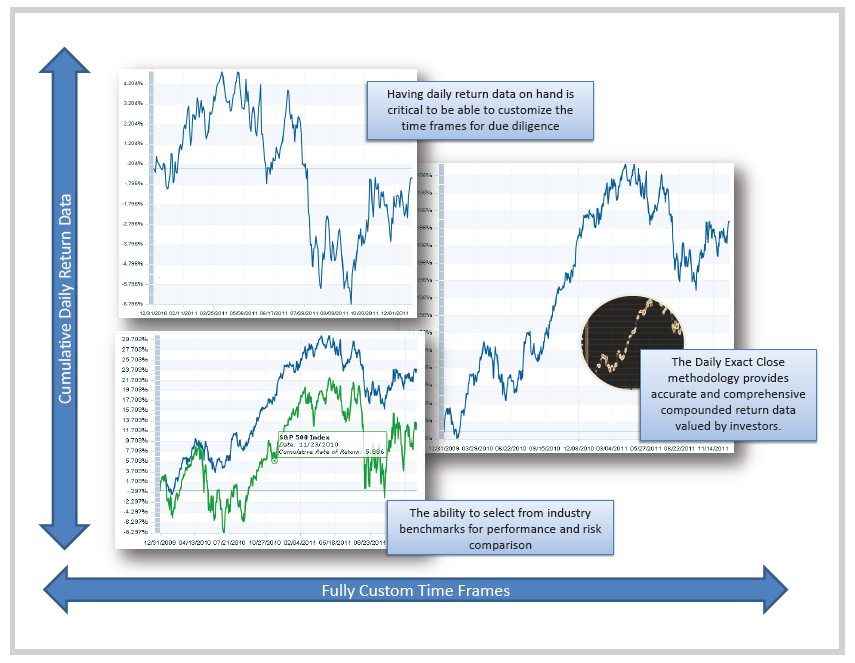

This article began with a review of the traditional metrics used by investors and concluded with a discussion of more advanced due diligence analytics. The full white paper demonstrated that when looking at historical performance data, managers can no longer just review total return since inception, but must also provide data for customized date ranges. In discussing correlations, managers may need to seek out a better benchmark to analyze their results than the S&P 500 or Russell 2000. When providing a composition breakdown, reporting gross and net positions is not sufficient, full delta-adjusted exposures are also necessary. It also showed that attribution analysis does not stop at Alpha from long and short positions, but should also be broken down by sector, analyst, stock selection, market capitalization and liquidity to form a true picture of returns. The due diligence process has evolved; make sure that you have the tools in place to meet the current demands of today’s sophisticated investor.

It is critical to note that not all investors allocate only after the intense quantitative process we have outlined above. Fundamentally, the hedge fund industry is still a story about people. At its core, investors are looking for active management of their assets. Investors want to entrust their assets to someone they believe to be an expert with a differentiated process. There will never be a replacement to a good story and a firm handshake, but the due diligence process helps provide additional clarity to the investor’s investment decision.

Patrick J. McCurdy. partner and head of capital development at Merlin Securities, consults hedge fund managers on their capital raising mandates and liaises with sophisticated investors on behalf of the firm.

- E-mail This

- Print This

- Order Reprints

- Facebook.